Is USDJPY Heading Towards JPY148 with Yen Weakening Against the Dollar?【September 3, 2024】

Fundamental Analysis

- Yesterday was a U.S. holiday, and USDJPY continued its trend of Yen weakening against the Dollar.

- USDJPY is showing a weakening Yen and strengthening Dollar, with no significant events, but numerous U.S. indicators will be released starting today.

USDJPY technical analysis

Analyzing the daily chart of USDJPY. The USDJPY remains above the 28-day moving average, indicating a continued Yen weakening and Dollar strengthening trend. It has surpassed the 23.6% Fibonacci retracement level and seems to be aiming for JPY148. The 38.2% Fibonacci retracement level is at JPY149.50, so it might take some time to reach it.

Furthermore, with key U.S. economic indicators, including the employment report, set to be released, it is uncertain whether the Yen weakening will continue. This rise may be a correction, and a potential pullback could happen at any time. If numbers indicating a worsening U.S. economy emerge, there could be a rapid shift towards Dollar selling.

The RSI is also around 50, suggesting that selling on the rebound may start. Caution is advised.

Day trading strategy (1 hour)

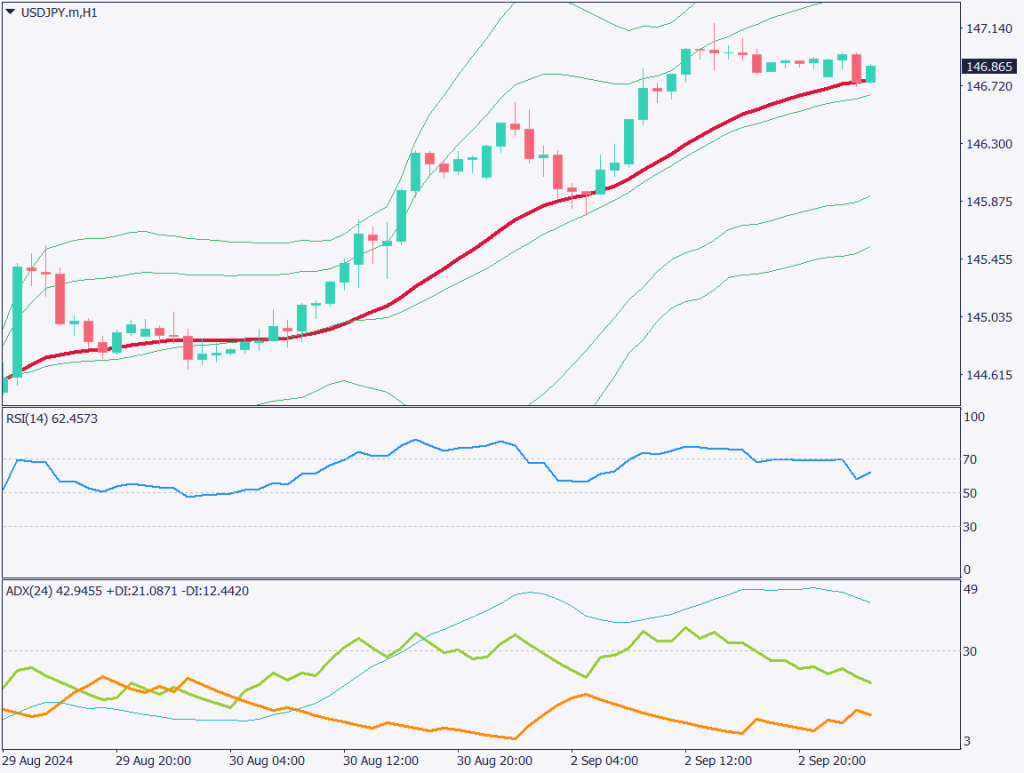

Analyzing the 1-hour chart of USDJPY. The USDJPY is rising, using the 28-hour moving average as support. The RSI is at 62, and yesterday’s high was JPY147.17. The key point is whether it will break the recent high.

Looking at the daily chart, the RSI is approaching 50, making it a likely point for a pullback. There are only a few materials supporting aggressive buying. The current strategy is to sell on the rebound.

Specifically, sell around JPY148. Consider closing at the 28MA. The stop is set at JPY148.35.

Support/Resistance lines

The following support and resistance lines should be considered:

JPY148: Major resistance line

Market Sentiment

USDJPY Sell: 52% Buy: 48%

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Swiss GDP | 16:00 |

| U.S. ISM Manufacturing PMI | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.