USDJPY Shows No Clear Direction as US Core Inflation Surprises on the Upside【September 12, 2024】

Fundamental Analysis

- US Core Consumer Price Index exceeds expectations, increasing the likelihood of a 0.25% rate cut.

- Harris leads in the US presidential debate, with no major market impact.

- BOJ member reiterates commitment to easing reduction, a factor for JPY appreciation.

USDJPY technical analysis

Analyzing the daily chart of USDJPY, the pair fell to 140.70 JPY but rebounded to the upper 142 JPY level following the release of the US core CPI. The RSI shows a rising low, indicating the possibility of a further rise to around 144 JPY.

With the expectation of a major rate cut subsiding, a strong USD buying scenario may develop. However, the long-term trend of JPY appreciation remains, suggesting a sell-on-rally strategy might be effective. The conversion line of the Ichimoku Kinko Hyo serves as a resistance level. Since it’s around 144 JPY, the rally may stall at that level, presenting a selling opportunity on the retracement.

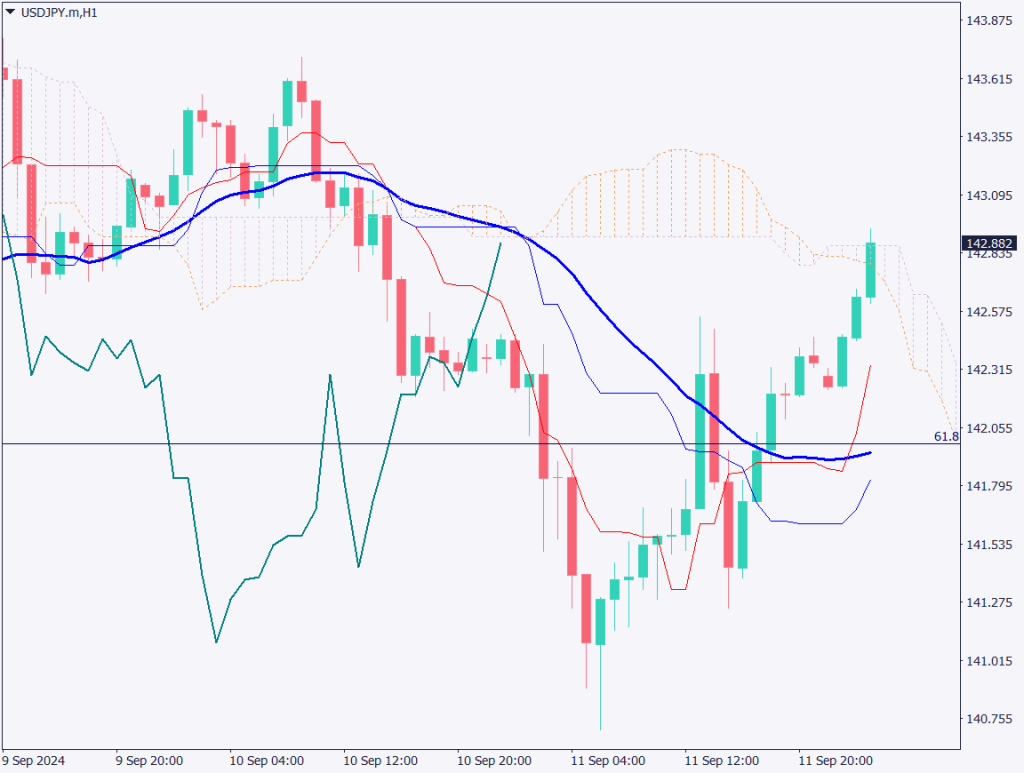

Day trading strategy (1 hour)

Analyzing the 1-hour USDJPY chart, the market is reversing the “Trump trade” due to the higher-than-expected US CPI and Harris’s lead in the debate. Trump is known for his support of the US manufacturing sector, which dislikes a strong USD. Therefore, Harris’s advantage may bring a sense of relief.

The USDJPY plunged to 140.70 JPY, resulting in a significant correction.

However, the fundamental factors—BOJ’s potential rate hike and the Fed’s possible rate cut—remain unchanged, meaning the JPY appreciation trend is likely to resume. The retracement target is around 144 JPY, where the daily conversion line is situated.

The day trading strategy is to sell on rallies. Entry at 144 JPY, take profit at 142.50 JPY, and stop loss at 145.20 JPY.

Support/Resistance lines

Key support and resistance levels to watch:

- 140.70 JPY – Yesterday’s low

- 140.25 JPY – 2023 year-end low

Market Sentiment

USDJPY Sell: 41% / Buy: 59%

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Japan Large Manufacturing Business Conditions Index | 08:50 |

| Speech by BOJ Member Tamura | 10:00 |

| US Continuing Jobless Claims | 21:30 |

| US PPI (Producer Price Index) | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.