Presidential Election Begins: Potential for Major Market Movements Late Night Japan Time【November 5, 2024】

Fundamental Analysis

- Due to a high volume of mail-in ballots, it may take time for final election results to be confirmed.

- Preliminary results are expected to roll in through live updates in each state during the evening in Japan.

- Both the forex and stock markets are expected to experience increased volatility—exercise caution with positions.

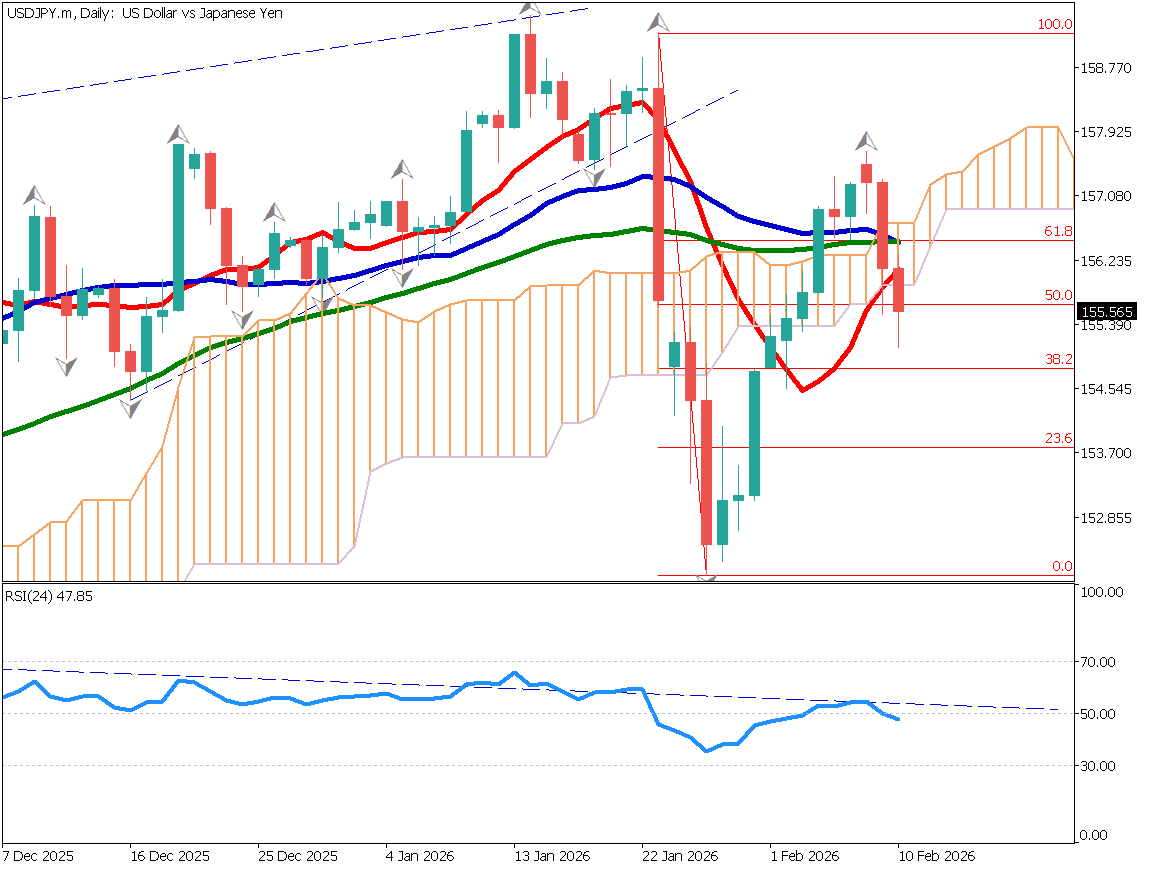

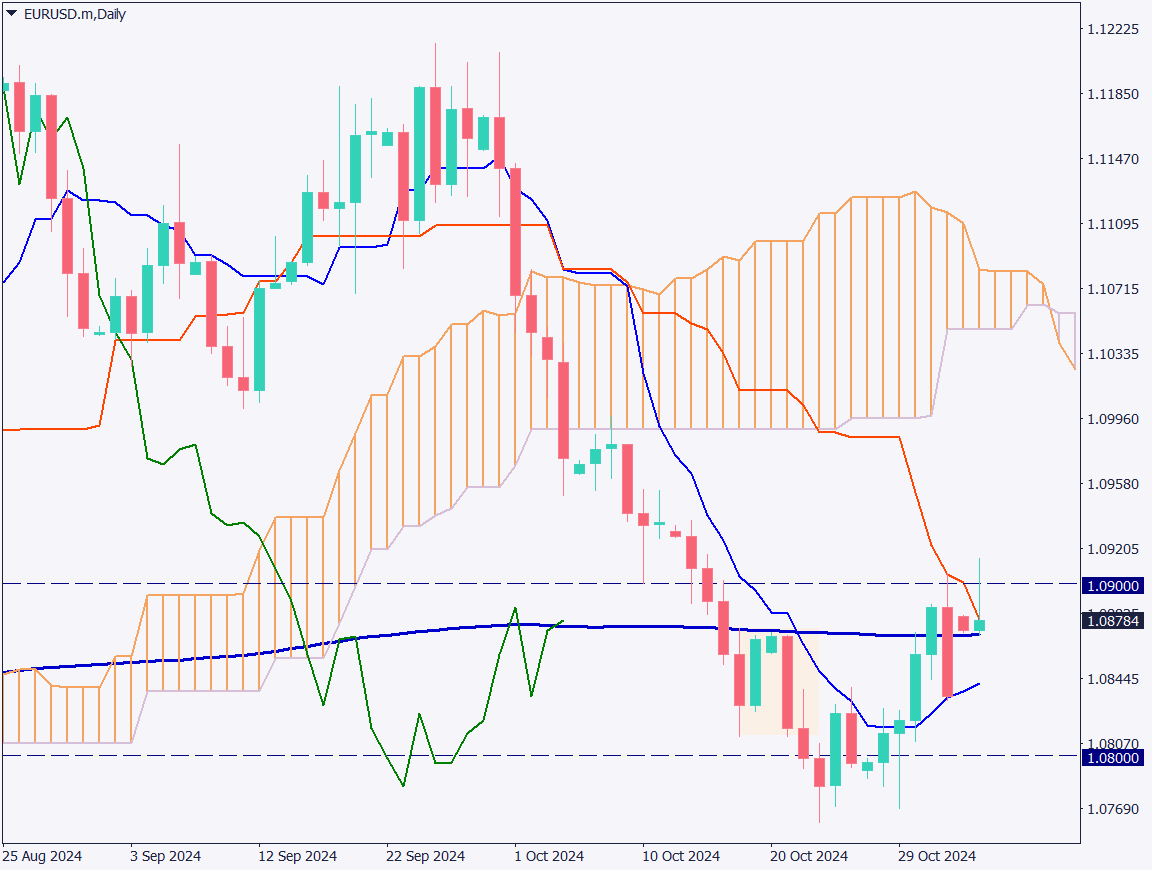

EURUSD Technical Analysis

This report analyzes the 1-hour chart of EURUSD. EURUSD reversed at the 1.09 USD level, with the conversion line serving as resistance. The pair has barely managed to stay above the 240-day moving average, but it faces strong selling pressure on recovery attempts.

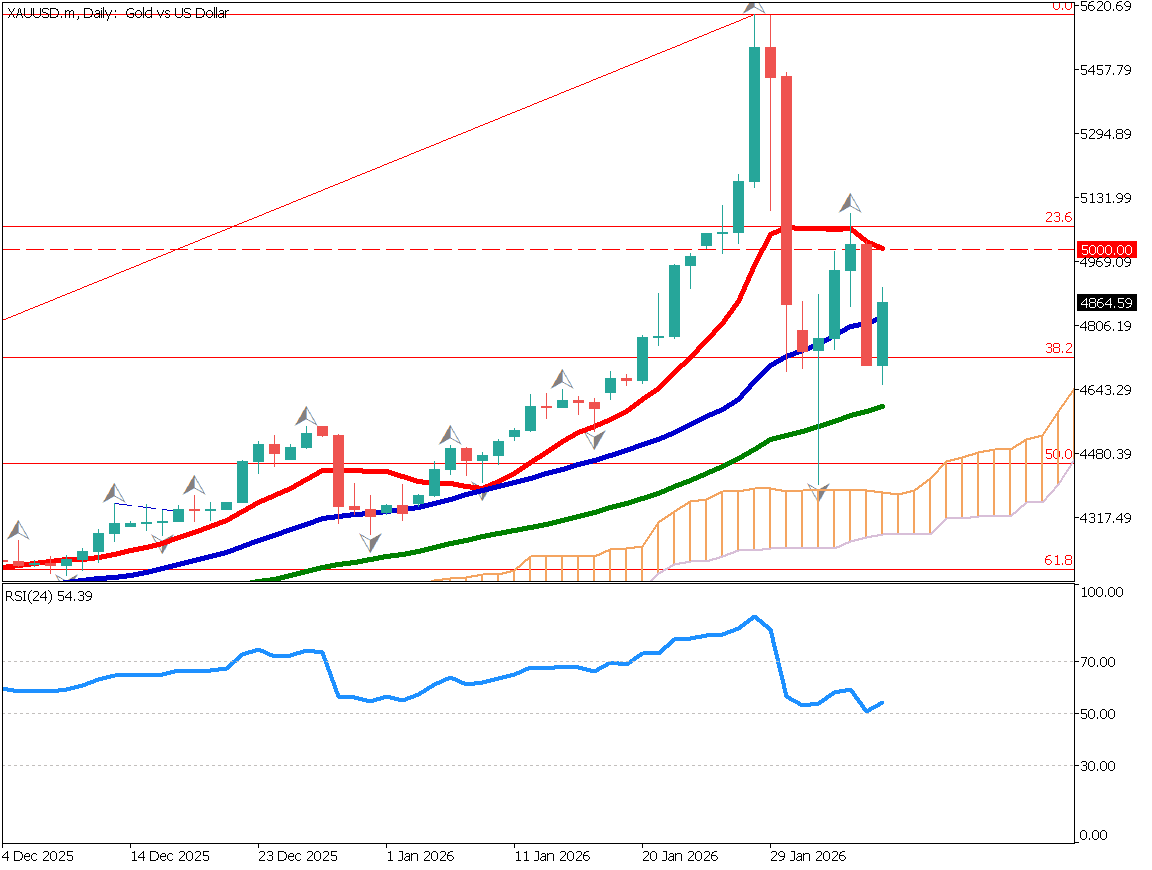

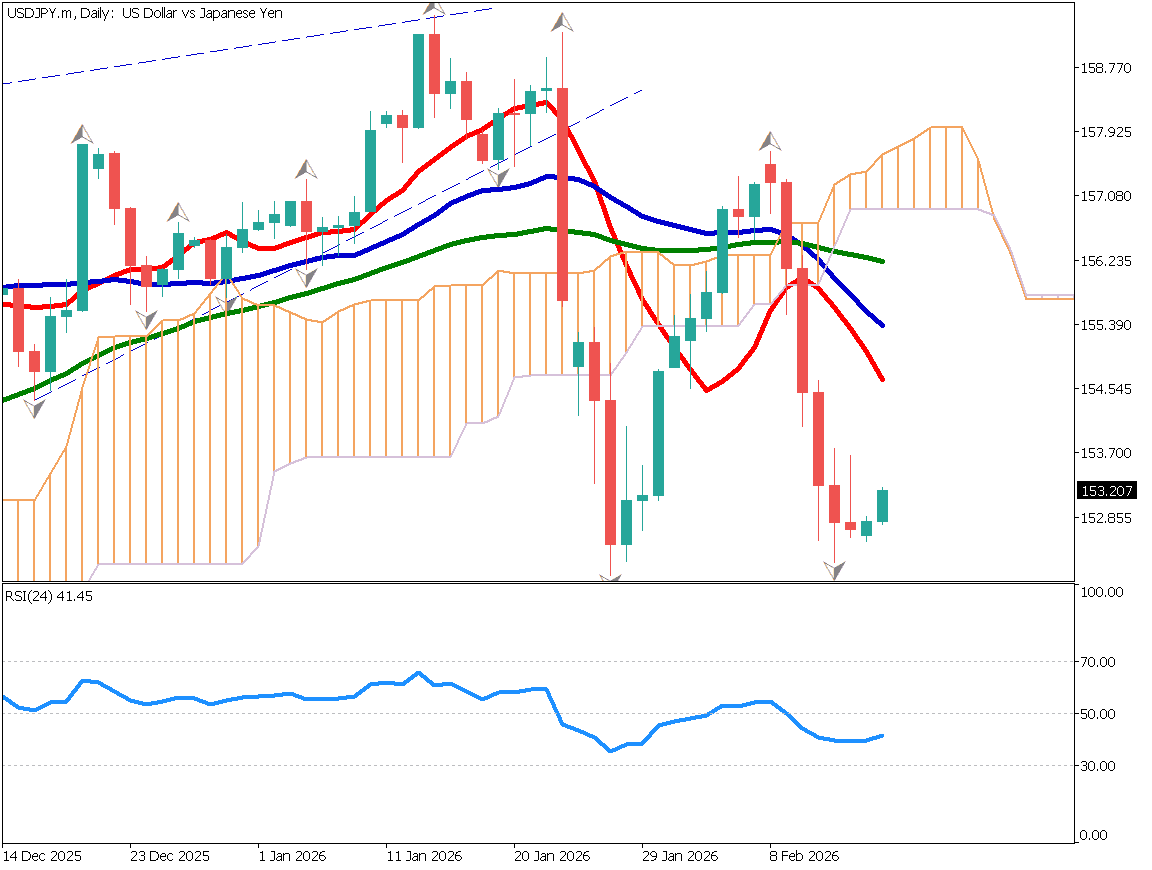

Today marks the presidential election, and significant fluctuations are anticipated across the forex, stock, and gold markets from evening to early morning Japan time. Previously, the market has moved in anticipation of a Trump victory, with USD and stock prices rising—a phenomenon dubbed the “Trump trade.” However, should Harris show a lead in key battleground states, this could disrupt current positions based on the Trump trade.

In any case, position risk management is essential.

Day trading strategy (1 hour)

Analyzing the 1-hour EURUSD chart, some media reported a Harris lead in certain states yesterday. This led to a dip in USD this morning, with EURUSD briefly surpassing 1.09 USD. However, this may be within a margin of error and not likely to have a significant impact. Depending on the election updates, EURUSD could potentially surpass 1.09 USD again, or conversely fall below 1.075 USD.

Day trading is recommended to take a break today. With unpredictable outcomes, it’s best to refrain from entry.

However, if Trump leads, expect USD strength, while a Harris lead could prompt a rollback of Trump trade positions, leading to USD weakness. Once conditions are clearer tomorrow, look for potential trading opportunities.

Support/Resistance lines

Key support and resistance lines to consider:

- 1.09 USD – Round number

Market Sentiment

EURUSD Sell: 21% / Buy: 79%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| RBA Interest Rate Decision | 12:30 |

| U.S. Presidential Election Vote Count | 19:00~ |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.