Presidential Election Results May Take Days to Be Announced【November 6, 2024】

Fundamental Analysis

- With preliminary vote counts expected on November 6, the presidential election results could significantly influence forex markets, depending on how the situation unfolds.

- The Dollar Index has plunged, leading to a stronger JPY as USD weakens against JPY.

- Should Trump lead, the forecast suggests a stronger USD, whereas a lead for Harris is expected to result in a weaker USD.

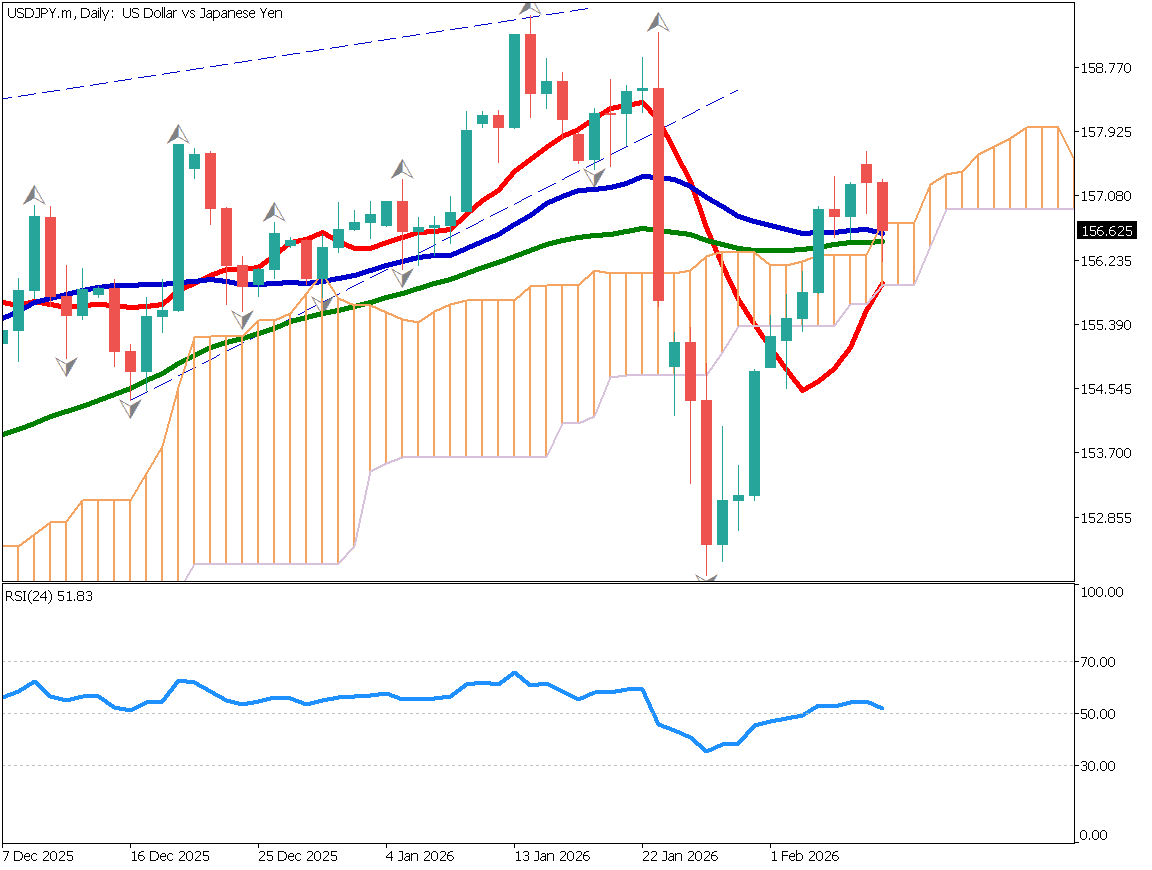

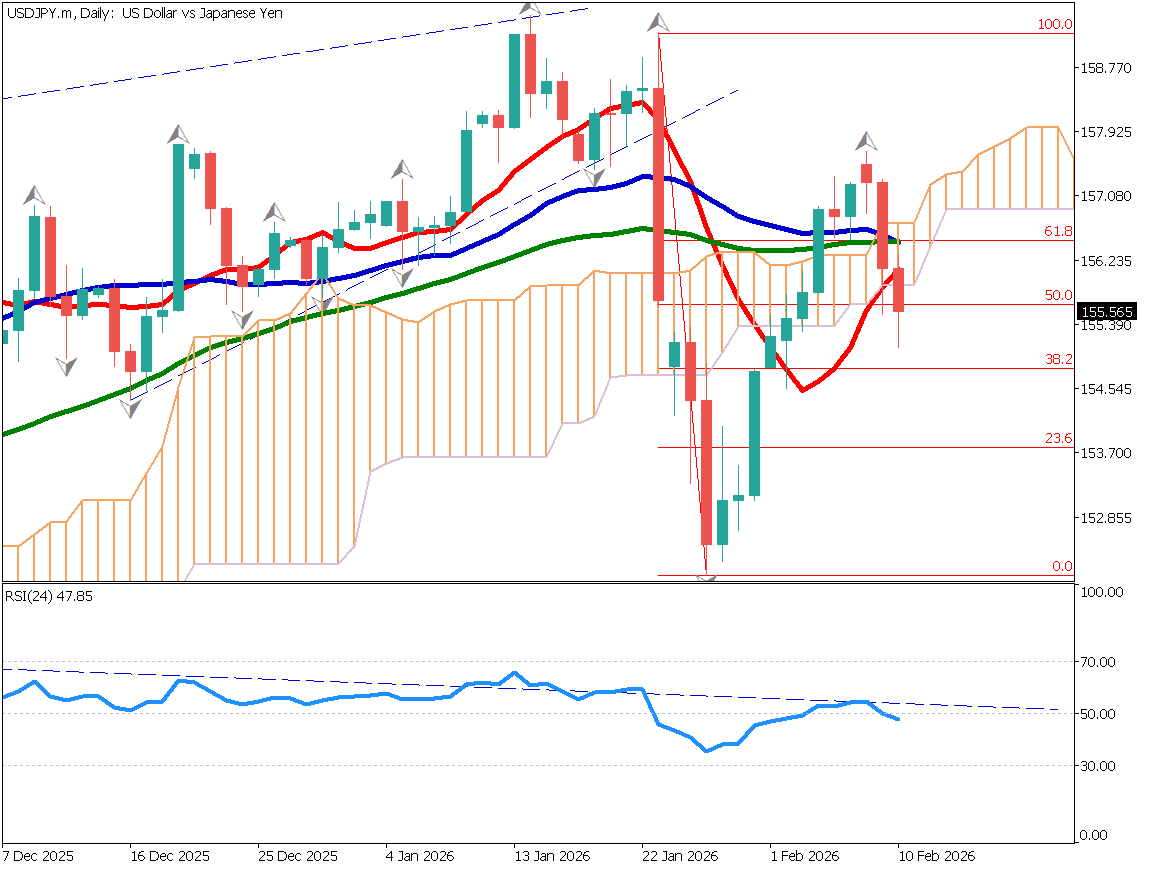

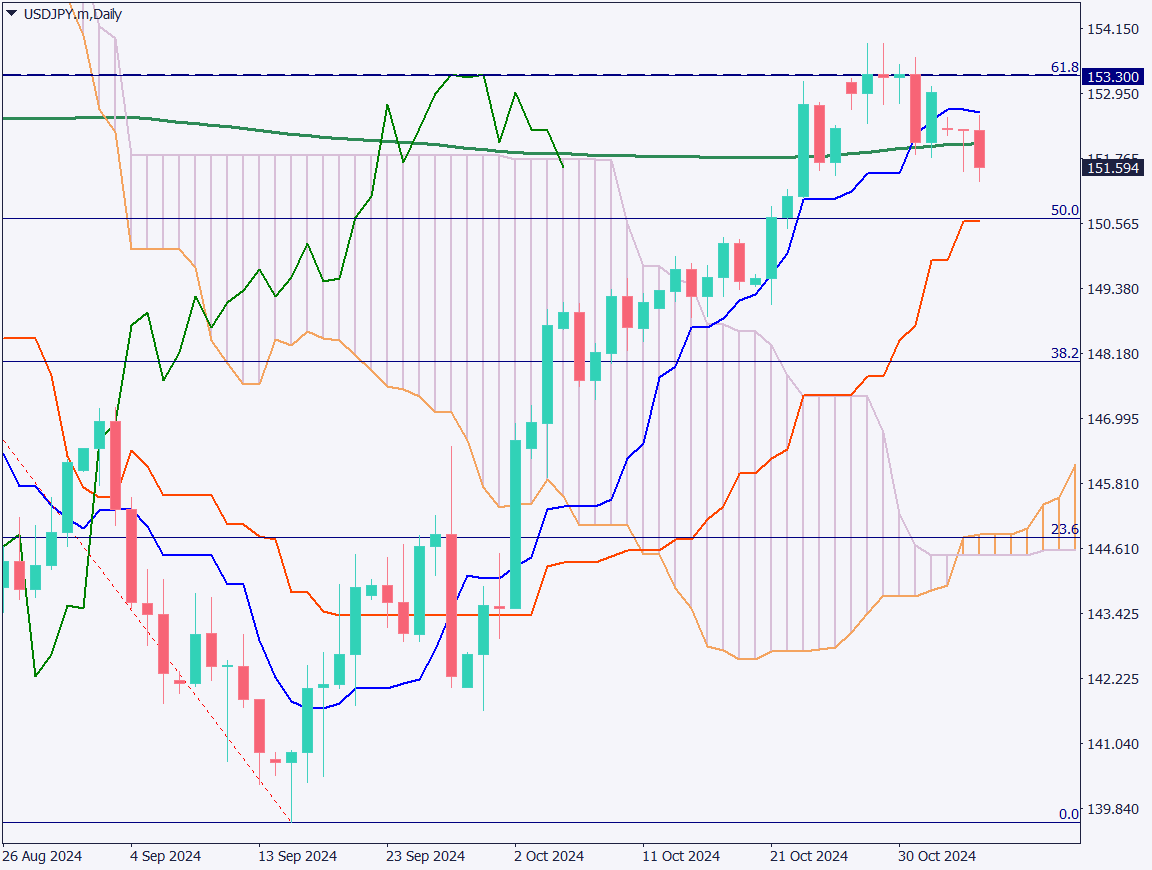

USDJPY Technical Analysis

Analyzing the daily USDJPY chart, the pair has broken below the 200-day moving average, trading around the 151.60 JPY level after failing to breach the 154 JPY range repeatedly. Although the 200-day moving average previously acted as a support level, it has finally broken on the fourth attempt, indicating a likely downtrend.

The retracement target is approximately around 150.50 JPY, where both the 50% retracement level and the base line are positioned.

However, due to the pending election results, forecasting remains uncertain. Vote count updates will be released throughout November 6, with each state’s situation likely to impact forex markets significantly. Key attention should be given to results from swing states, which are expected to cause substantial fluctuations in the market.

Day trading strategy (1 hour)

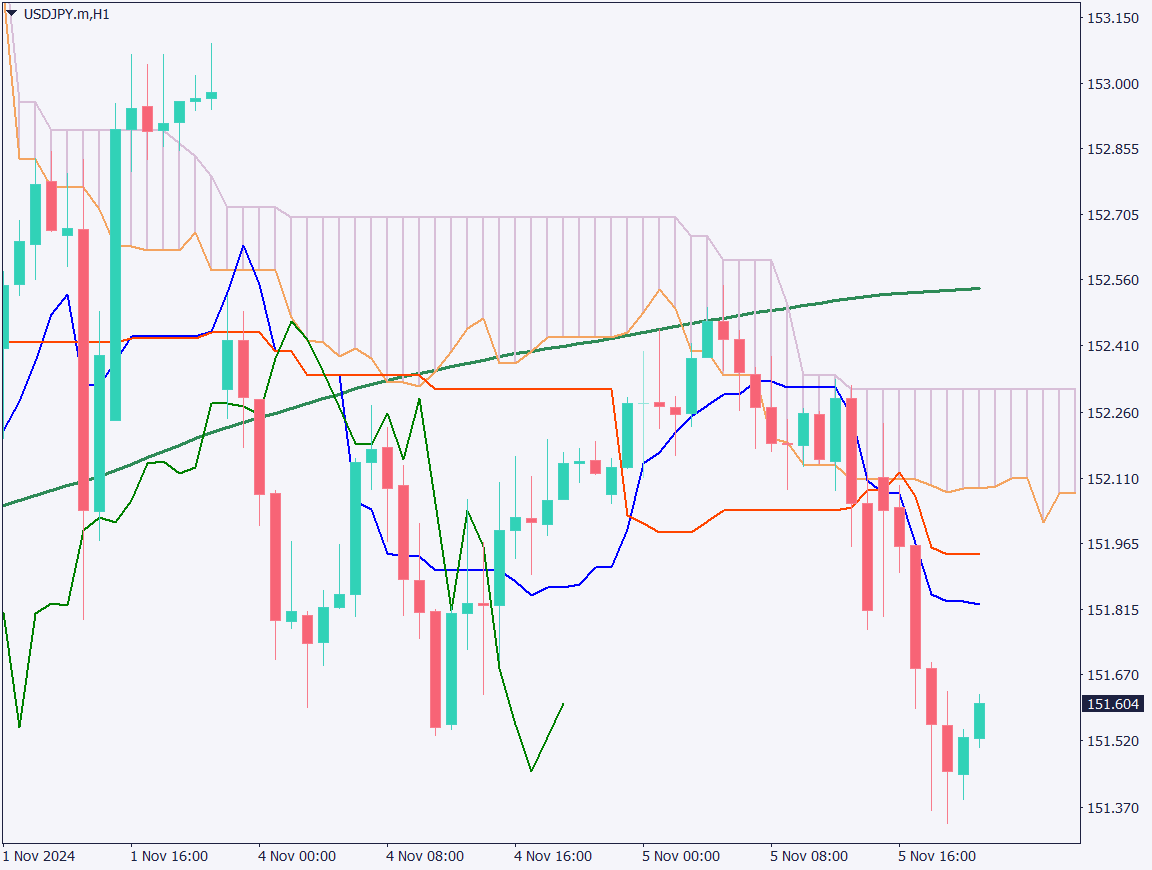

Upon analyzing the 1-hour USDJPY chart, the pair experienced a downturn from the 240 moving average and continued to update its low, now trading around 151.60 JPY. The conversion line has crossed below the base line, and the lagging line has also moved below the candlesticks.

Today, given the election’s influence on market movement, a cautious approach is recommended for day trading, favoring a pause in trading. As results may take time to clarify, observing the market carefully is advised. The strategy will shift to follow trends once the outcome becomes apparent.

Support/Resistance lines

Key support and resistance lines to consider:

- 150.40 JPY – Support Level

- 149.65 JPY – Important Monthly Price Level

Market Sentiment

USDJPY Sell: 66% / Buy: 34%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Bank of Japan Monetary Policy Meeting Minutes | 8:50 |

| Nikkei Services PMI | 9:30 |

| U.S. Crude Oil Inventories | Next Day 0:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.