USDJPY Remains in the Low 153 JPY Range as U.S. Consumer Confidence Index Surges【October 30, 2024】

Fundamental Analysis

- The U.S. Consumer Confidence Index exceeded all expectations and surged.

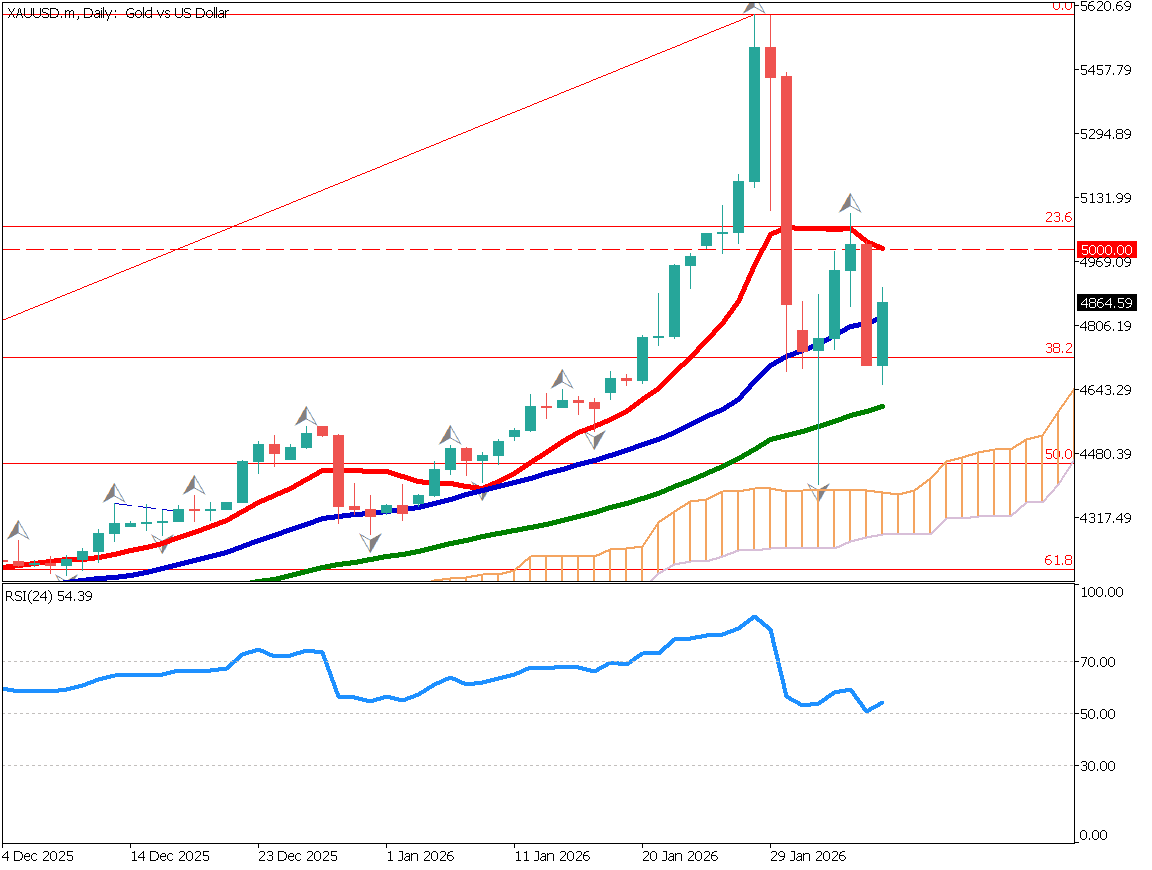

- Gold is hitting new all-time highs, surpassing the key level of 2,770 USD.

USDJPY technical analysis

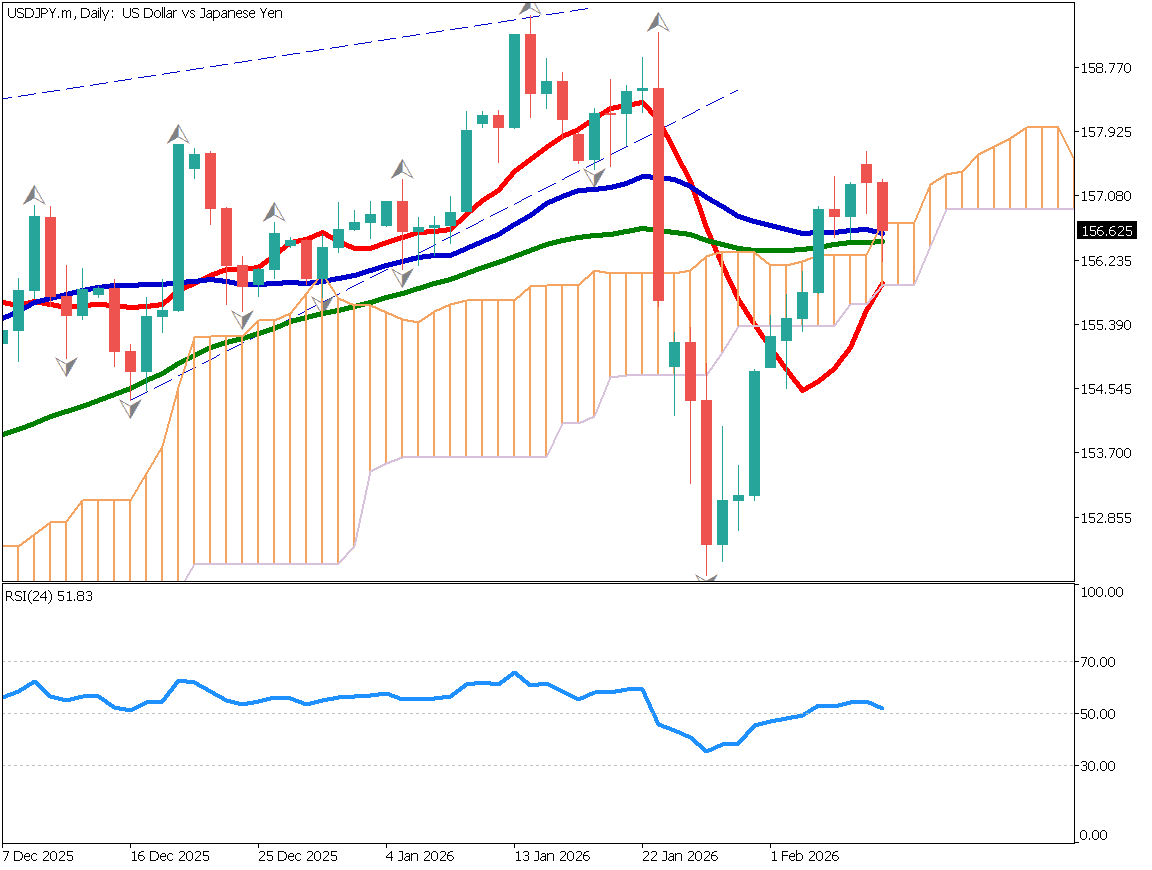

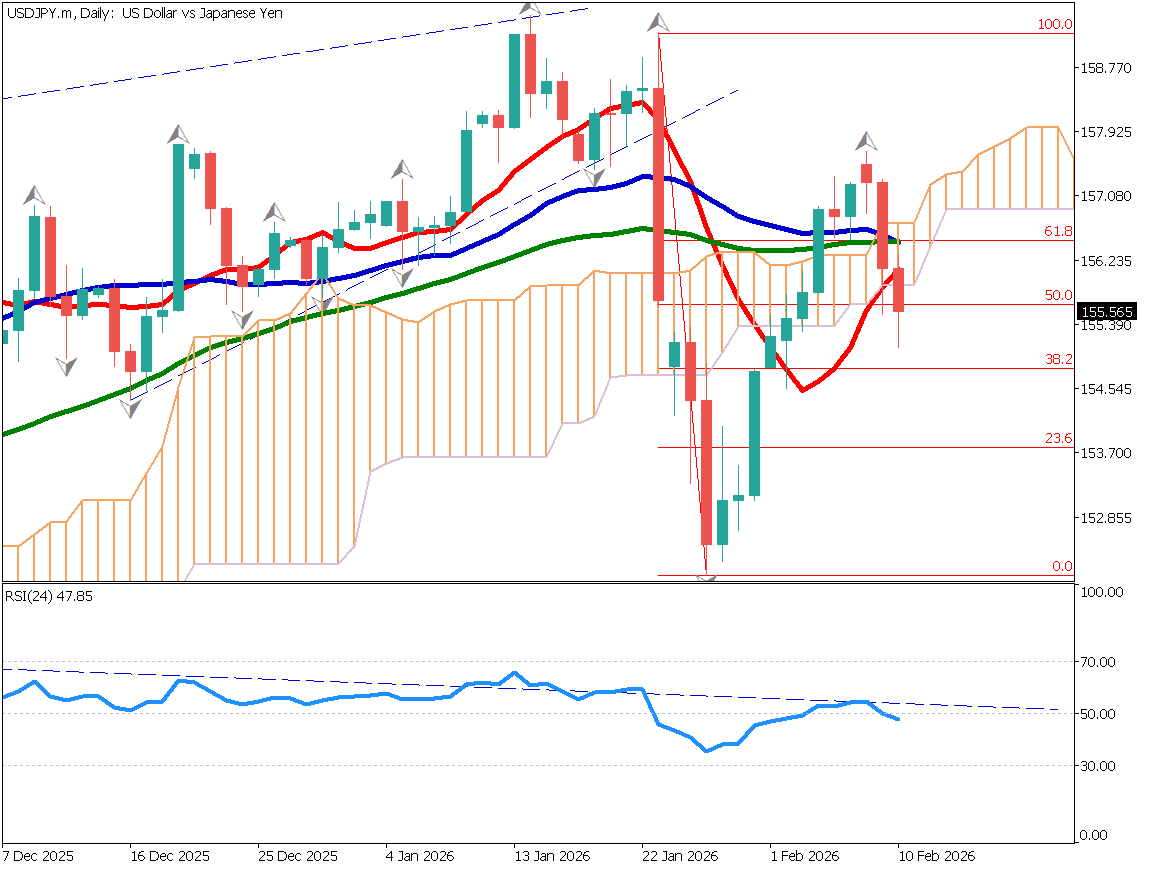

Analyzing the daily chart of USDJPY, the pair has clearly broken above the 200-day moving average, signaling a strong upward trend. It has also closed above 153.30 JPY, corresponding to the 61.8% Fibonacci retracement, and tested the 154 JPY level for the second consecutive day.

The 10-day moving average is approaching the 200-day moving average, and attention is on whether a golden cross will form. The 10-day moving average has been functioning as a support line, and USDJPY has remained above it throughout October.

The Bank of Japan’s monetary policy meeting is being held today and tomorrow, but a rate hike is unlikely. Ongoing optimism about the U.S. economy is believed to be fueling continued USD buying.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY, the pair is forming a double top with a high of 153.88 JPY. However, strong buying on dips is also present. Buying interest has emerged at the key Fibonacci level of 153.30 JPY on the daily chart, resulting in a narrow range.

The U.S. ADP Employment Report will be released today. There have been reports of increased layoffs and a reduction in job openings, raising the possibility of a weak outcome. There is also a chance that USDJPY could fall to the 152 JPY range.

For day trading, targeting a deeper pullback is advisable. Consider setting a buy limit at 152.65 JPY, the lower boundary of the Ichimoku Cloud, with a stop at 152.35 JPY and aiming to take profit in the high 153 JPY range.

Support/Resistance lines

The following are key support and resistance lines to consider:

- 153.88 JPY – Recent High

- 151.50 JPY – Key Level

Market Sentiment

USDJPY: Sell 70% / Buy 30%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Australian Consumer Price Index | 9:30 AM |

| German Employment Statistics | 5:55 PM |

| German GDP | 6:00 PM |

| Eurozone GDP | 7:00 PM |

| U.S. ADP Employment Report | 9:15 PM |

| Core Personal Consumption Expenditure Price Index | 9:30 PM |

| U.S. GDP | 9:30 PM |

| U.S. Crude Oil Inventories | 11:30 PM |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.