Gold Hits Record High as Stage Is Set for U.S. Rate Cuts【September 13, 2024】

Fundamental Analysis

- U.S. unemployment claims have increased, signaling a gradual deterioration in the employment environment.

- The U.S. Producer Price Index (PPI) slightly exceeded expectations, leading to a slight retreat in expectations for significant rate cuts.

- Gold hit a record high, reaching 2558 USD.

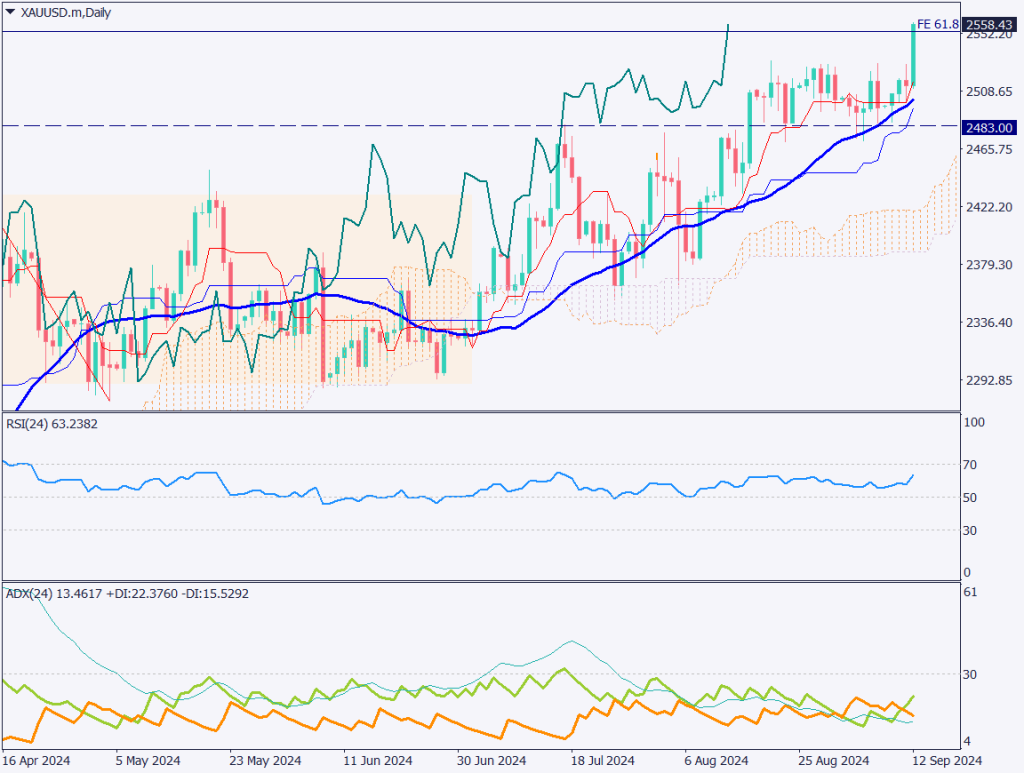

XAUUSD technical analysis

Analyzing the daily chart for gold, the metal broke out of its range-bound market and surged to 2558 USD, hitting an all-time high following U.S. economic data releases yesterday. While the price is nearing the 61.8% Fibonacci expansion level and a correction could be expected, the overall outlook remains bullish.

The 100% Fibonacci level corresponds to 2770 USD, which is still far off. However, with growing expectations of rate cuts, the upward pressure is likely to persist.

U.S. unemployment claims have increased, and inflation rates are also rising. As a result, although the outlook for significant rate cuts has slightly receded, a rate cut is almost certain to prevent further deterioration in the employment situation. The ECB implemented a rate cut yesterday, and the U.S. dollar, as the world’s reserve currency, is soon expected to enter a rate-cut cycle.

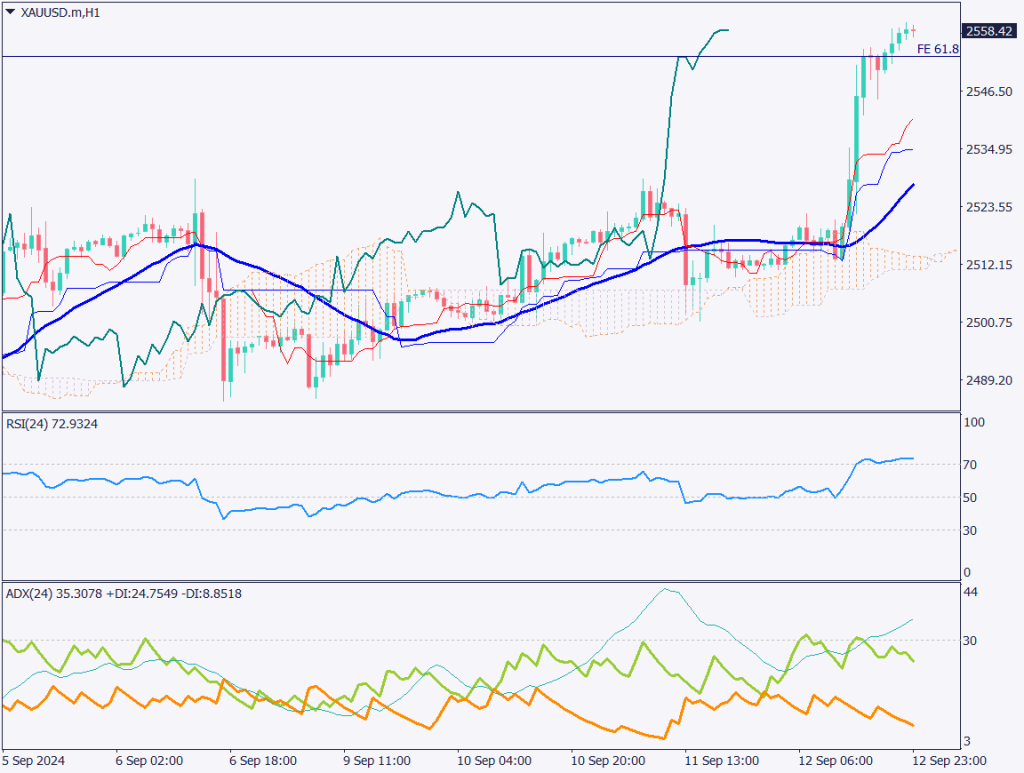

Day trading strategy (1 hour)

Analyzing the 1-hour chart for gold, it shows a sharp rise following the release of U.S. economic data. The +DI has slightly decreased, but the ADX remains above 30, indicating that the uptrend continues. However, in the short term, the RSI has reached 72, suggesting that a correction phase may occur. A decline towards 2530 USD, the previous high in the range-bound market, is possible.

One strategy would be to enter a sell position once the RSI falls below 70, aiming to capitalize on the correction. Another approach is to wait for a pullback and enter a buy position.

For a buy position, aim to enter around 2530 USD. For those targeting the correction, exit around 2545–2550 USD once the RSI dips below 70.

Support/Resistance lines

The following support and resistance levels should be considered:

- 2530 USD: The previous high in the range-bound market

Market Sentiment

XAUUSD Sell: 76% Buy: 24%

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Japan Iron and Steel Production | 13:30 |

| Michigan University Consumer Sentiment Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.