USDJPY Nears Recent High, Approaching 155JPY【November 13, 2024】

Fundamental Analysis

- The Dollar Index has reached a five-month high.

- The 155JPY range for USDJPY holds a significant resistance level.

USDJPY Technical Analysis

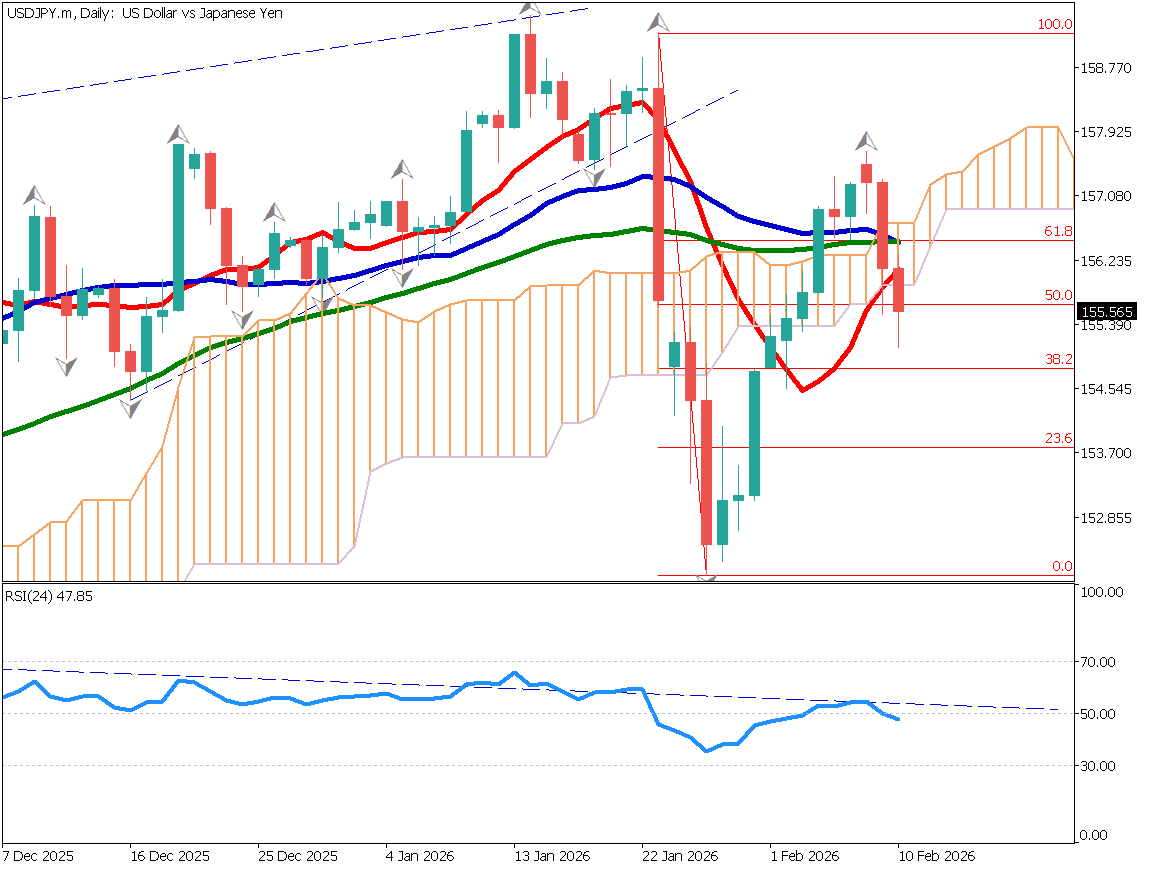

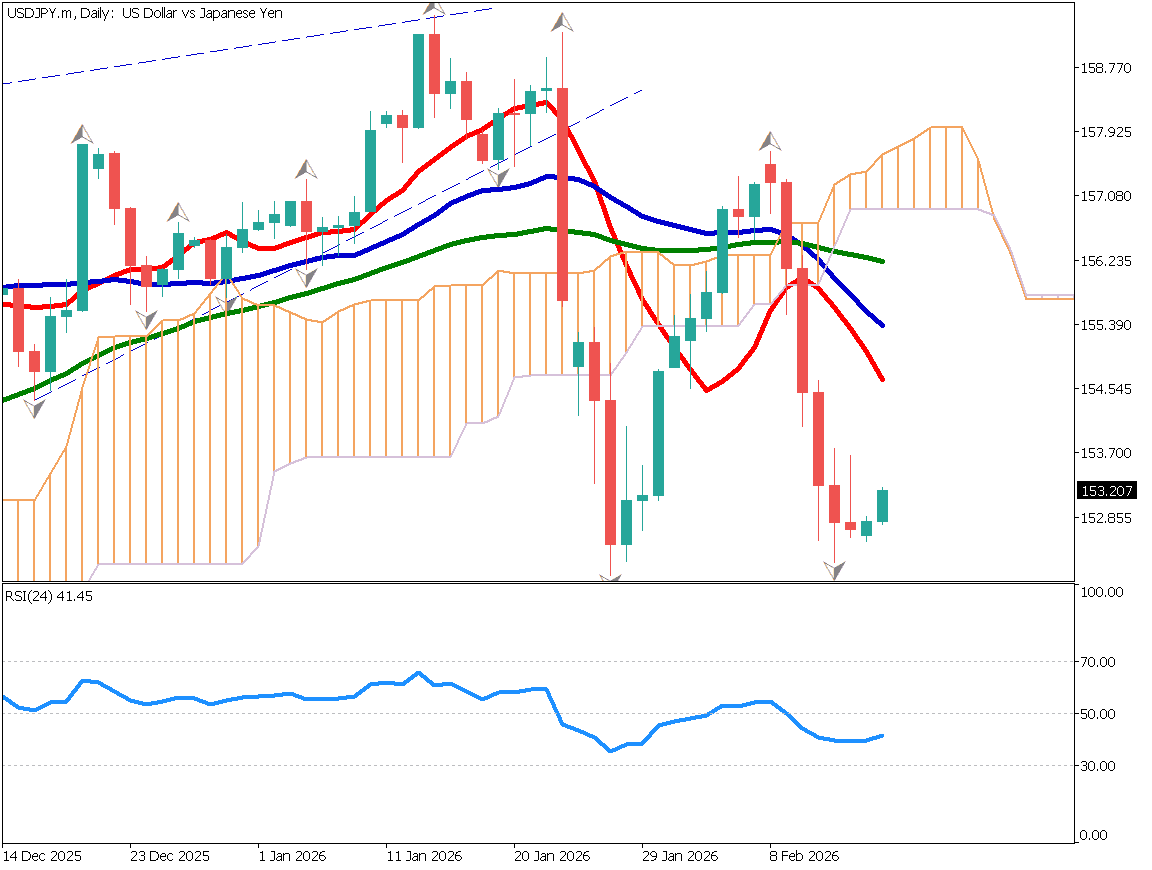

Analyzing the daily chart of USDJPY, the pair has risen to 154.95JPY and is approaching the 155JPY level, showing a rebound and upward momentum. Following a strong bullish candlestick, USDJPY briefly declined before breaking above the previous high, indicating a continuation of the uptrend.

Currently, USDJPY is touching the +2σ line on the Bollinger Bands, suggesting some resistance. The pair is reacting near the 161.8% Fibonacci expansion level, with the next target projected at the 256.8% level around 159JPY.

Day trading strategy (1 hour)

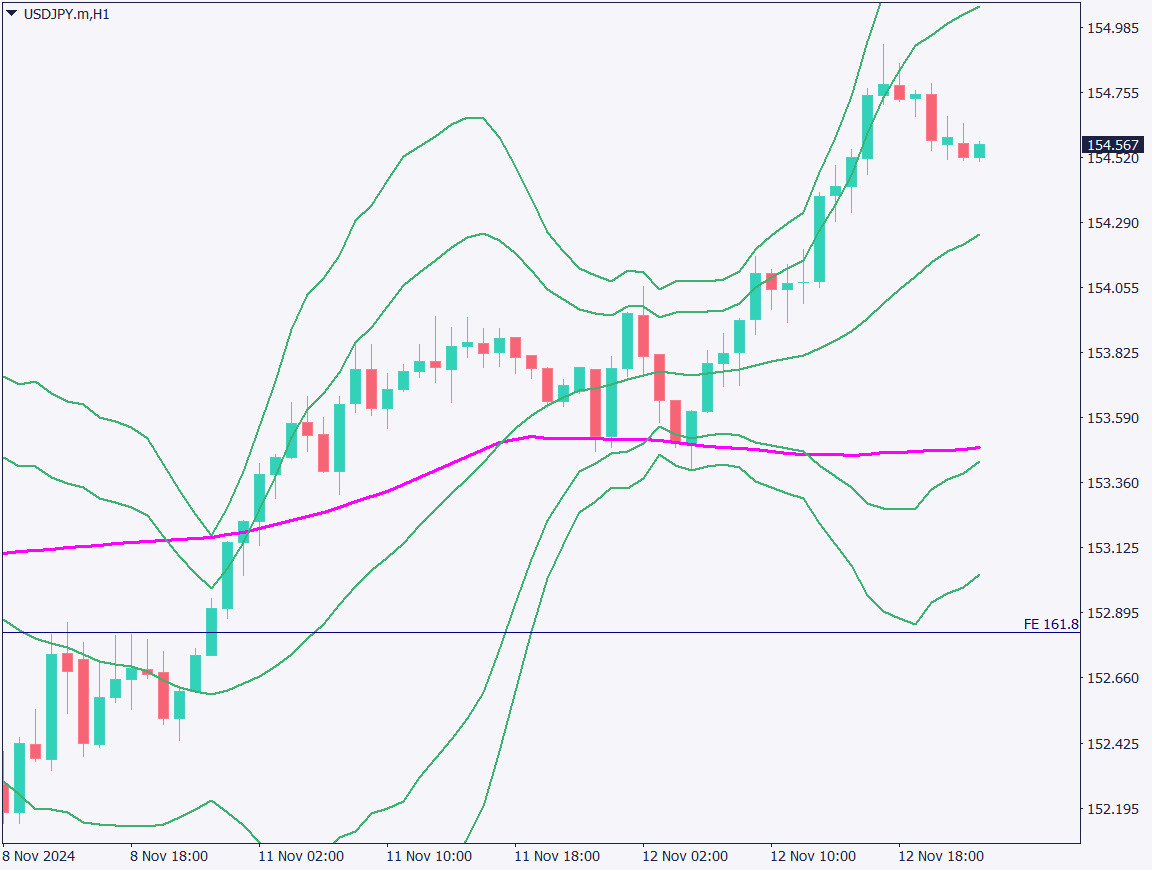

Analyzing the 1-hour chart for USDJPY, the 90-period moving average appears to be a key level. After rebounding from this moving average, USDJPY has risen to 154.95JPY. At present, the moving average is not upward-sloping, instead remaining flat. The chart structure suggests a continuation of the upward trend.

The upside target is anticipated at 155.60JPY, with strong resistance likely around the 155JPY level. As U.S. stock indices saw some adjustment yesterday, there may be profit-taking if USDJPY reaches the 155JPY range.

The day trading plan is to look for a reversal sell near the highs. Specifically, enter a sell at 155.50JPY, exit at 154.90JPY, and set a stop loss above 155.75JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 155.60JPY: Monthly resistance line

Market Sentiment

USDJPY: Sell – 68% / Buy – 32%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| U.S. CPI | 22:30 |

| Speech by FOMC Member Williams | 23:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.