USDJPY Weakened to JPY156; Fed Chair Powell Signals No Urgent Rate Cuts【November 15, 2024】

Fundamental Analysis

- Fed Chair Powell commented that there is no urgent need to cut rates. U.S. interest rates remain around 4.5%, widening the Japan-U.S. interest rate differential, favoring a weaker JPY and stronger USD.

- The Dollar Index has surged for five consecutive days, with continued buying of the U.S. dollar.

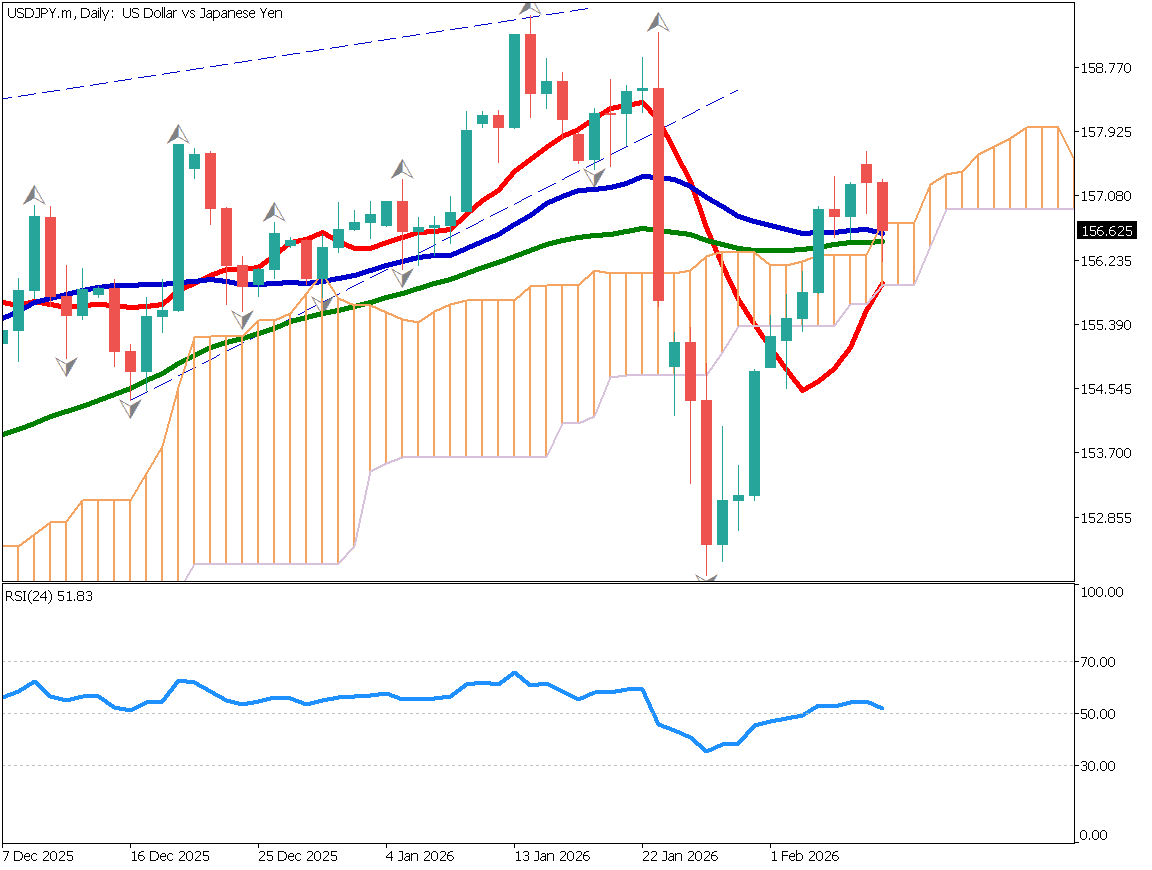

USDJPY Technical Analysis

Analyzing the daily chart for USDJPY, the pair has broken through the resistance line at JPY155.60, climbing to JPY156.25. The 200-day moving average is clearly acting as support. Additionally, the gap between the short-term and long-term GMMA indicates the strength of the upward trend.

Fed Chair’s statement on no rush for rate cuts, along with the widening interest rate differential, has contributed to further USD buying. USDJPY shows strong upward momentum.

Looking at the ADX, which is at 42, and the +DI at 33, it signals a robust trend. Key price levels to watch going forward are JPY156.85 and, if it breaks above, JPY159.34 as a strong resistance level.

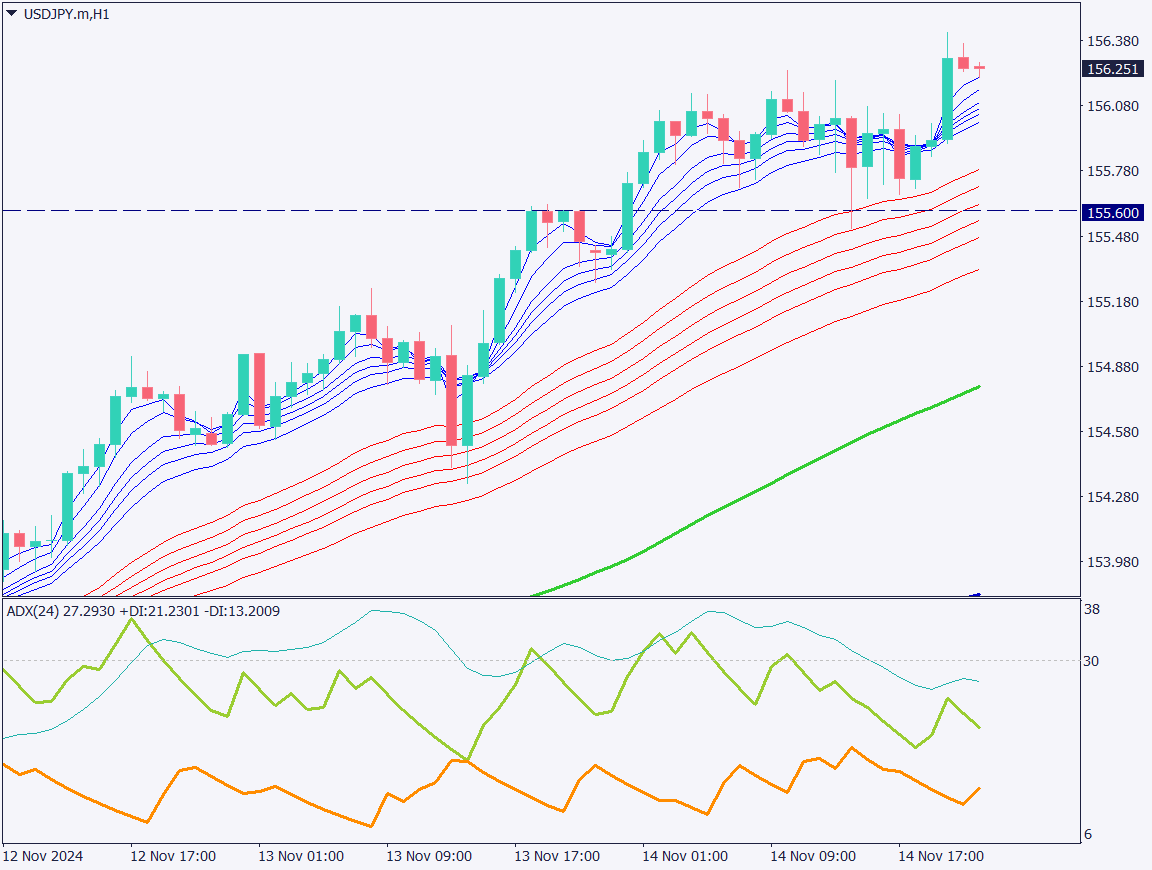

Day trading strategy (1 hour)

Analyzing the 1-hour chart for USDJPY, JPY156 has acted as a resistance, with the pair temporarily falling to JPY155.60 before rebounding. The hawkish remarks by Fed Chair shifted sentiment strongly towards a weaker JPY. The gap in the long-term GMMA indicates a very strong uptrend.

Meanwhile, ADX is at 27, with +DI at 21.

The day trading strategy suggests a buy on dips. Entry is recommended at JPY156.15, with an exit at JPY156.80, and a stop below JPY156.

Support/Resistance lines

Key support and resistance lines to consider:

- JPY159.34 – Monthly resistance level

- JPY156.85 – Weekly resistance level

- JPY155.60 – Major historical support zone

Market Sentiment

USDJPY: Sell – 63%, Buy – 37%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japan GDP | 8:50 |

| UK GDP | 16:00 |

| U.S. Retail Sales | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.