USDJPY Experiences Sharp Decline as Strong US Retail Sales Diminish Rate Cut Expectations【November 18, 2024】

Fundamental Analysis

- The USD’s upward trend takes a breather, with USDJPY forming an engulfing candle at high levels.

- US retail sales data was significantly revised upward, easing expectations of a December rate cut.

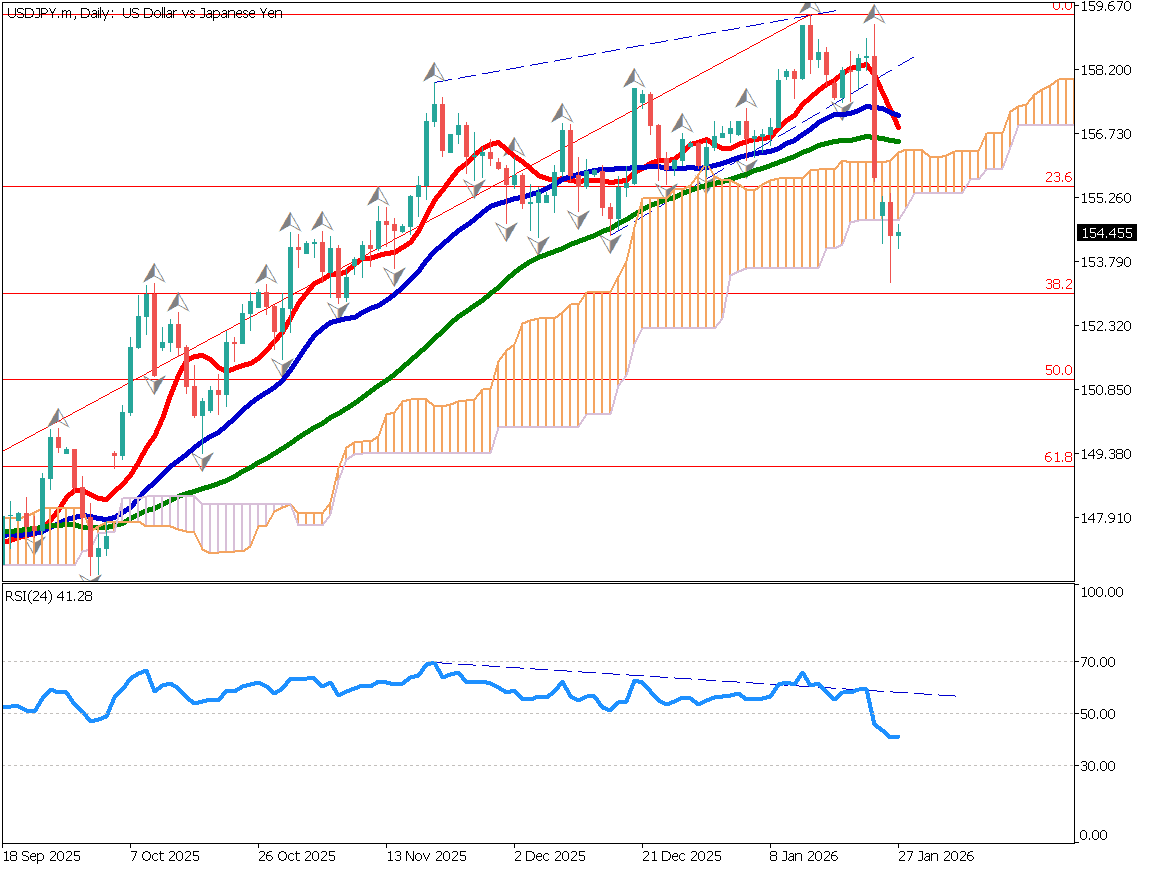

USDJPY Technical Analysis

Analyzing the daily chart of USDJPY:

USDJPY reached a high of 156.75 JPY but saw a reversal as the strong USD trend paused, pulling back to the 154 JPY range. The substantial upward revision of US retail sales data eased rate cut expectations, which weighed on US equity prices, causing USDJPY to decline in tandem.

At high levels, USDJPY has formed an engulfing candle, indicating growing JPY strength. The 240-day moving average is acting as a support line, but further downward pressure remains possible. Attention should be paid to whether USDJPY falls below 153.880 JPY in the near term.

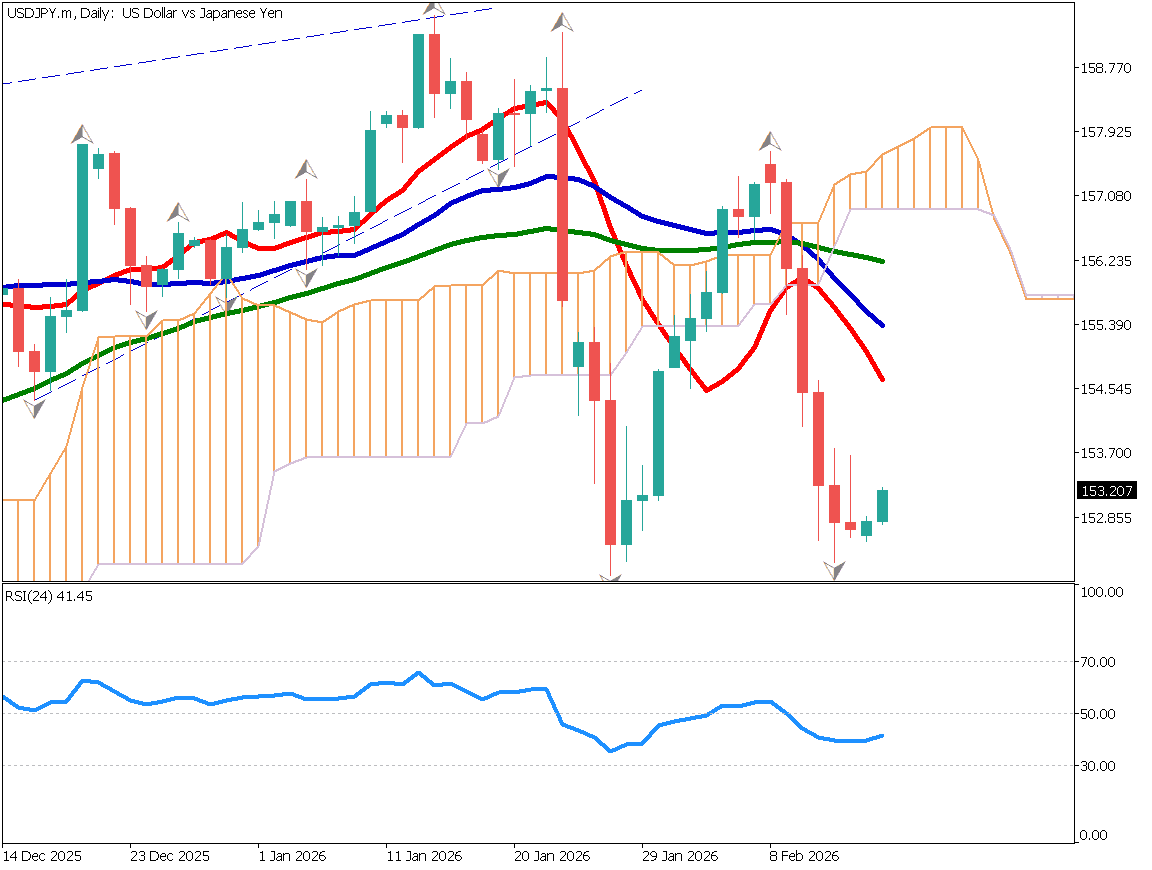

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY:

USDJPY is pivoting around 155 JPY, making it the focus of today’s trading. It briefly dipped below 30 on the RSI, rebounded at the 240-day moving average, but if it breaks below 153.86 JPY, a downtrend is likely to occur.

Looking at currency strength, JPY is relatively stronger than USD today.

As a day trading approach, it’s crucial to follow the trend in this challenging market. A sell entry is suggested, targeting incremental sell rotations near the 152 JPY level. However, if USDJPY surpasses 155 JPY, the strategy needs reconsideration. Flexibility is key.

Support/Resistance lines

Key support and resistance lines to consider:

- 155.00 JPY: Round number / Pivot point

- 153.86 JPY: Last week’s lowest level

Market Sentiment

USDJPY: Sell: 52% | Buy: 48%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Speech by the President of the Deutsche Bundesbank | 17:00 |

| Key ECB official speeches | 22:00 |

| Speech by ECB President Lagarde | 3:30 (next day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.