Gold Retraces from Peak as Pre-Election Position Adjustment Takes Place【November 4, 2024】

Fundamental Analysis

- U.S. Nonfarm Payrolls increased by 12,000, a weaker figure, potentially already priced into the market.

- On the day before the presidential election, position adjustments are ongoing. In seven key battleground states, Trump holds a slight advantage, but the race remains extremely close. Caution is advised on Election Day.

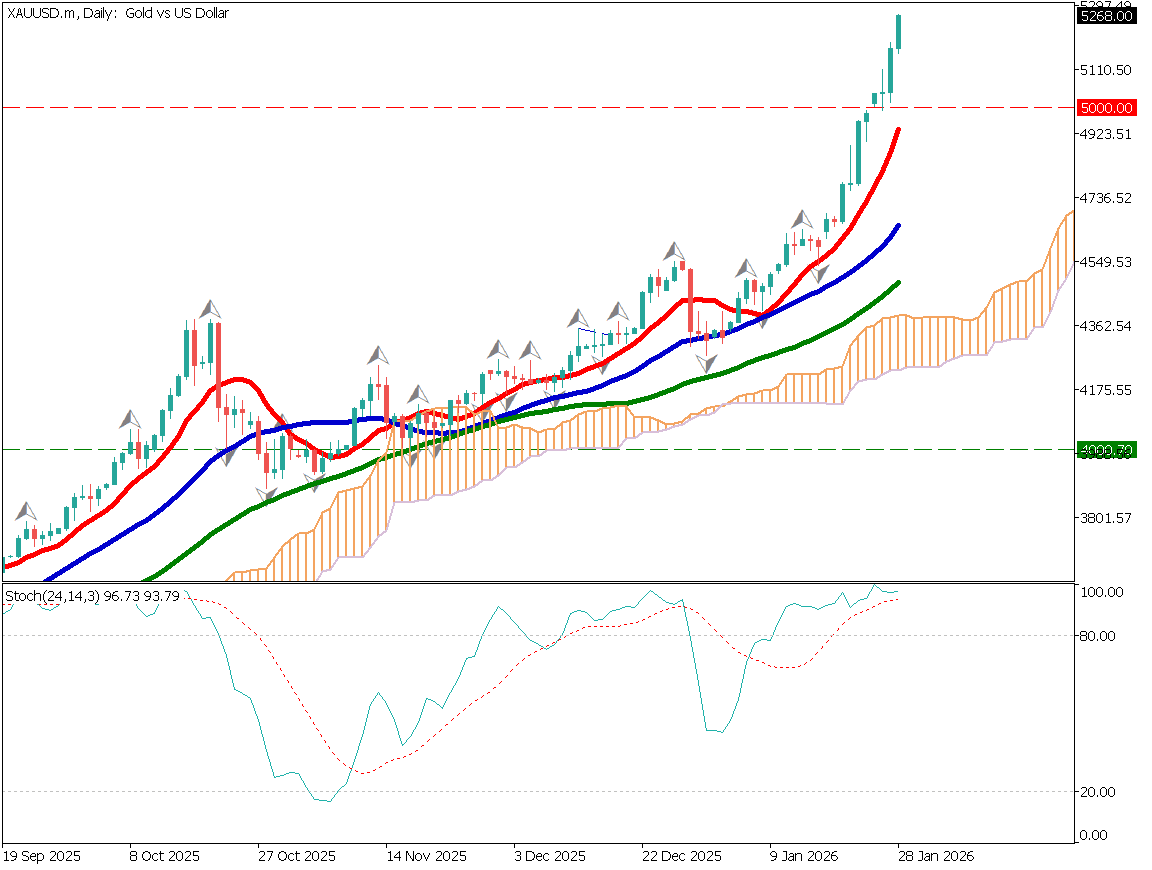

Gold Technical Analysis

Analyzing the daily chart, gold has fallen to around 2,735 USD after reaching its peak. At the peak, an engulfing pattern formed, and RSI dropped from its high to 57.

Gold’s recent rally is thought to reflect election uncertainty, but with the election approaching, position adjustments are intensifying. As Election Day falls on Tuesday, further adjustments are likely.

A drop to around 2,700 USD is expected. Should both candidates accept the election results smoothly, a substantial adjustment could occur.

Day trading strategy (1 hour)

Analyzing the 1-hour chart, the 12-period moving average has crossed below the 24-period moving average, forming a death cross. When plotting Fibonacci Expansion, 2,728 USD aligns with the 61.8% level.

With the election a day away, there is likely limited appetite for large positions, favoring position adjustments and a potential drop to the 100% level at 2,703 USD.

For day trading, the strategy is to sell. Enter a new sell position, targeting exits at 2,728 USD and 2,703 USD, with a stop set if the price rises above the 12-period moving average.

Support/Resistance lines

Key support and resistance lines to consider:

- 2,725 USD – Fibonacci 61.8%

- 2,703 USD – Fibonacci 100%

Market Sentiment

XAUUSD Sell: 45% Buy: 55%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Germany Manufacturing PMI | 18:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.