USDJPY Adjusts Positions as FOMC Decides on Second Consecutive Rate Cut【November 8, 2024】

Fundamental Analysis

- The FOMC rate cut has been implemented; is it already priced in?

- The prospect of a “Triple Red” with the Republican Party controlling the Presidency, Senate, and House appears more realistic.

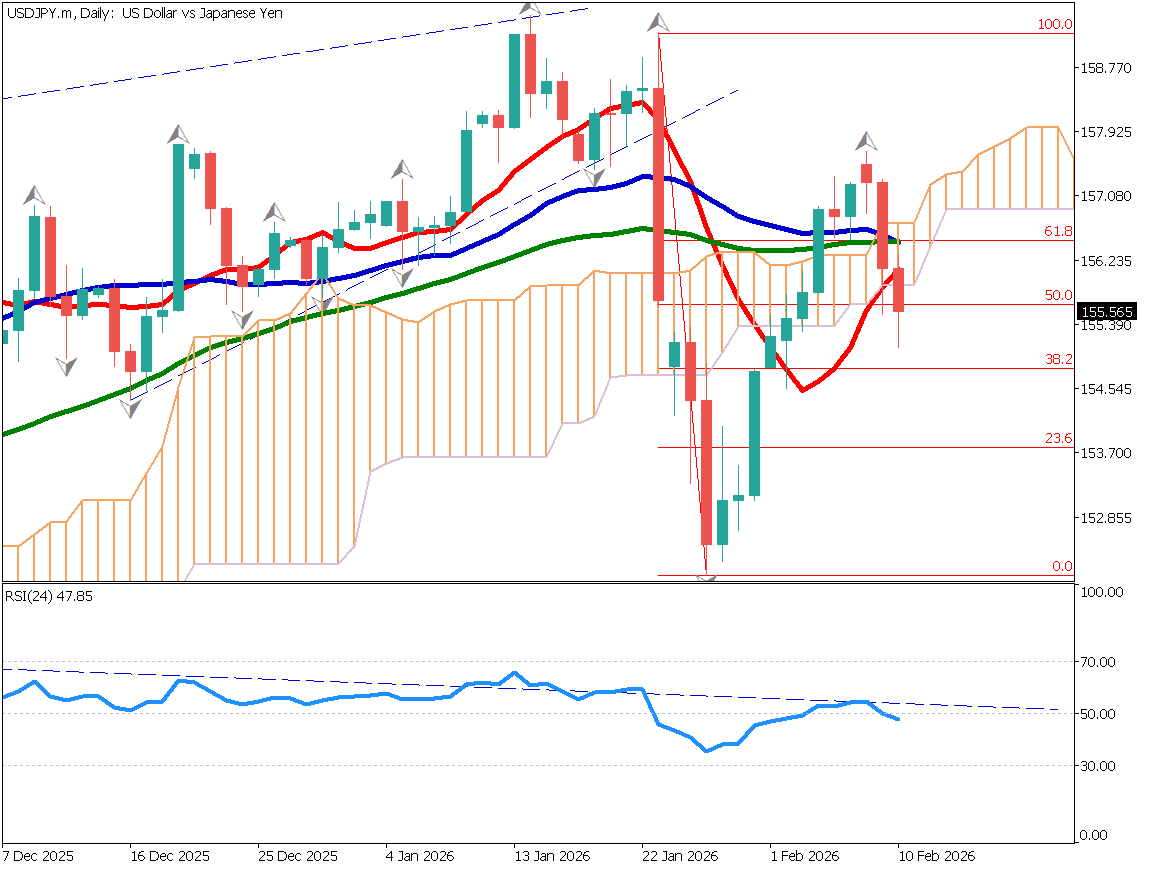

USDJPY Technical Analysis

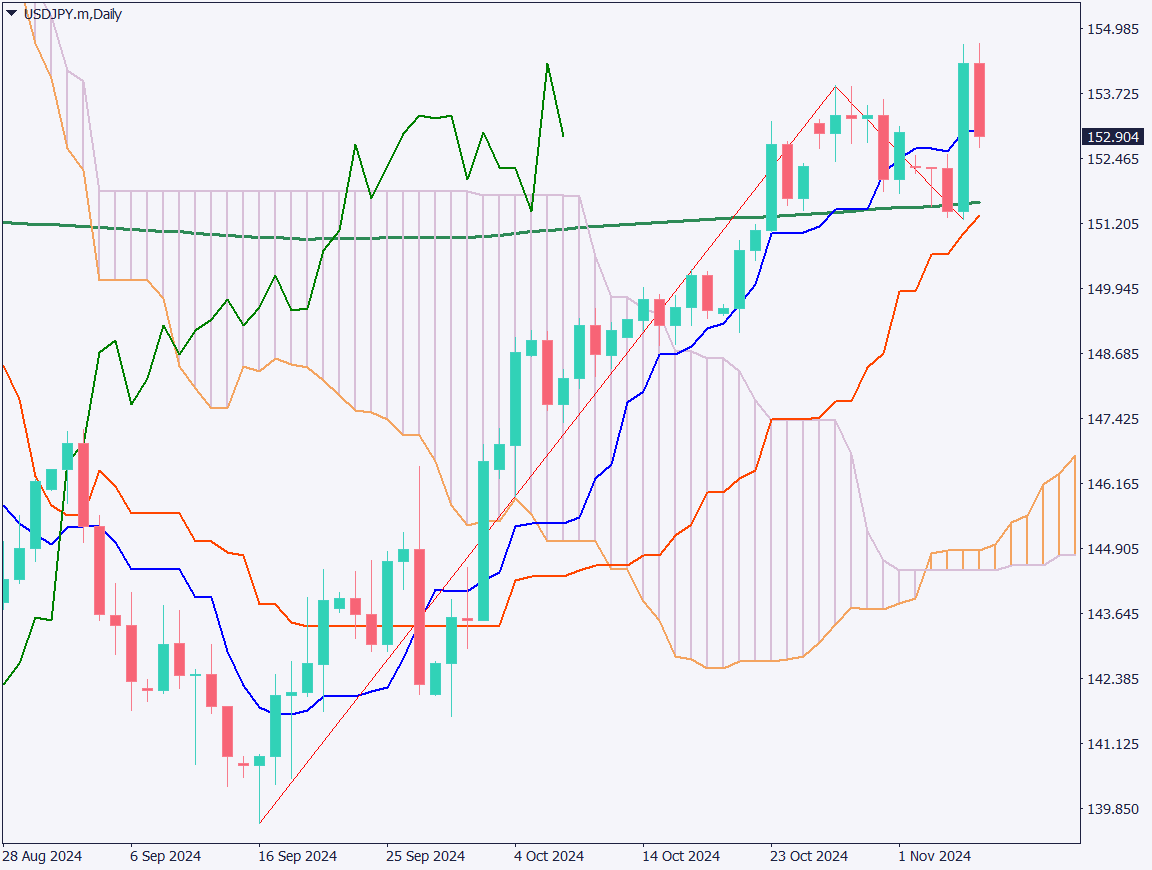

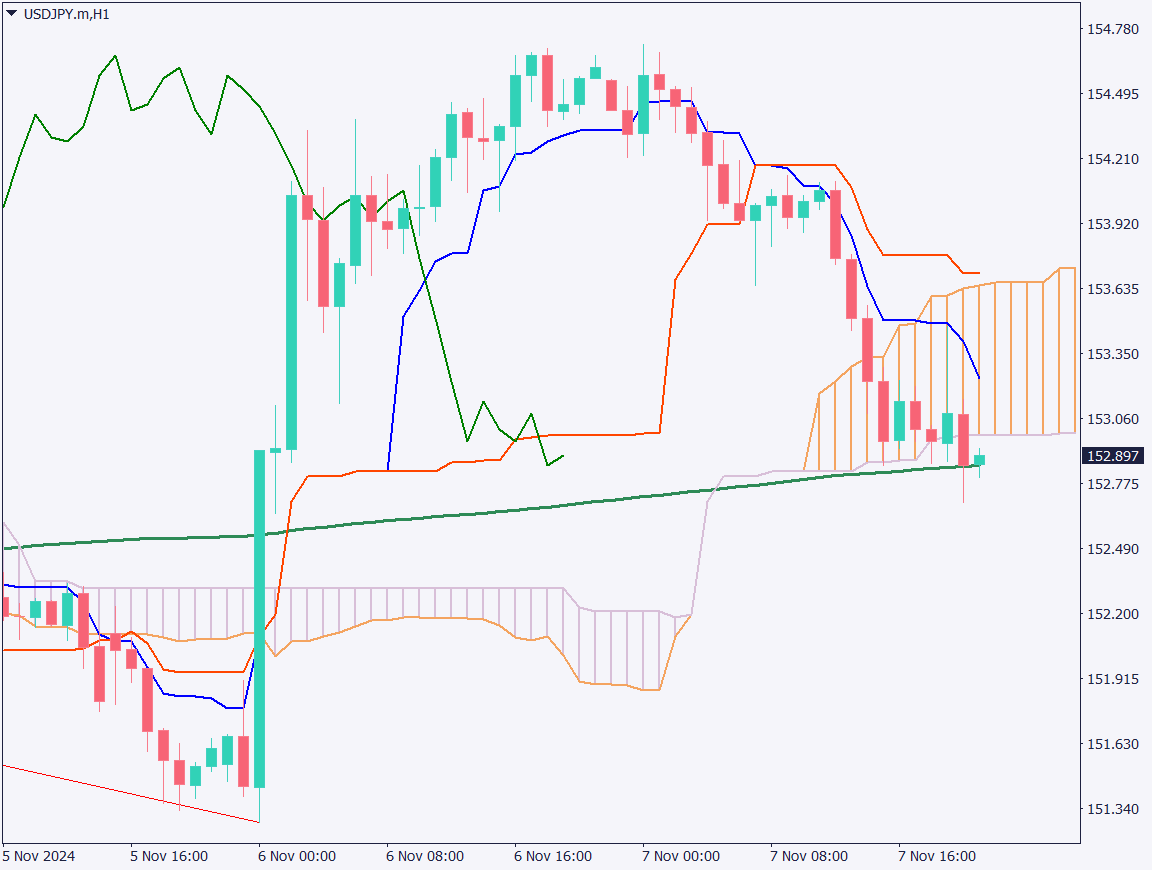

Although there were expectations of a “Trump rally” following his victory, the presence of the FOMC has led to a wait-and-see approach for testing higher levels. Unlike the rally in 2016, USDJPY has not experienced a sharp surge.

With the FOMC rate cut, USDJPY has fallen into the 152 JPY range, breaking below the Ichimoku conversion line. However, this decline may offer a buying opportunity, potentially leading to an upward movement. Due to statements from government officials expressing caution about further JPY depreciation, testing higher levels may be delayed until next week.

We would like to observe whether the 200-day moving average will serve as a support level.

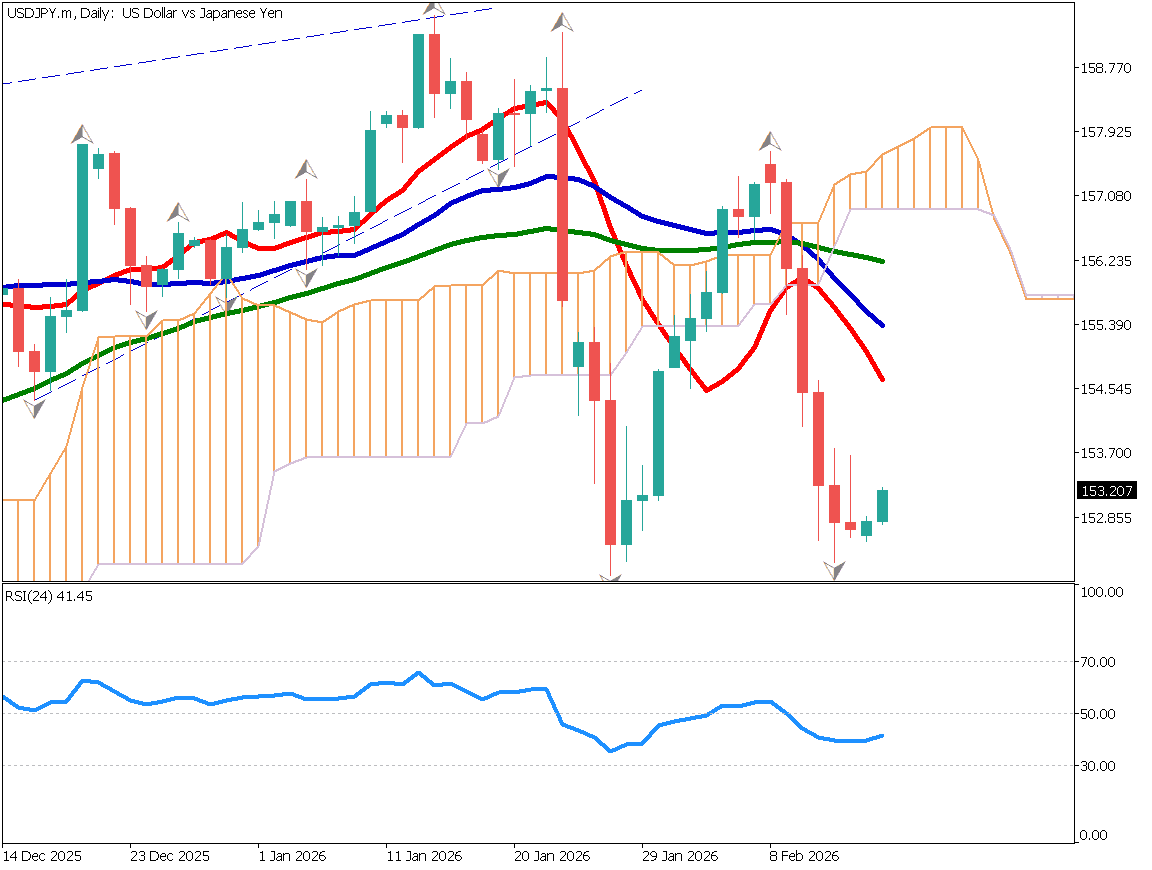

Day trading strategy (1 hour)

Analyzing the 1-hour chart for USDJPY, the pair rose near 154.80 JPY before falling to the 200-moving average following the FOMC announcement. In the short term, the key focus is whether the 200-moving average will act as support.

The FOMC rate cut could drive USD depreciation temporarily, but following the FOMC’s outcome, the “Trump rally,” or USD appreciation trend, may resume.

The basic day trade strategy will be to buy on dips. Entry on dips around the upper 152 JPY range, with a target of around 154.50 JPY, and a stop below 152.50 JPY, below the 200-moving average.

Support/Resistance lines

Key support and resistance lines to consider:

- 154.80 JPY – Recent High

- 151.34 JPY – Key Previous Low

Market Sentiment

USDJPY Short: 63% / Long: 37%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Canada Employment Report | 22:30 |

| U.S. Michigan Consumer Sentiment Index | 00:00 (Midnight) |

| FOMC Member Bowman Speech | 01:00 (Following Day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.