USDJPY Reaches 148 JPY as U.S. Employment Report Exceeds Market Expectations by 100,000 Jobs【October 7, 2024】

Fundamental Analysis

- The U.S. employment report delivered exceptionally strong results, with all indicators surpassing expectations.

- Market expectations for a U.S. rate cut have diminished, leading to revisions in interest rate outlooks.

- The USDJPY continues to rise, reaching levels not seen since early August, driven by a stronger dollar and a weaker yen.

USDJPY technical analysis

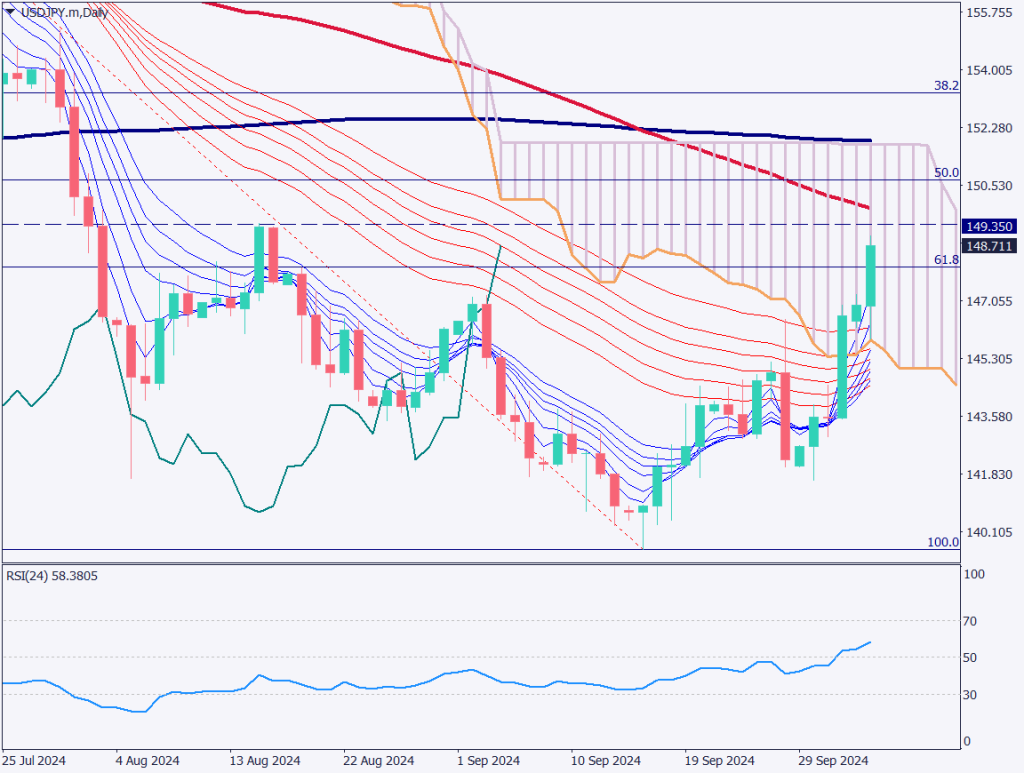

Analyzing the daily chart for USDJPY, the pair has surpassed the 61.8% Fibonacci retracement level and closed near 148.70 JPY. Resistance lies ahead at the 52-day moving average, with an additional resistance level at 149.35 JPY. As the pair is moving within the Ichimoku cloud, it is expected to experience volatility.

A corrective sell-off is likely, with potential for a drop to the low 147 JPY range.

The U.S. employment report significantly exceeded market expectations, with a notable improvement in unemployment rates. The fact that the number of new jobs surpassed expectations by 100,000 is particularly impactful. While attention should be paid to comments from U.S. officials, the dollar is expected to remain strong throughout this week.

Day trading strategy (1 hour)

Analyzing the 1-hour chart for USDJPY, the pair rebounded from the 52-hour moving average, briefly reaching the 149 JPY level. The strong employment data caused a sharp shift from yen strength to yen weakness, likely triggered by stop-loss orders on short positions. The pair has moved past the 161.8% Fibonacci expansion level. The next key level is at the 256.8% Fibonacci expansion near 150.40 JPY.

Looking at the RSI, it is nearing a drop below 70, which suggests the possibility of forming a new lower price point. The price level that could act as a new low is expected to be around 147.50 JPY, near the 161.8% Fibonacci expansion.

The day trading approach will focus on buying at dips. Entry points are set at 147.50 JPY and 147 JPY, with a target of taking profits at the 149 JPY level. Stop-loss orders should be placed if the pair clearly falls below the 52-hour moving average.

Support/Resistance lines

The key support and resistance levels to watch are as follows:

- 150.35 JPY – 90-day moving average

- 149.35 JPY – High from August 15

Market Sentiment

USDJPY – Sell: 72% / Buy: 28%

Today’s important economic indicators

| Economic indicators and events | Japan time |

| Speech by Bundesbank Official (Germany) | 16:25 |

| Speech by Fed Governor Bowman | 02:00 (next day) |

| Speech by FOMC Member | 02:50 (next day) |

| Speech by FOMC Member | 07:00 (next day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.