EURUSD Turns Bearish as Fed Considers Further Rate Cuts【November 21, 2024】

Fundamental Analysis

- NVIDIA’s Sales Forecast Falls Short but Maintains Consecutive Doubling

- US and UK Allow Missile Use on Russian Territory; Landmine Deployment Reported

- Geopolitical Tensions Rise, Gold Extends Gains

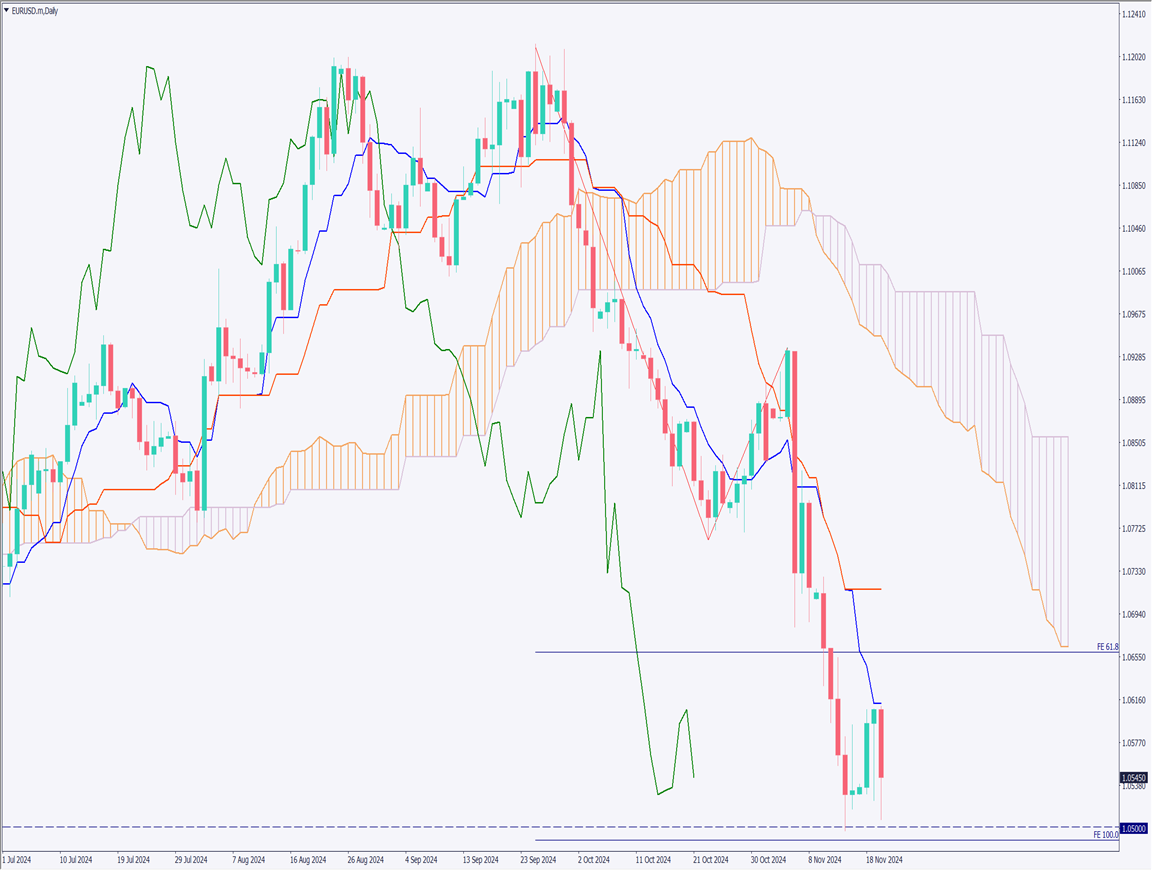

EURUSD Technical Analysis

Analyzing the daily chart for EURUSD, the pair rebounded at 1.05 USD and climbed toward the conversion line before strong selling pressure pushed it back. At the time of writing, EURUSD is trading near 1.0550 USD. Rising expectations of an ECB rate cut and escalating geopolitical tensions across Europe weigh heavily on the Euro.

Reports indicate that the US and UK have authorized the use of long-range missiles and landmines within Russian territory, further straining relations. In response, Russia has deployed North Korean troops to the battlefield, prompting calls for action from the US and UK.

Risk aversion has led to selling pressure on the Euro, while safe-haven buying strengthened the USD. The key focus is whether EURUSD will decisively break below the recent low of 1.05 USD.

Day trading strategy (1 hour)

Analyzing the hourly chart for EURUSD, the pair fell to 1.0506 USD yesterday but failed to establish new lows. Strong buying interest has emerged near 1.05 USD. At the time of writing, slight USD buying pressure persists, but a definitive break below the low remains uncertain.

For day trading, a contrarian strategy is recommended, with a plan to enter buy positions when EURUSD touches the -3σ line of the Bollinger Bands and exit at the middle line. If EURUSD breaks below 1.05 USD, a switch to a sell-on-rally strategy is advised.

Support/Resistance lines

Key support and resistance lines to consider:

- 1.05 USD: Psychological round number

Market Sentiment

EURUSD: Sell: 16% / Buy: 84%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| US Initial Jobless Claims | 22:30 |

| Philadelphia Fed Manufacturing Index | 22:30 |

| BOE Official Speeches | 23:00 |

| US Existing Home Sales | Midnight (00:00) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.