Trump Wins Presidency: Trump Trade in Stocks, USD, and Cryptocurrency Gains【November 7, 2024】

Fundamental Analysis

- US stock indices and the Nikkei 225 surged, fueled by optimism around Trump’s proposed tax cuts.

- Cryptocurrencies rallied in response to expected regulatory easing on digital assets.

- Trump’s inauguration is set for January 20, 2025, marking the beginning of a potential new phase in the Trump market.

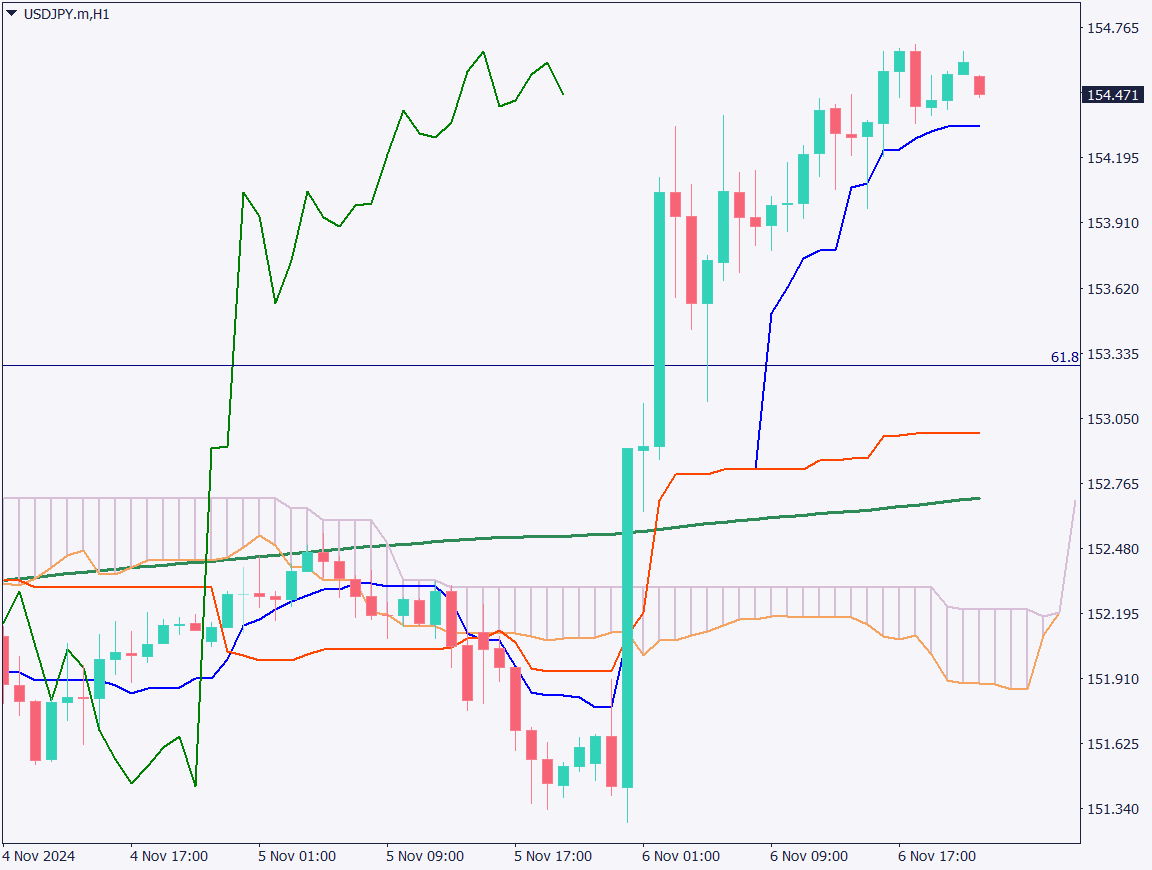

USDJPY Technical Analysis

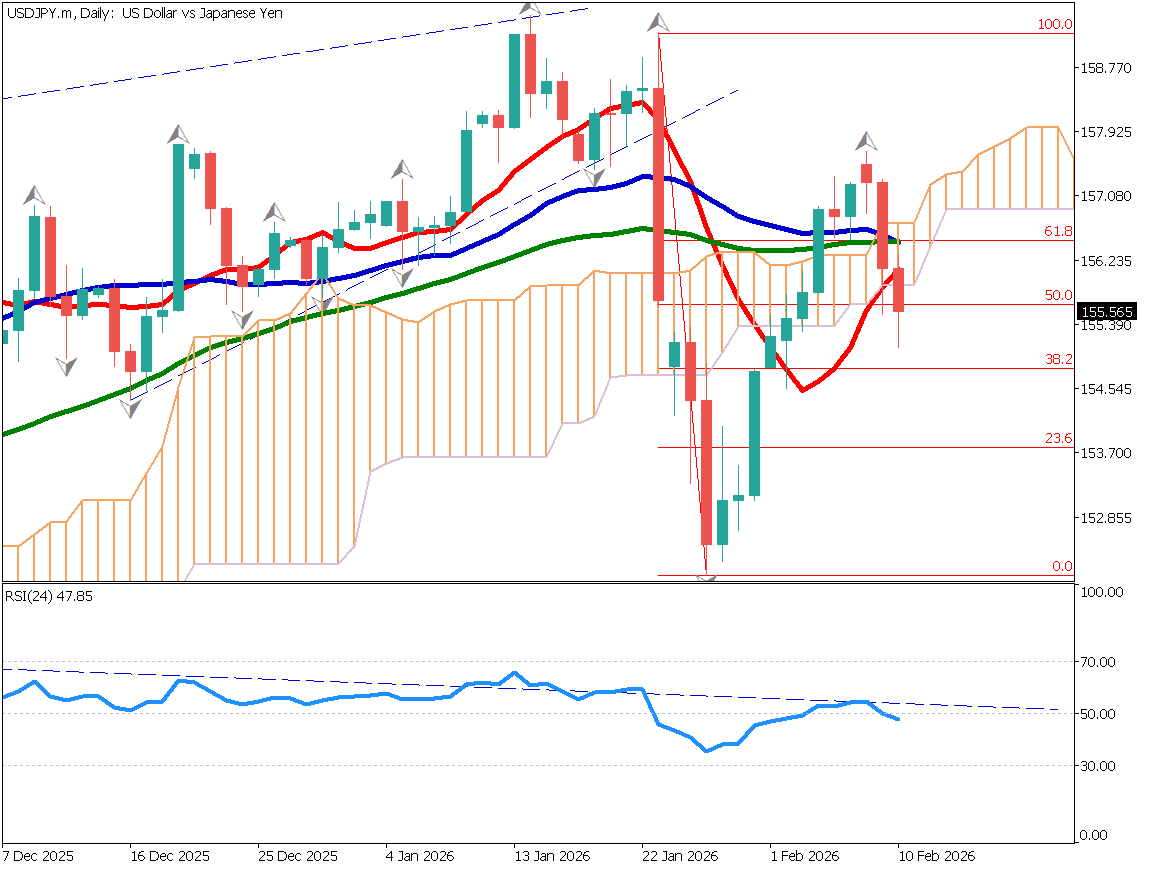

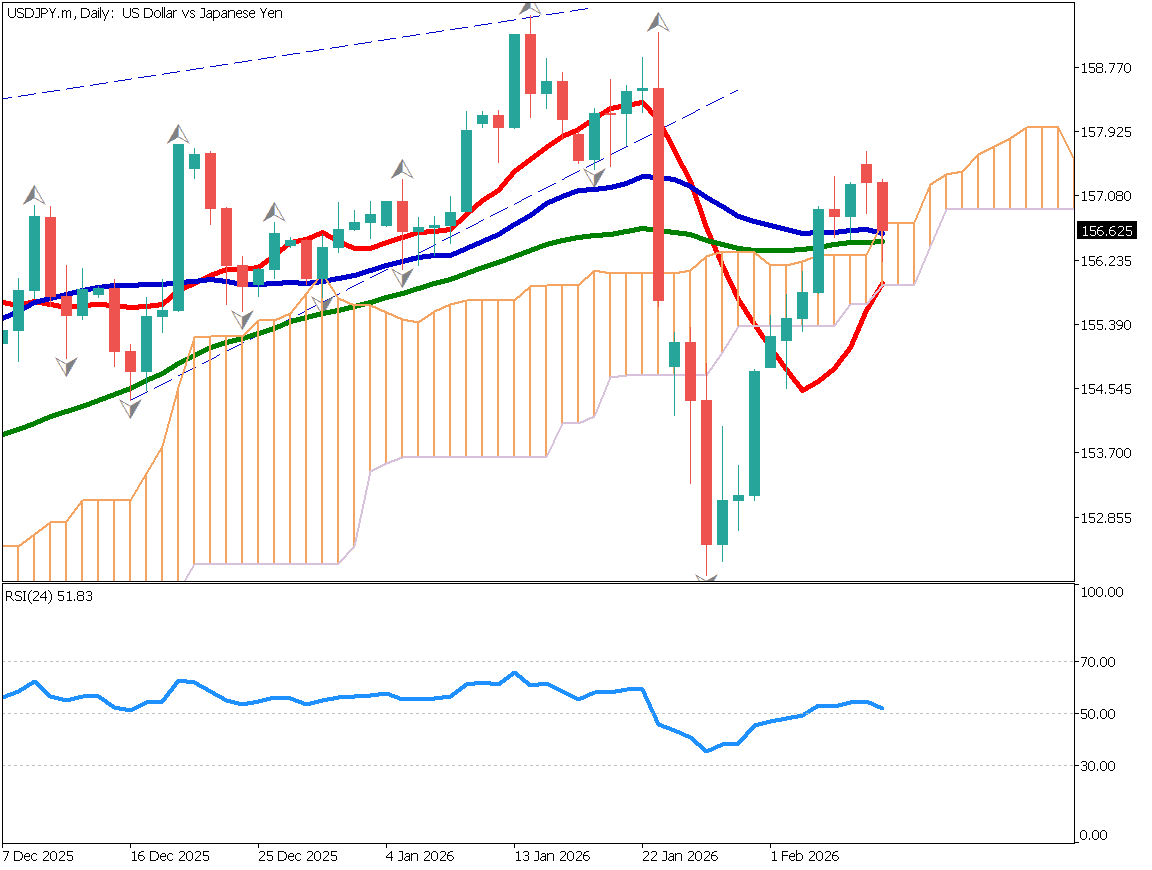

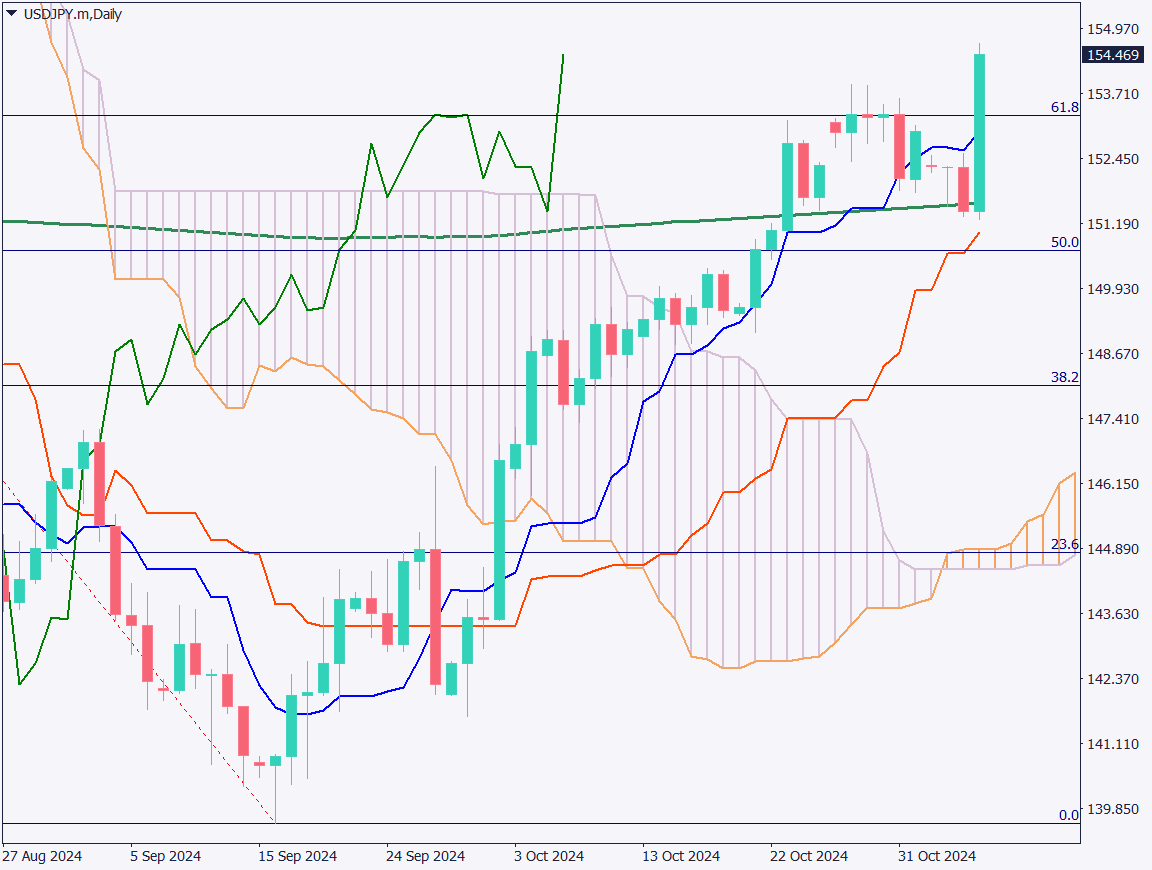

Analyzing the USDJPY daily chart: the pair has surpassed the 61.8% Fibonacci retracement level, reaching 154.40 JPY. This upward movement suggests a continuation of the bullish trend as recent highs were broken. A key factor is the 200-day moving average, which is acting as a clear support line, indicating a robust lower bound and an upward bias.

When Trump first won in 2016, JPY weakened consistently until his inauguration. Although this win lacks the surprise of the previous election, attention is on how long the Trump market will persist this time.

Meanwhile, with recession concerns easing in the US, there’s speculation that the Bank of Japan (BOJ) may find it easier to raise rates. If the BOJ hikes rates toward the year-end, it may exert upward pressure on JPY. A degree of caution regarding JPY appreciation is warranted from late November to December.

Day trading strategy (1 hour)

Analyzing the USDJPY hourly chart: despite projections of a tight race, a hidden wave of Trump supporters emerged. Support appeared fervent, yet it wasn’t reflected in polling data, resulting in predictions of a close contest.

Ultimately, Trump secured a sweeping victory with over 11 million additional votes compared to his previous run. This time, he surpassed Harris both in vote count and electoral wins. In Congress, Republicans are expected to gain seats, with a potential “Triple Red” scenario being discussed.

In the short term, a festive event-like market is anticipated.

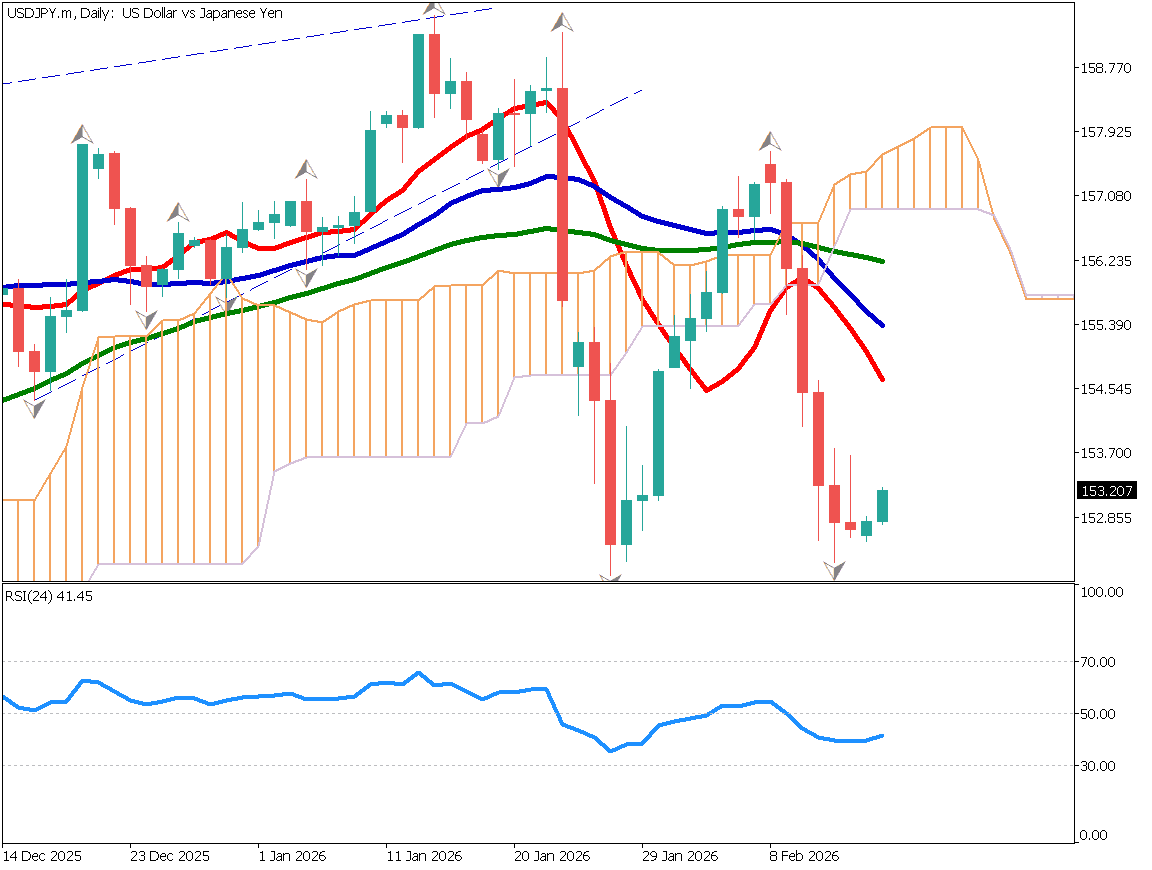

The day trading stance on USDJPY is bullish. Buying near the 153 JPY level is recommended, with upside targets around 155.50 JPY and 157.50 JPY. A manual stop loss is advisable if momentum appears to shift.

Support/Resistance lines

Key support and resistance lines to consider:

- 157.70 JPY – Previous daily resistance level

Market Sentiment

USDJPY: Sell: 66% | Buy: 34%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| UK Policy Rate Announcement (expected 0.25% cut) | 21:00 |

| US Unemployment Claims | 22:30 |

| US Policy Rate Announcement | Following day 3:00 |

| FOMC Press Conference | Following day 4:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.