USDJPY Reacts to Yen Weakness, Ruling Party Loses Majority in Lower House Election【October 29, 2024】

Fundamental Analysis

- The ruling party lost its majority in the Lower House election, causing USDJPY to surge with a significant price gap.

- With the potential for political instability in Japan, the market environment may lean towards further yen weakness.

- Crude oil saw a sharp drop, falling into the $67 range after opening with a substantial price gap.

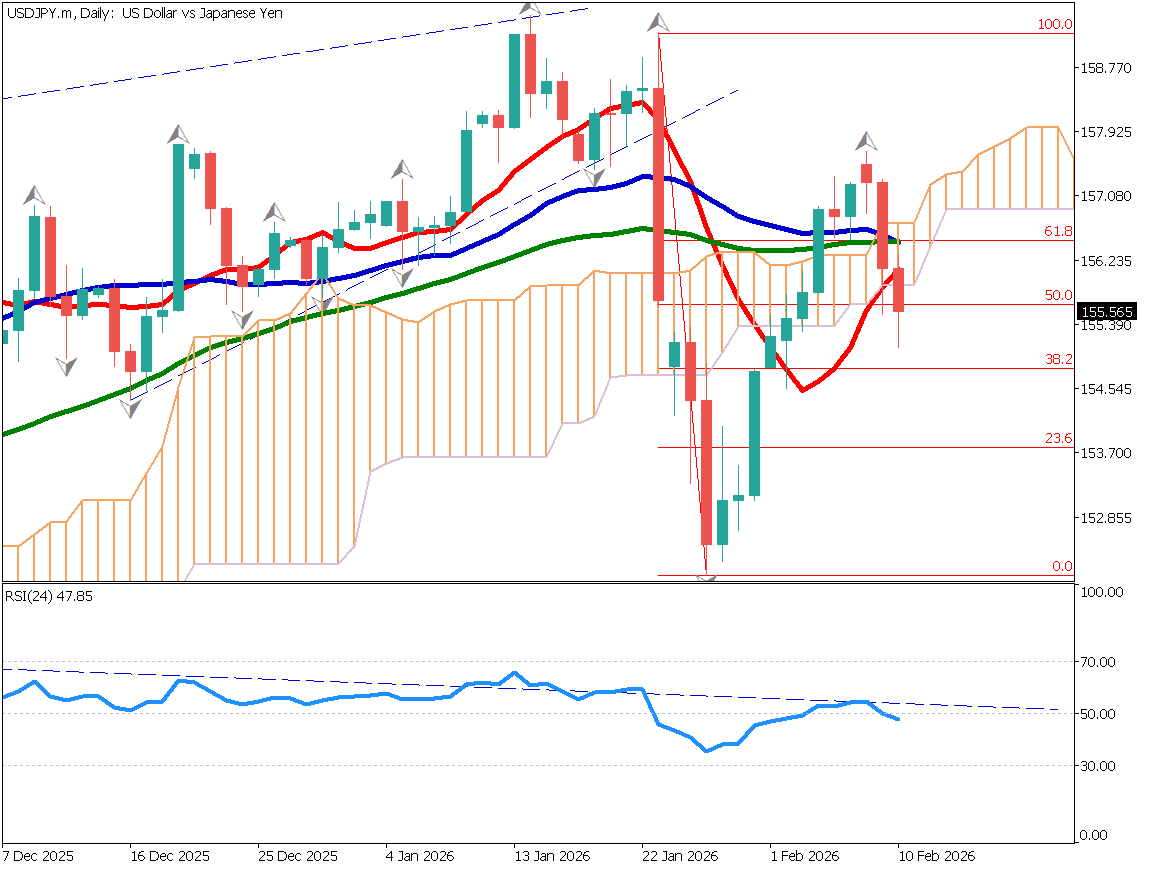

USDJPY technical analysis

USDJPY surged to 153.88 JPY with a large price gap following the Lower House election, where the ruling party suffered a major defeat. Losing the majority means the ruling party will need to collaborate with the opposition to govern, raising concerns about political instability.

In this situation, the market may have speculated that the Bank of Japan will find it difficult to raise interest rates anytime soon. Additionally, with the U.S. Federal Reserve maintaining a cautious stance on rate cuts, the interest rate differential between the U.S. and Japan came into focus.

The 153.30 JPY level corresponds to the 61.8% Fibonacci retracement of the recent downtrend, serving as the last line of defense. USDJPY has risen, supported by the 10-day moving average, and a break above 153.30 JPY could lead to a move towards the 155 JPY range. However, with the RSI above 70, there is also a possibility of corrective selling.

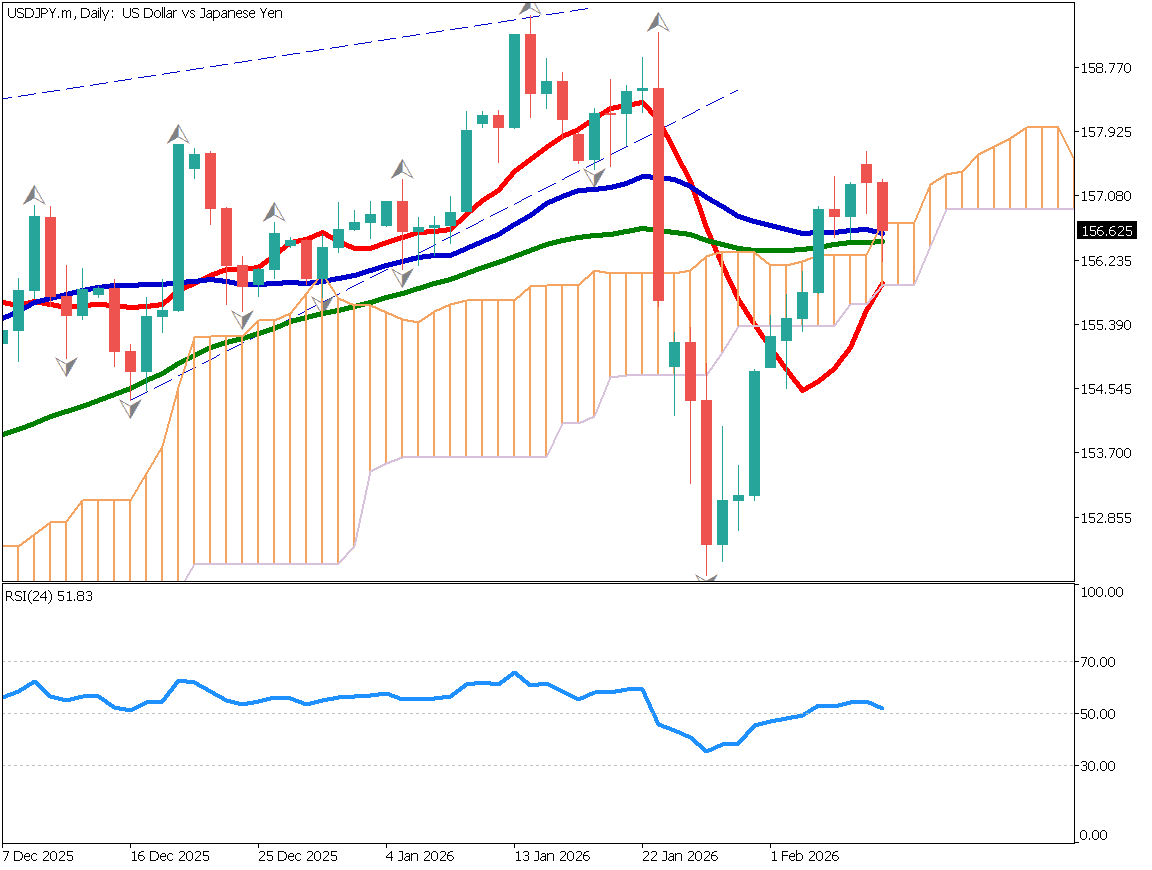

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY, the pair rose to 153.88 JPY, but strong resistance at 153.30 JPY capped the upside. While USDJPY rose with a price gap, the gap has now been filled. The key focus will be whether it can break through 153.30 JPY.

This week, the U.S. employment report is due, and the U.S. presidential election is scheduled for next week. Institutional investors are likely to avoid holding large positions, suggesting limited movement.

The day trading strategy favors contrarian selling. Consider new short positions at 153.65 JPY, with a stop at 154 JPY, and target profit-taking at 153.15 JPY.

Support/Resistance lines

The following are key support and resistance lines to consider:

- 153.88 JPY: Recent high

- 153.30 JPY: Corresponds to the 61.8% Fibonacci retracement

Market Sentiment

USDJPY Short: 73% Long: 27%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japan Unemployment Rate | 8:30 AM |

| U.S. Consumer Confidence Index | 11:00 PM |

| U.S. JOLTS Job Openings | 11:00 PM |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.