USDJPY Updates 2024 Low as U.S. Rate Cut Expectations Lead the Market【September 16, 2024】

Fundamental Analysis

- The probability of a 0.50% rate cut at the FOMC meeting is priced at 40%, pushing USD lower.

- USDJPY has reached its lowest level in 2024, and the focus is on how much the rate cut expectations will rise.

USDJPY technical analysis

Analyzing the daily USDJPY chart, the pair closed at the 140 JPY level, updating the 2024 low. The key point today is whether the pair will close below the January low of 140.81 JPY.

Although USD saw a brief rise due to the increase in U.S. inflation rates, the expectation of a significant rate cut dominated the market, boosting stock prices and driving the USD lower during London and New York sessions. Traders are selling on the anticipation of a 0.50% rate cut.

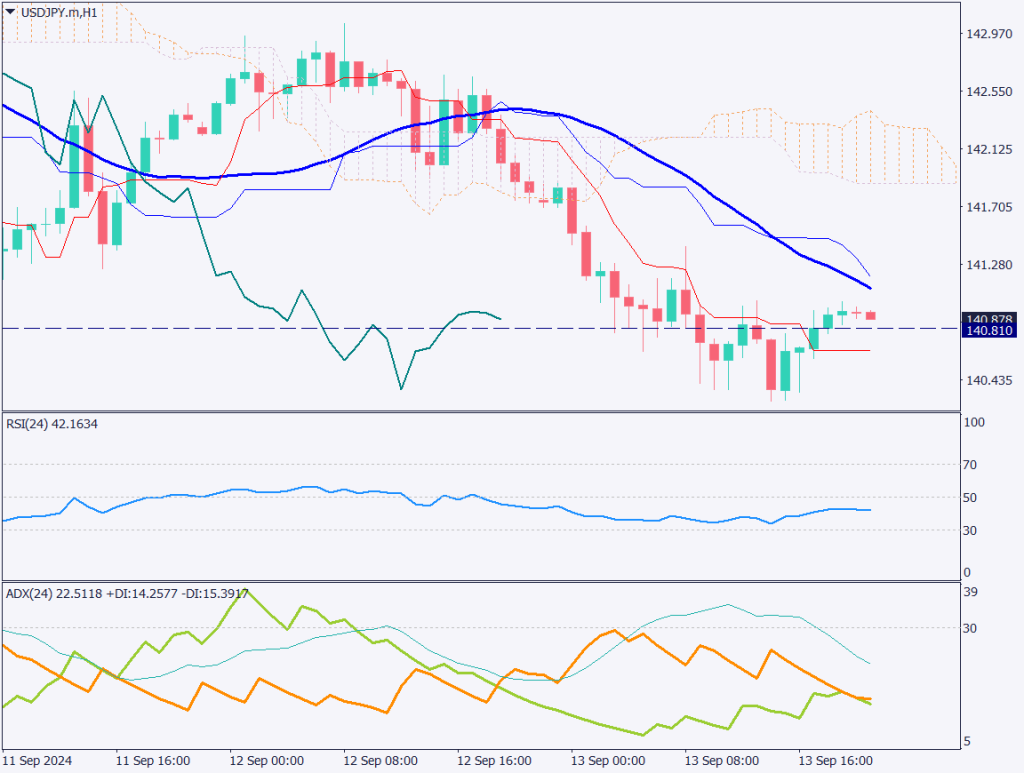

The -DI is on an upward trend, and ADX shows signs of gradual increase. Meanwhile, the RSI shows higher lows, indicating the appearance of a divergence. Attention should also be paid to potential corrective movements.

Day trading strategy (1 hour)

Analyzing the 1-hour USDJPY chart, the 28 MA is functioning as a resistance line. On Friday, rate cut expectations heightened, leading to a strong sell-off, but today may see corrective movements ahead of key indicators this week.

The RSI has the potential to rise to 50.

Today’s day trading plan is to sell on the rebound. The plan is to sell at 141.35 JPY and settle around 140 JPY, with a stop at 141.65 JPY.

Support/Resistance lines

Here are the support and resistance levels to consider going forward:

- 140.810 JPY – January 2024 low

- 140.250 JPY – Last week’s low

Market Sentiment

USDJPY: Sell 32% Buy 68%

Today’s important economic indicators

| Economic indicators and events | Japan time |

| NY Fed Manufacturing Index | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.