USDJPY in the 142 JPY Range; Mixed Results in U.S. Employment Data【September 9, 2024】

Fundamental Analysis

- The number of new U.S. jobs fell short of expectations, while average hourly earnings exceeded forecasts.

- The market’s focus is now on the U.S. CPI, which will have a significant impact on the FOMC’s rate cuts.

- USDJPY may continue to decline, with the JPY strengthening.

USDJPY technical analysis

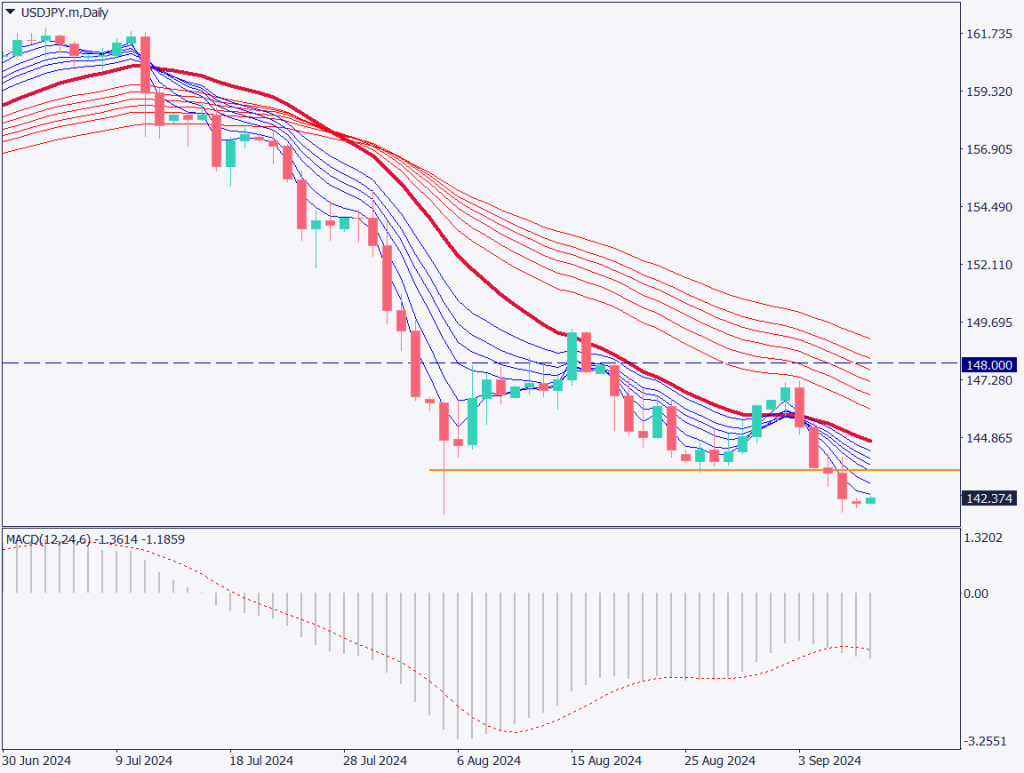

Analyzing the daily chart of USDJPY, the pair broke downwards from the 143.50 JPY level. Following the release of U.S. employment data, USDJPY briefly dropped into the 141 JPY range. Although it didn’t break below 140 JPY, given the mixed employment data, the long-term trend is expected to remain downward.

Looking at the MACD, the histogram is once again extending downward, falling below the signal line. The long-term GMMA is also widening, indicating further downside pressure. The near-term target is the recent daily low of 141.70 JPY. If USDJPY breaks below 141.70 JPY and the U.S. CPI results are weak, the pair may test a break below 140 JPY this week.

We should remain cautious about the risk of further declines.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY, a sell-on-recovery strategy is preferred. While USDJPY rebounded after the employment data, the 143.50 JPY level is confirmed as a solid resistance line. The selling pressure around the 143 JPY level remains strong.

For day trading, the strategy is to sell on recovery. Place a sell limit order at 143.15 JPY. If the price reaches 143.35 JPY, set a stop-loss, and look for another selling opportunity. The take-profit levels are 142.50 JPY and 141.70 JPY.

Support/Resistance lines

The key support and resistance levels to consider going forward are as follows:

- 143.50 JPY: Major resistance

- 141.70 JPY: Recent daily low

Market Sentiment

USDJPY – Sell: 34% Buy: 66%

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Japan GDP | 8:50 |

| Australia Building Approvals | 10:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.