Gold Surges as Tensions Between the West and Russia Drive Funds to Safe-Haven Assets【November 25, 2024】

Fundamental Analysis

- The US, UK, and France have approved Ukraine’s use of missiles within Russian territory.

- Russia has responded with threats, hinting at potential attacks on Europe.

- USD and Gold have seen significant buying interest.

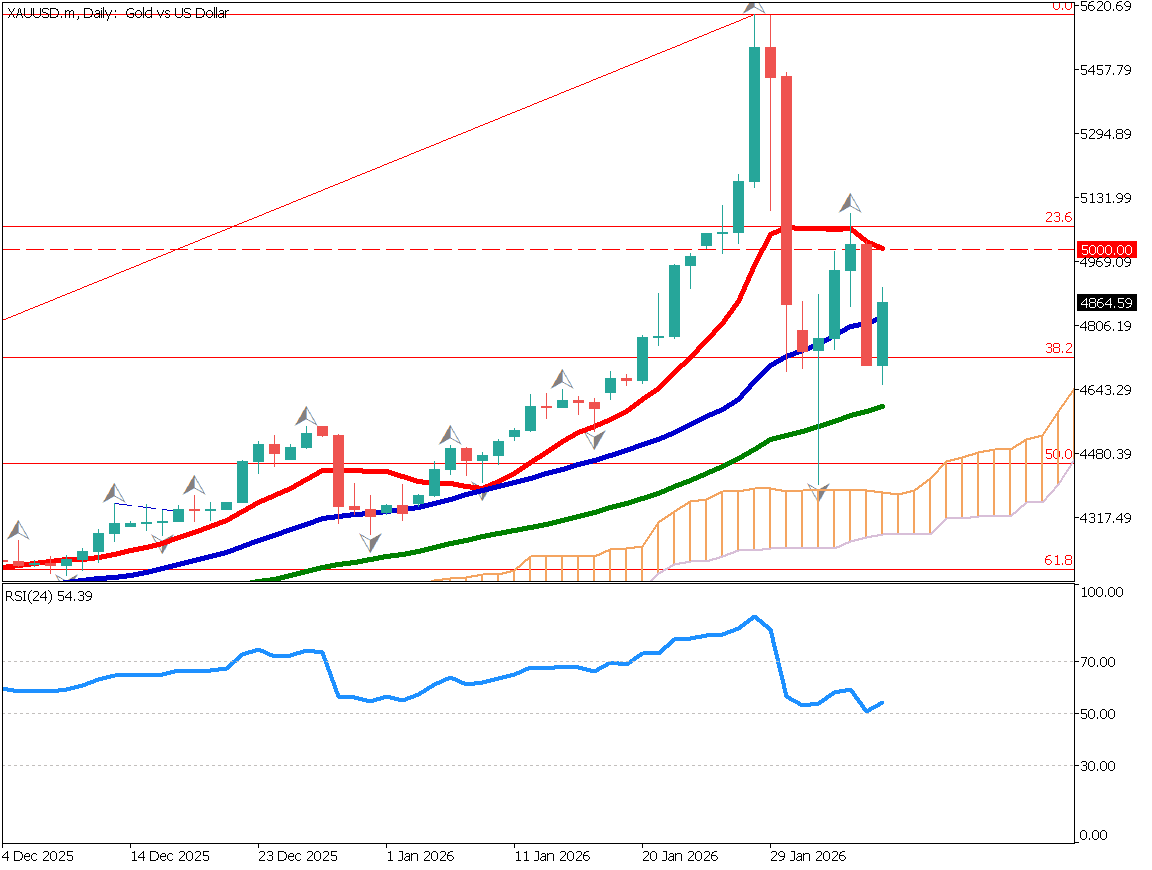

XAUUSD Technical Analysis

Analyzing the daily chart for Gold:

- Gold briefly dipped below the daily Ichimoku cloud but rebounded at the 50% Fibonacci retracement level.

- An upward trendline has been recognized, fueling a sharp rally.

- Gold has now broken above the cloud, signaling a potential challenge to its all-time high.

Gold is being purchased as a safe-haven asset amidst escalating geopolitical risks. As tensions between the West and Russia intensify, market sentiment has shifted. Currently trading around 2710 USD, Gold may surpass its all-time high of 2790 USD within the coming weeks. Caution is advised.

Day trading strategy (1 hour)

Analyzing the 1-hour chart for Gold:

- The Tenkan-sen line is acting as a support level, highlighting a clear upward trend.

- A strong bullish trend has emerged, supported by both technical and fundamental factors.

However, the latter half of the week includes the US Thanksgiving holiday, marking the start of the holiday season. Profit-taking activities should be considered. Despite this, Gold historically sees year-end buying.

Trading Approach:

- Focus on buying near 2700 USD.

- Enter buy positions if Gold dips below 2700 USD.

- Close positions around 2750 USD.

- Set a stop loss below the Kijun-sen at 2689 USD.

Support/Resistance lines

Key support and resistance lines to consider:

- 2710 USD: Previous swing high

Market Sentiment

XAUUSD: Sell: 59% / Buy: 41%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| German Economic Forecast | 18:00 |

| ECB Lane Speech | 00:30 (Next Day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.