USDJPY Holds Steady as Treasury Secretary Appointment of Mr. Bessent Announced【November 26, 2024】

Fundamental Analysis

- Hedge Fund Leader Bessent Nominated as Treasury Secretary

- The appointment of Mr. Bessent, known for his extensive experience on Wall Street, as Treasury Secretary has been well-received due to his anticipated ability to communicate effectively with financial markets. This move is seen as a counterbalance to potential extreme policies from the administration.

- The equity and forex markets responded with a risk-on sentiment, with U.S. stock indices climbing. However, USD faced selling pressure.

USDJPY Technical Analysis

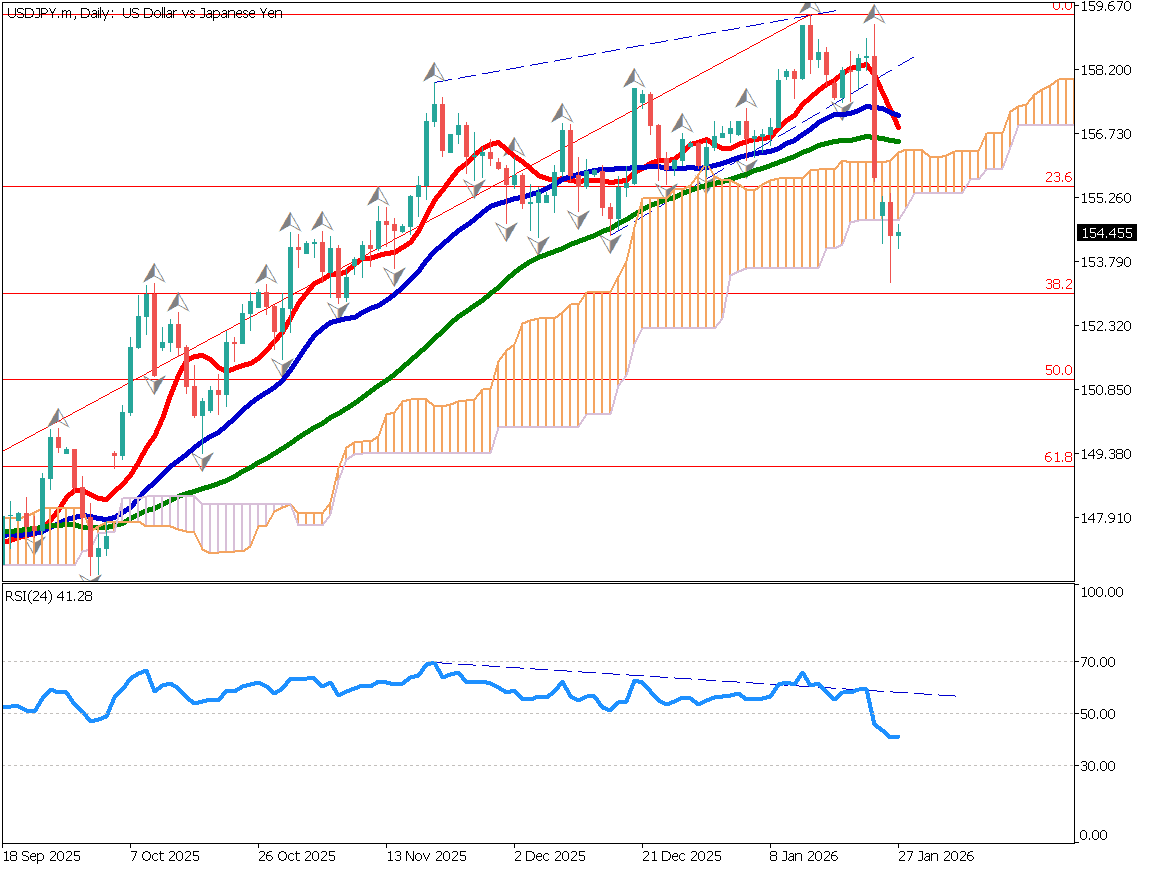

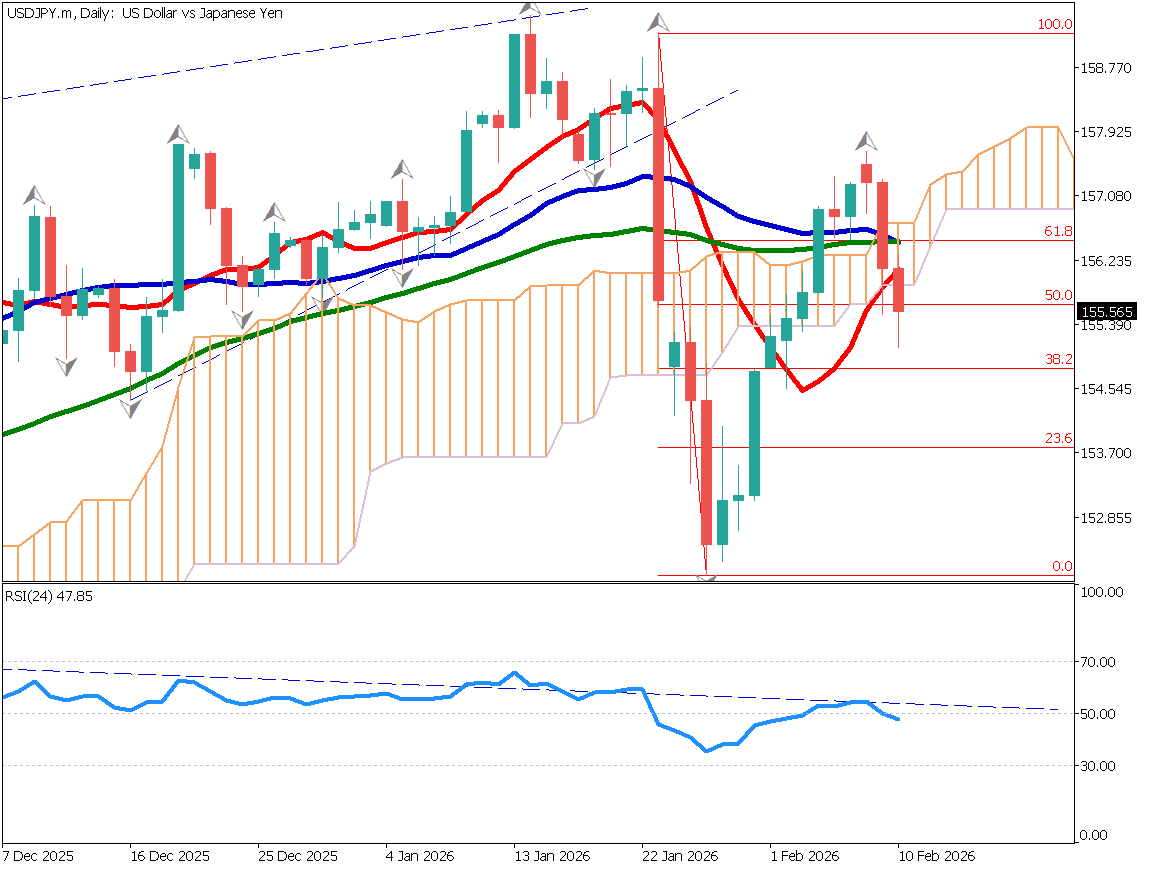

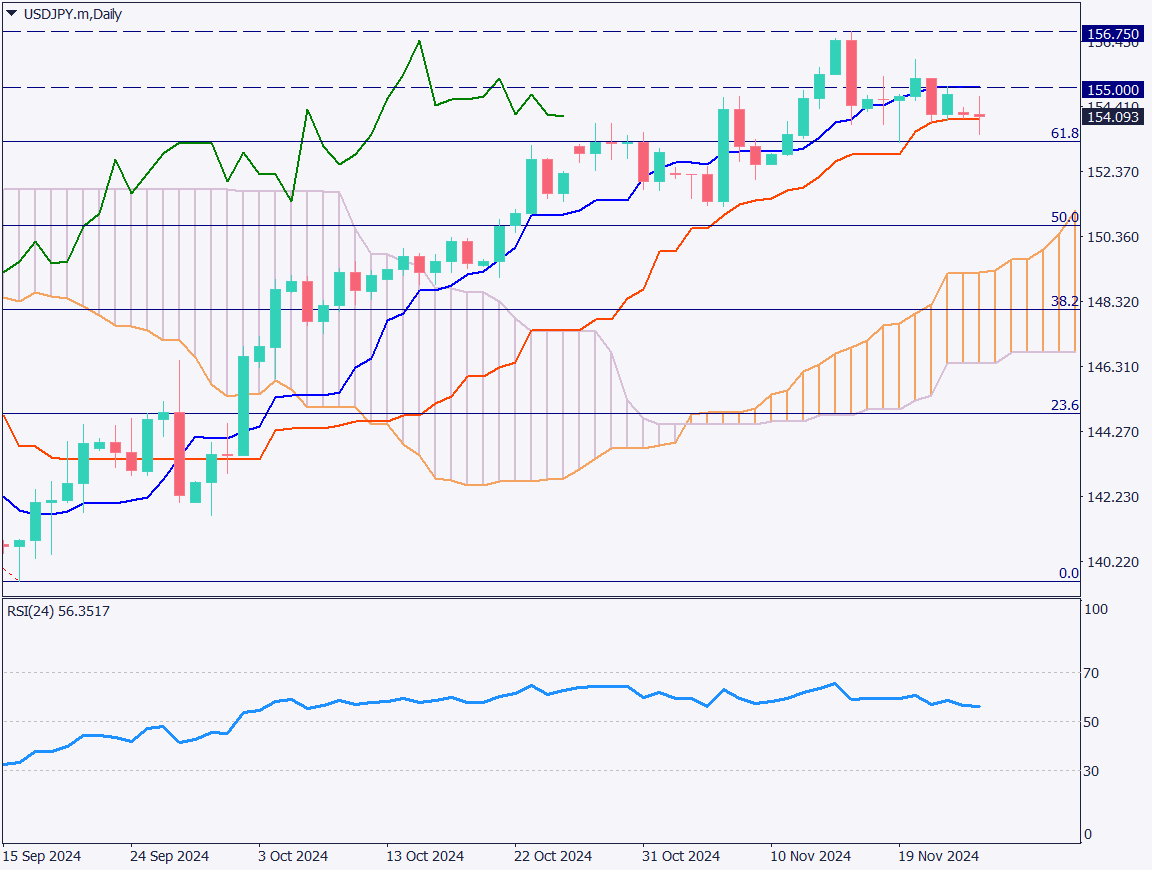

Analyzing the daily chart for USDJPY, the pair remains supported by the Ichimoku Kinko Hyo baseline. After briefly dipping into the 153 JPY range, it rebounded but still shows indecisiveness with wicks on both ends.

Should the Ichimoku baseline be breached, the next support zone aligns with the Fibonacci retracement level of 61.8% at 153.30 JPY. The RSI is at 55, indicating uncertainty about further declines.

Day trading strategy (1 hour)

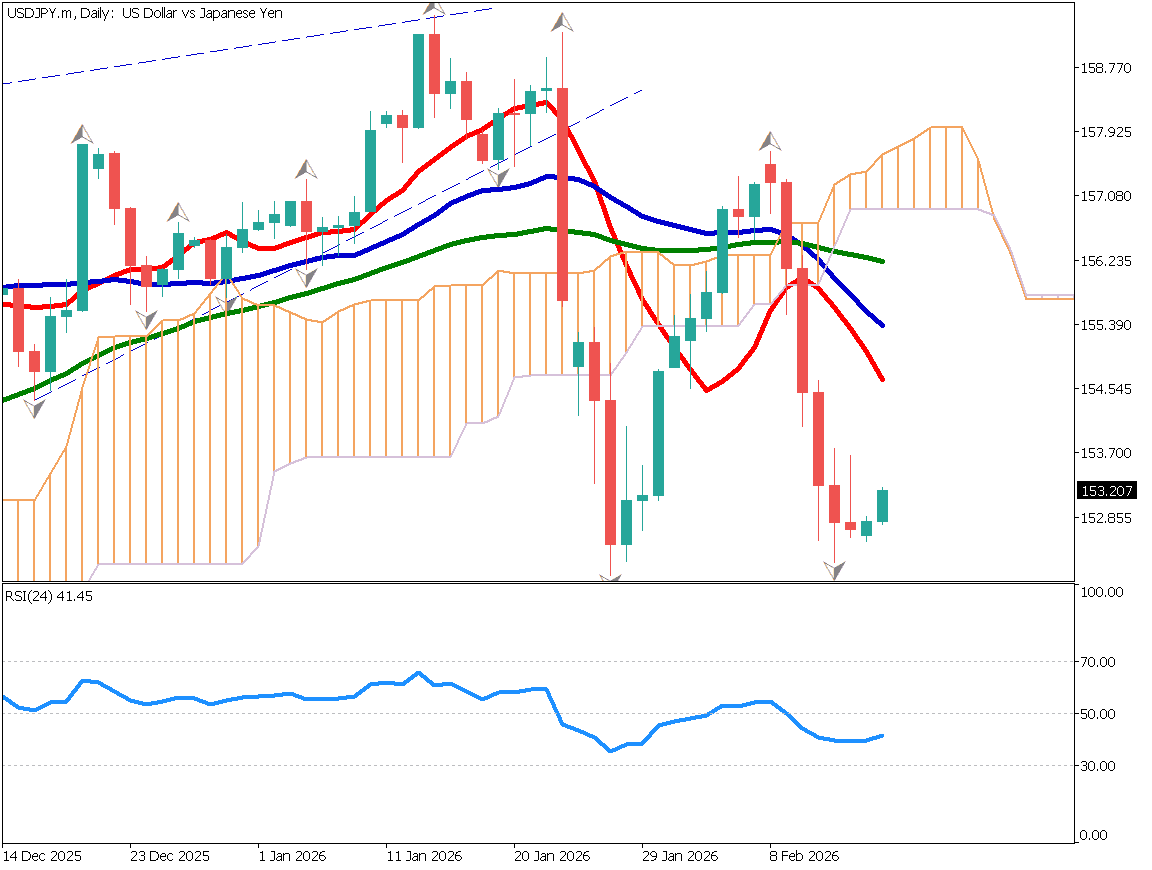

On the 1-hour chart, USDJPY is consolidating within a narrow range. Multiple bounces have been observed between 153.30 JPY and 153.50 JPY, coinciding with the daily Fibonacci retracement levels.

However, descending highs and resistance from the Ichimoku Kinko Hyo cloud suggest bearish pressure. With USD buying driven by risk-off sentiment, the continuation of unwinding moves remains uncertain.

Today’s Intraday Strategy:

Consider a countertrend entry around 153.30 JPY, targeting a reversal and exiting at 154 JPY. If 153.30 JPY breaks decisively and new lows are set, switch to a selling strategy to follow the trend.

Support/Resistance lines

Key support and resistance lines to consider:

- 155.60 JPY: Fibonacci 38.2%

- 152.73 JPY: Daily Support Line

Market Sentiment

USDJPY Sell: 66% / Buy: 34%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Bank of Japan Core CPI | 14:00 |

| U.S. Consumer Confidence Index | 00:00 (Midnight) |

| FOMC Meeting Minutes | 04:00 (Next Day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.