Gold Profit-Taking as Funds Flow into USD and Equity Markets【November 12, 2024】

Fundamental Analysis

- Bitcoin surged by 10,000 USD since the weekend, potentially fueled by a “Trump rally.”

- Rising equities and a strengthening USD are prompting a fund outflow from gold.

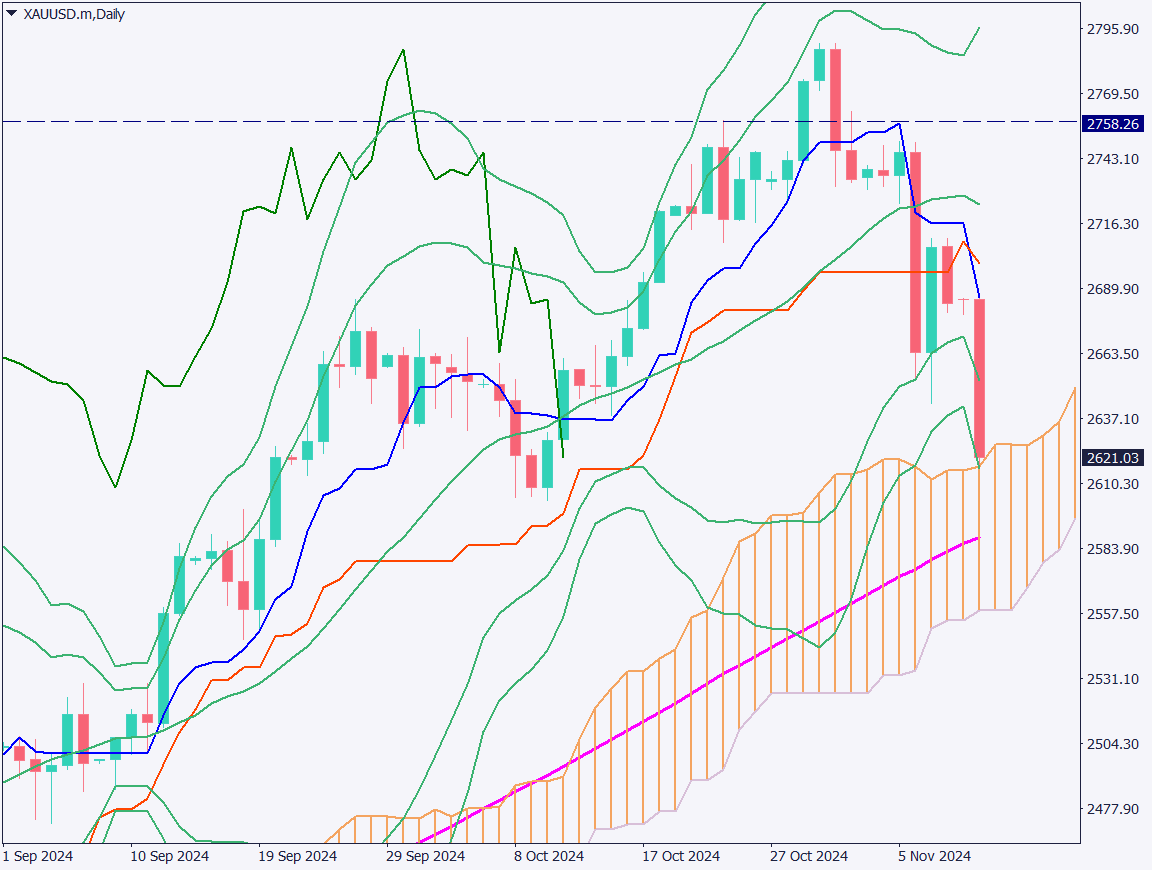

XAUUSD Technical Analysis

Analyzing the daily chart for gold, the Ichimoku Kinko Hyo cloud provides support at lower levels, and the price is touching the -3σ line of the Bollinger Bands. There’s a strong potential for a rebound from the -3σ line, with a scenario of a rally up to the -2σ line expected today.

With U.S. stock markets resuming after the presidential election and FOMC meetings, this is the first week of trading. The focus is on whether a “Trump rally” will take shape. Policies associated with Mr. Trump are typically seen as favorable to the stock market, contributing to a supportive market environment for rising equities.

Gold is prone to profit-taking in an environment of rising stocks and a strengthening USD. Given this, a potential decline to around 2,600 USD by the end of this week is anticipated.

Day trading strategy (1 hour)

Analyzing the hourly chart for gold, the 90-period moving average serves as a pullback point, with gold falling near 2,610 USD. The daily analysis shows potential for a temporary rise to around 2,640 USD due to the Ichimoku cloud and the Bollinger Bands’ -3σ line.

For a contrarian trade, consider a long position at 2,605 USD today. Set a stop-loss if it breaks below 2,600 USD. The profit target is set at 2,636 USD.

Support/Resistance lines

Key support and resistance lines to consider:

- 2,600 USD: Fibonacci/Round Number Level

Market Sentiment

XAUUSD Sell: 38% | Buy: 62%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| UK Employment Data | 16:00 |

| ECB’s McCaul Speech | 21:00 |

| Speech by Fed’s Waller | Midnight |

| FOMC Member Speech | 4:00 Following Day |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.