EURUSD Rises, Driven by Expectations of Significant US Rate Cuts, Leading to Broad USD Weakness【September 17, 2024】

Fundamental Analysis

- USDJPY reaches the strongest level of JPY appreciation in about a year, briefly trading in the 139 JPY range.

- Expectations of a significant US rate cut are ahead of the curve, but there is no solid foundation for a large rate cut.

- The currency market is broadly bearish on USD, with position adjustments already starting in preparation for the FOMC.

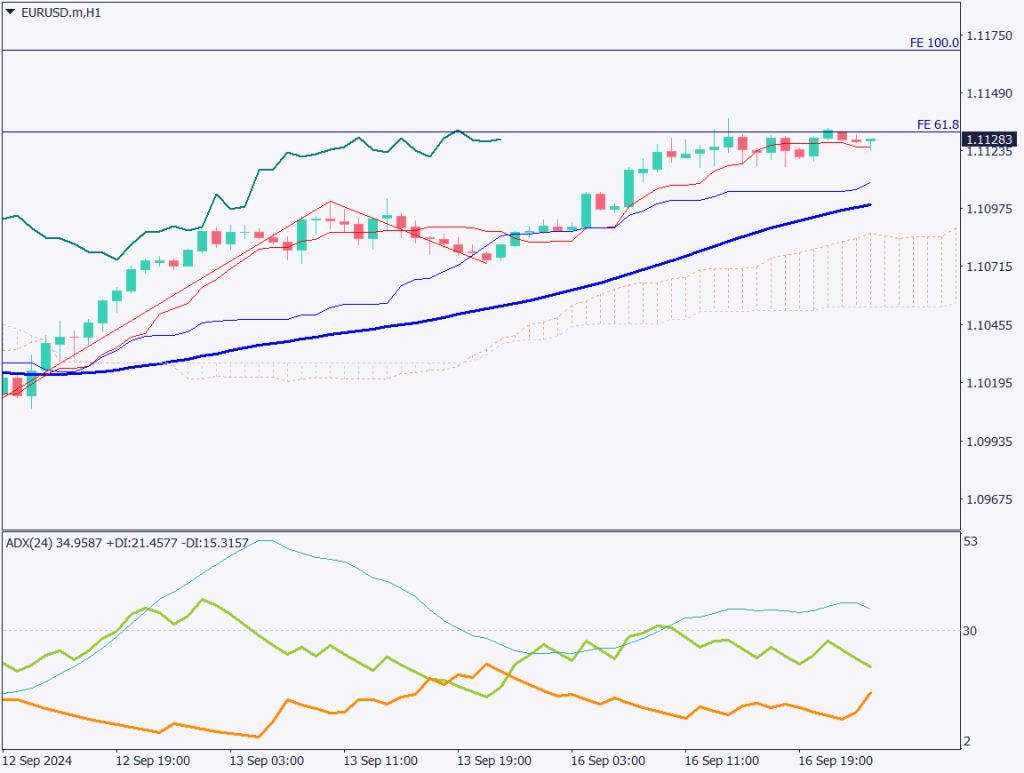

EURUSD technical analysis

Analyzing the daily chart of EURUSD, it has broken out of the upper limit of a weekly triangle and is on the rise. On the daily chart, there was a corrective movement, but the pair formed a dip and is climbing again. When drawing a Fibonacci expansion, the price has surpassed the 100% level and is aiming for 161.8%.

Expectations of a significant US rate cut are leading the market, driven by an article from WSJ, but it seems that the fundamental anticipation of a rate cut is moving the market. As the FOMC is on Thursday, there is still time. The USD weakness is likely to continue, and the possibility of surpassing the recent high on the daily chart remains.

If the ADX exceeds 30 again, the pair might aim for the 161.8% level at 1.125 USD. The immediate target is the recent high at 1.12 USD.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of EURUSD, the 61.8% Fibonacci expansion acts as a resistance line, capping the upside. While market expectations are leading, there is no concrete evidence yet. However, since a rate cut is almost certain, the market is still inclined to move towards USD weakness.

The 100% level corresponds to 1.1170 USD. If the 61.8% level is surpassed, we would consider a buy entry with a target to close at 1.1170 USD. Stronger resistance is expected near the 1.12 USD level.

The day trading strategy is to buy. Enter at the breakout of 1.1130 USD and exit at 1.1170 USD. Place a stop if the pair falls below 1.110 USD.

Support/Resistance lines

The support and resistance lines to consider moving forward are as follows:

1.125 USD – Daily Fibonacci target

1.12 USD – Recent daily high

1.1135 USD – 1-hour resistance line

Market Sentiment

EURUSD Sell: 89% Buy: 11%

Today’s important economic indicators

| Economic indicators and events | Japan time |

| US Core Retail Sales | 21:30 |

| Canada Consumer Price Index | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.