USDJPY Trending Above 155 JPY Level, Continuation of Upward Trend with New Highs Reached【November 14, 2024】

Fundamental Analysis

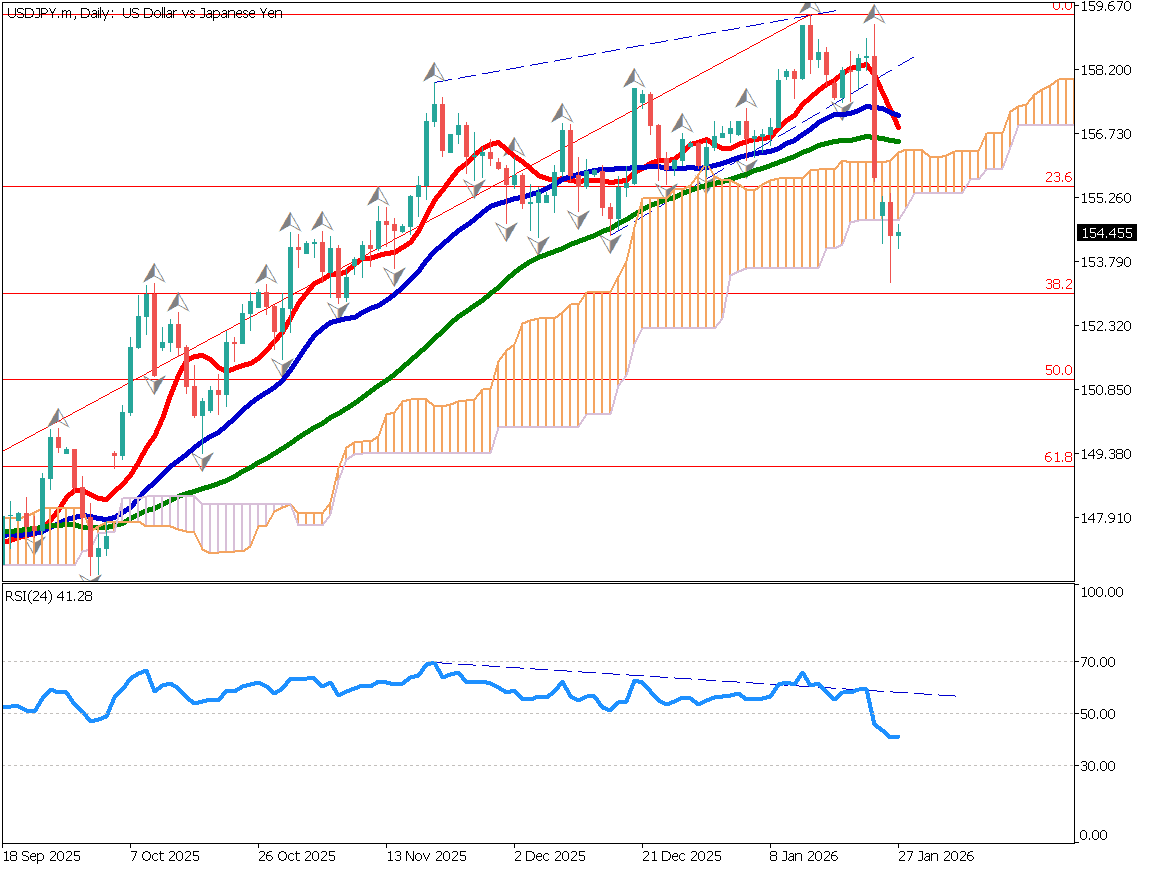

- USDJPY has clearly surpassed the recent high of 154.70 JPY, indicating the emergence of an upward trend.

- While the uptrend appears stable, there is caution over potential interventions to curb JPY depreciation.

USDJPY Technical Analysis

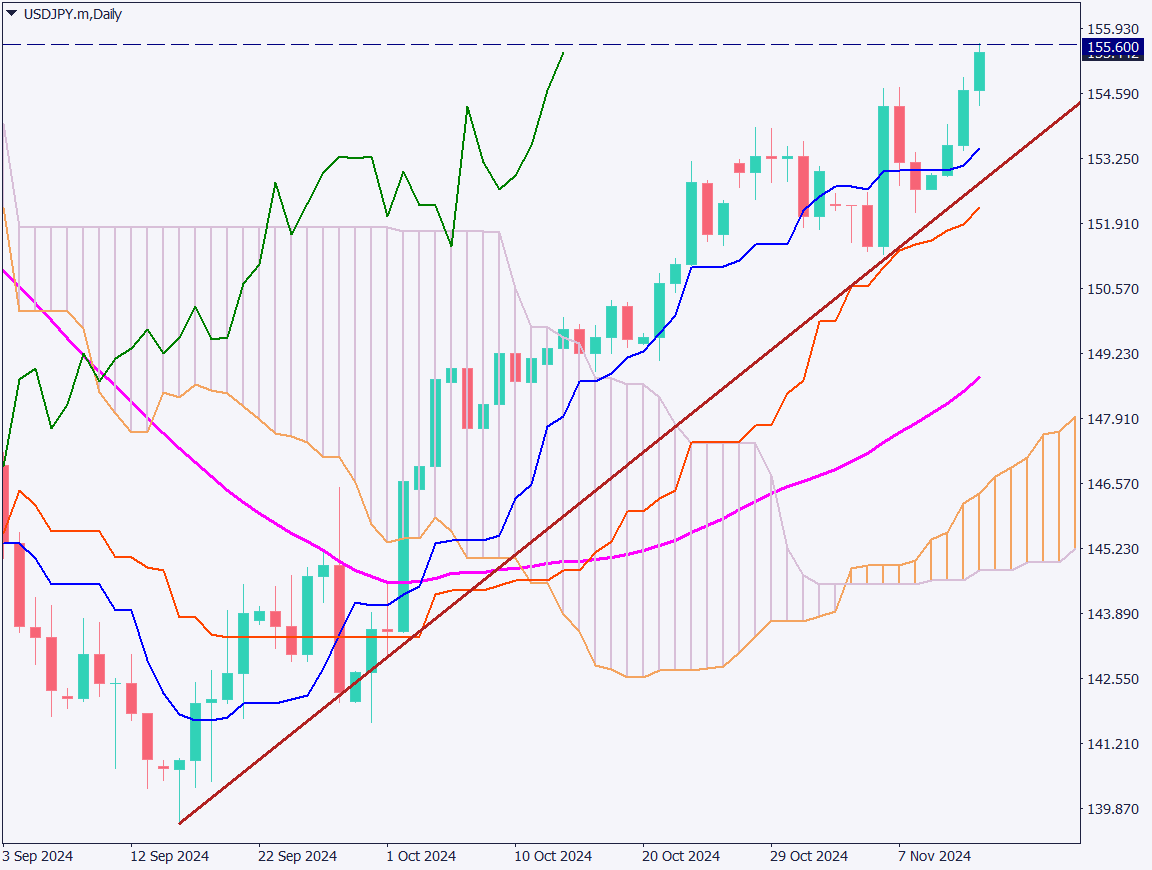

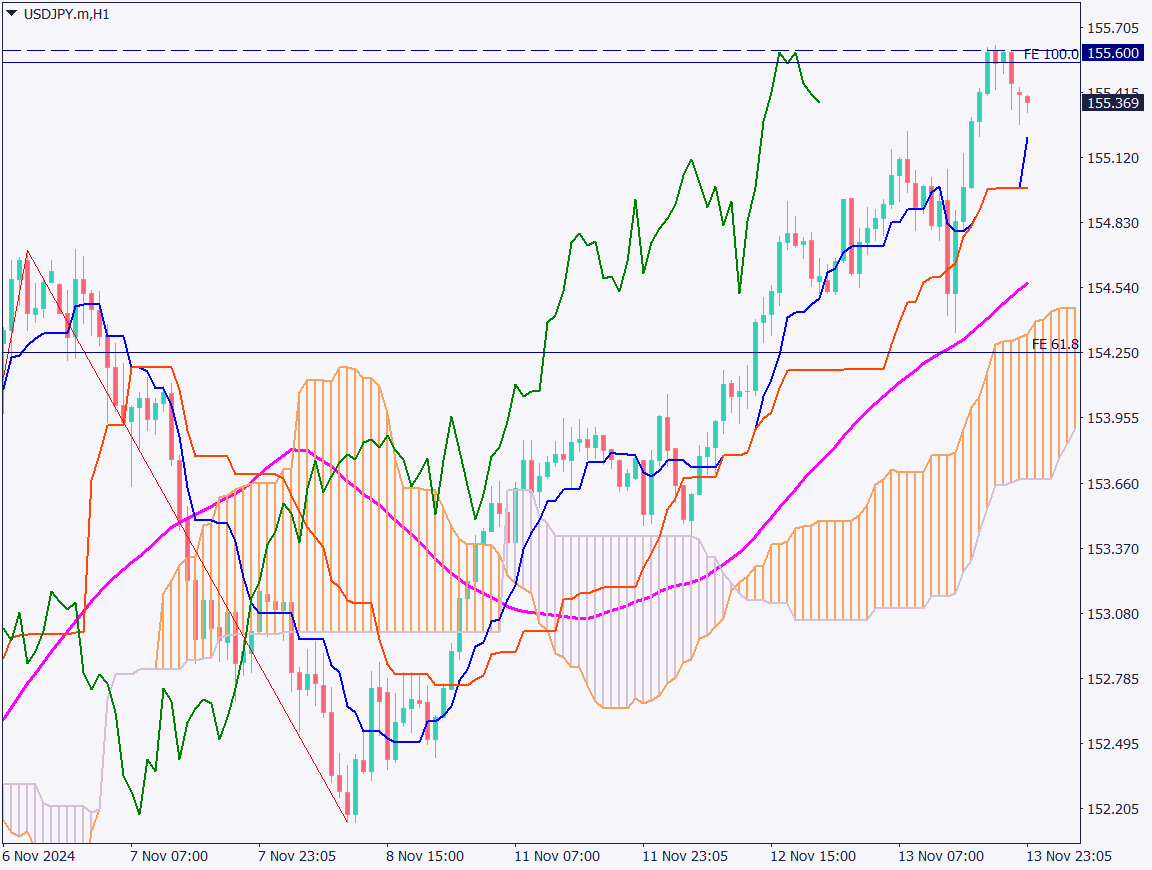

Analyzing the daily chart of USDJPY, the pair has broken above recent highs, reaching up to 155.60 JPY. It has moved above the baseline of the Ichimoku Cloud and touched the resistance line at 155.60 JPY. USDJPY also exceeds the +2σ line on the Bollinger Bands, suggesting a very strong uptrend.

The primary driver behind this movement is the sharp rise in the Dollar Index, which has shown a remarkable rally over the last four trading days, sustaining a bullish trend for USDJPY.

Should USDJPY break above 155.60 JPY, there is potential for further gains toward the 158 to 160 JPY range, warranting caution regarding further JPY depreciation.

Day trading strategy (1 hour)

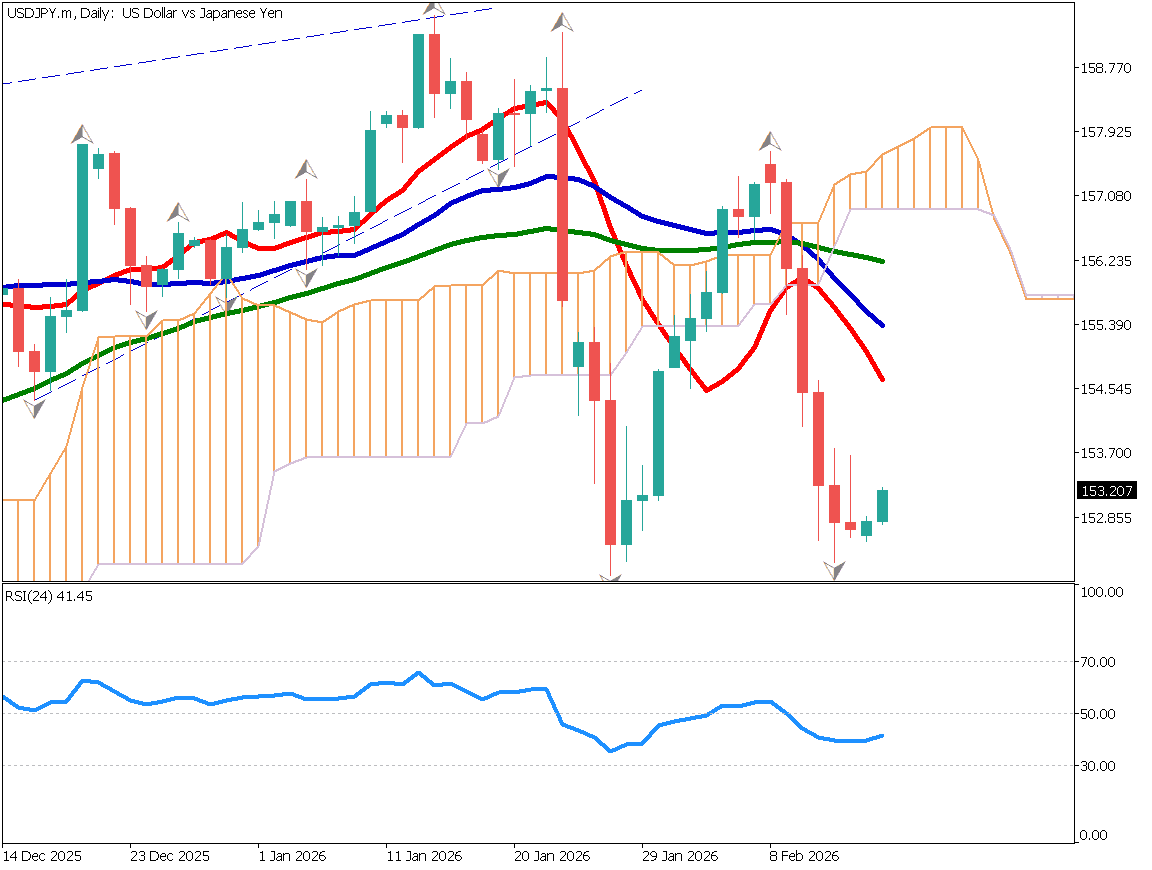

In the hourly chart analysis of USDJPY, 155.60 JPY serves as the current high and a monthly resistance line, which may take time to break. Should the price dip below the conversion line, a pullback to the lower 155 JPY range may occur, while a rebound could prompt another test at breaking 155.60 JPY.

The day trading strategy suggests buying on dips. Enter at 155.35 JPY, take profits near 155.60 JPY and around 158 JPY, and set a stop loss if USDJPY drops below 155 JPY.

Market Sentiment

USDJPY Sell: 70% | Buy: 30%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Australia Employment Report | 9:30 |

| EU GDP | 19:00 |

| US Core PPI | 22:30 |

| US Continuing Jobless Claims | 22:30 |

| US Federal Reserve Chair Powell’s Speech | Following day at 5:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.