USDJPY at 153 JPY is the final resistance line, what about the results of the House of Representatives election?【October 28, 2024】

Fundamental Analysis

- The upward trend in USDJPY continues, and attention is focused on whether the ruling party will secure a majority in the House of Representatives election.

- With one week left until the U.S. Presidential Election, the “Trump trade” continues to push the USD higher.

USDJPY technical analysis

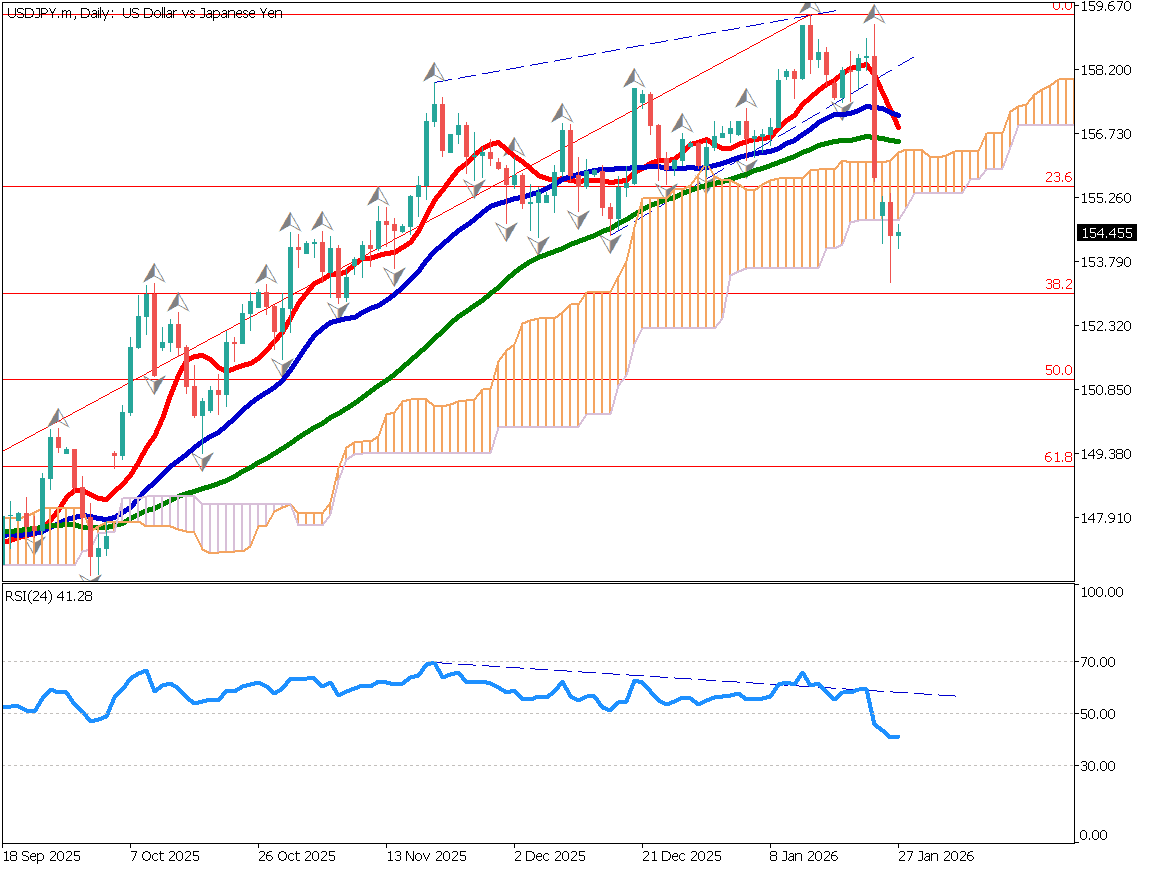

Let’s analyze the daily chart for USDJPY. The 240-day moving average is functioning as a support line. A “return move” pattern, where the price temporarily pulls back after a breakout, has been observed, and the support line is holding strong, indicating a highly reliable signal.

The upper target is expected to be around 153.30 JPY, corresponding to the 61.8% Fibonacci retracement. If it exceeds 153.50 JPY, the market may anticipate a full recovery, potentially leading to a rise toward the 160 JPY level, which warrants caution.

The ruling party failed to secure a majority in the House of Representatives election. The market is likely to be concerned about potential political instability. At the time of writing, it’s challenging to predict which direction the exchange rate will move. However, stock prices are expected to drop significantly.

Day trading strategy (1 hour)

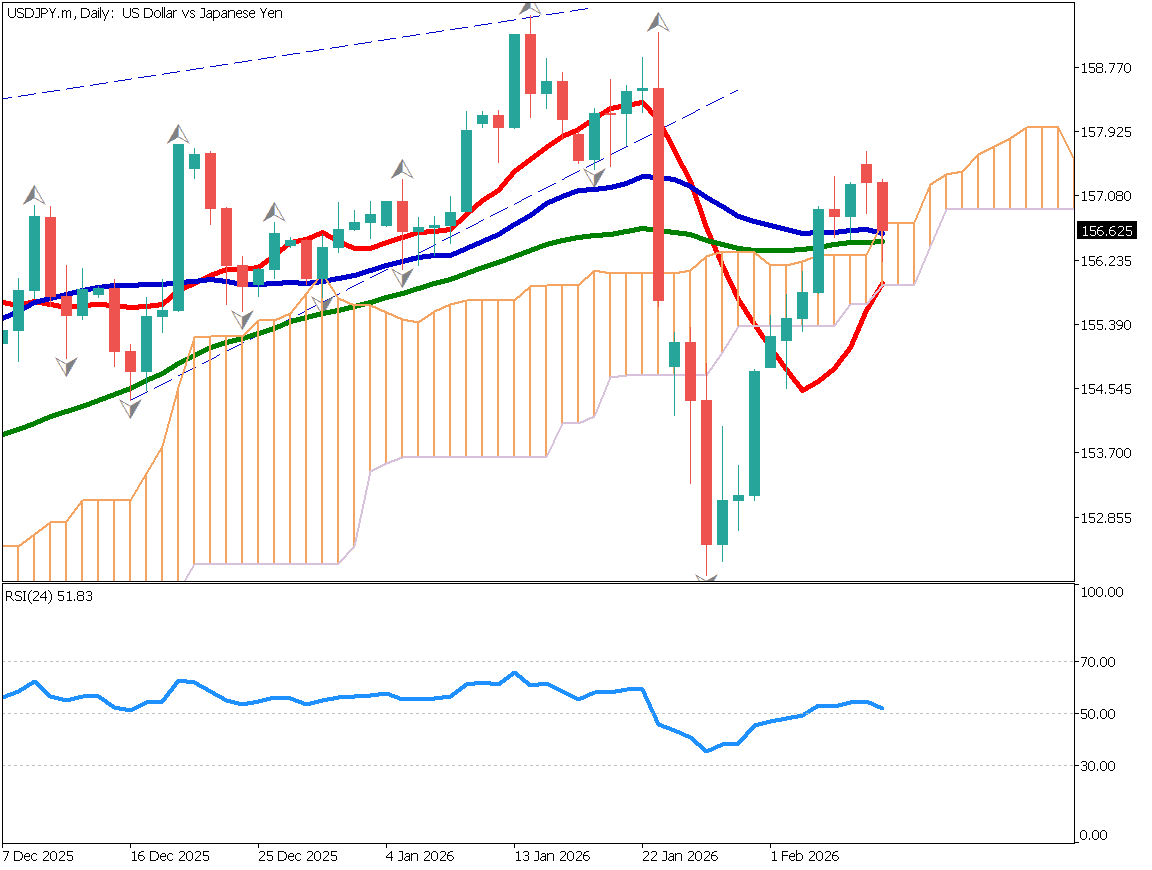

Analyzing the 1-hour chart of USDJPY, purely based on the chart’s formation, it appears that the strong upward trend will continue, with the 10-period moving average acting as support as the price attempts to break through the 153 JPY level.

With the ruling party falling short of a majority, concerns about political instability are expected to surface. There is a potential for high volatility, so caution is advised. Stock prices are predicted to fall, but it is uncertain whether this will lead to a stronger JPY, considering recent trends.

Monday’s trading should be approached with caution. While this is a day trading forecast, I plan to observe the morning market before determining my strategy.

Support/Resistance lines

The following are key support and resistance lines to consider:

- 153.30 JPY – Daily Chart Fibonacci 61.8%

Market Sentiment

USDJPY – Sell: 66%, Buy: 34%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Bank of Canada Governor’s Comments | 2:30 AM (Next day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.