USDJPY Declines Temporarily but Supported by Dip-Buying, Eyes on Breaking Above 155JPY【November 20, 2024】

Fundamental Analysis

- Reports suggest that Russia has eased its nuclear usage standards, triggering risk aversion and strengthening JPY temporarily.

- European stocks remain weak as tensions between Ukraine and Russia escalate sharply.

USDJPY Technical Analysis

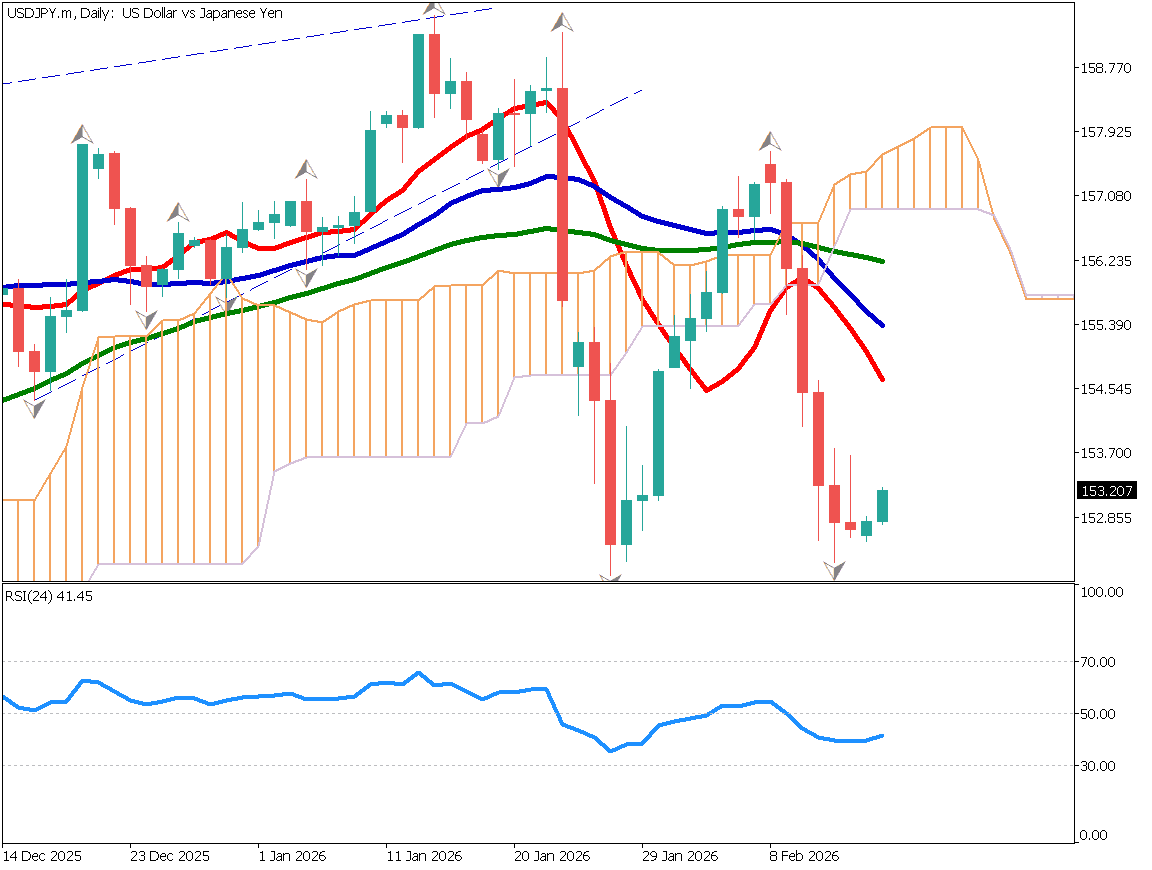

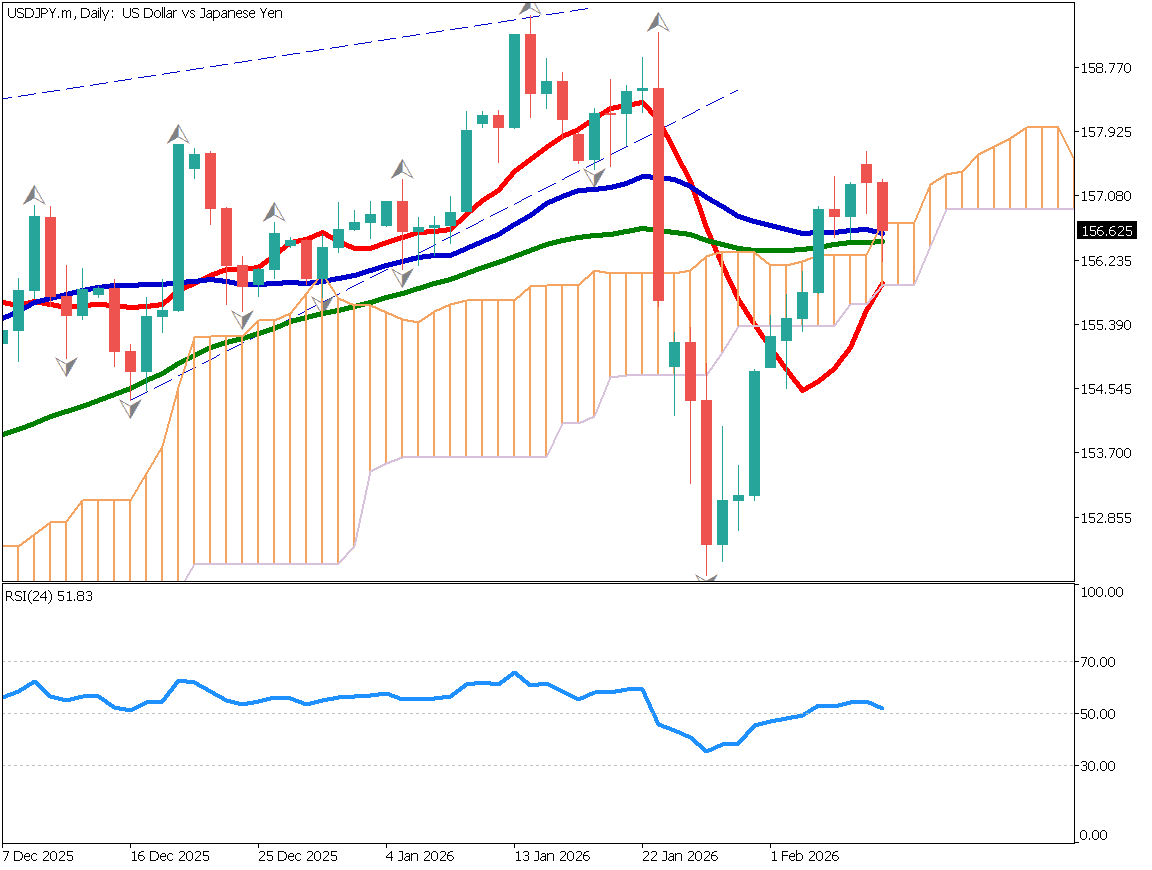

Analyzing the USDJPY daily chart reveals that the conversion line has acted as a support level, with strong dip-buying observed around the 153JPY level. The candlestick pattern resembles a dragonfly doji, indicating robust dip-buying sentiment.

Following reports that Ukraine used long-range missiles provided by the US to strike Russia, the latter revised its nuclear usage standards. This spurred risk-averse movements, causing USDJPY to dip to 153.30JPY temporarily before rebounding and turning upward.

The Ichimoku Kinko Hyo conversion line and the 61.8% Fibonacci retracement level appear to have functioned as strong support zones.

Day trading strategy (1 hour)

Analyzing the USDJPY 1-hour chart, dip-buying strength is evident, confirming solid support for lower levels. RSI is at 51, indicating a shift to a bullish trend for the first time in five days. However, resistance is observed in the cloud, suggesting it may take some time for USDJPY to break above 155JPY.

Entry: Around 154.25JPY

Exit: Around 156JPY

Stop-Loss: Below the recent low of 153.25JPY

Support/Resistance lines

Key support and resistance lines to consider:

- 155JPY: Psychological Round Number

- 153.28JPY: Recent Low

Market Sentiment

USDJPY Sell: 64% / Buy: 36%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| UK Consumer Price Index | 16:00 |

| ECB President Lagarde Speech | 22:00 |

| US Crude Oil Inventories | Midnight (00:00) |

| FOMC Member Speeches | 2:15 (Next Day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.