USDJPY Reacts to a Decline as Israel Reaches a Ceasefire Agreement with Lebanon【November 27, 2024】

Fundamental Analysis

- President Biden announced that Israel has reached a ceasefire agreement with Lebanon.

- Former President Trump revealed plans to impose additional tariffs on China, Canada, and Mexico.

- Major currency pairs experienced temporary and intense sell-offs.

USDJPY Technical Analysis

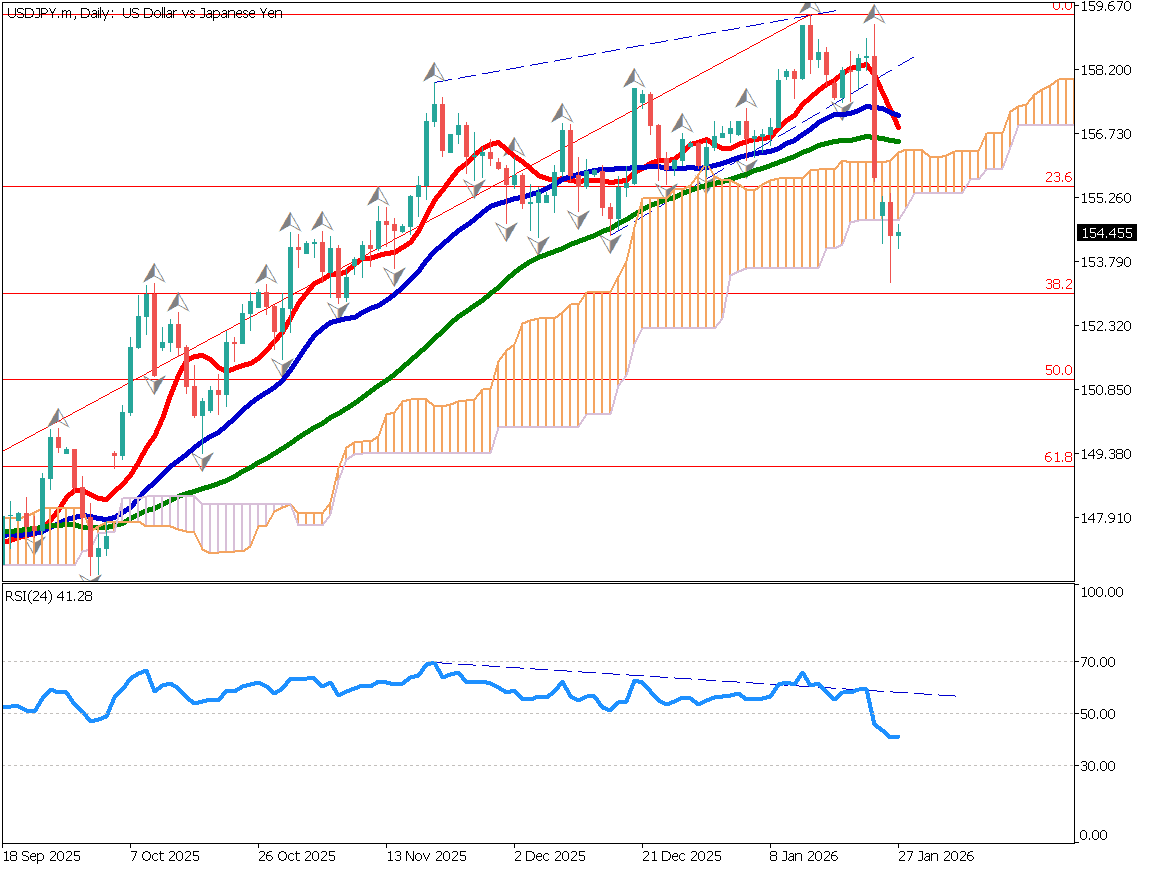

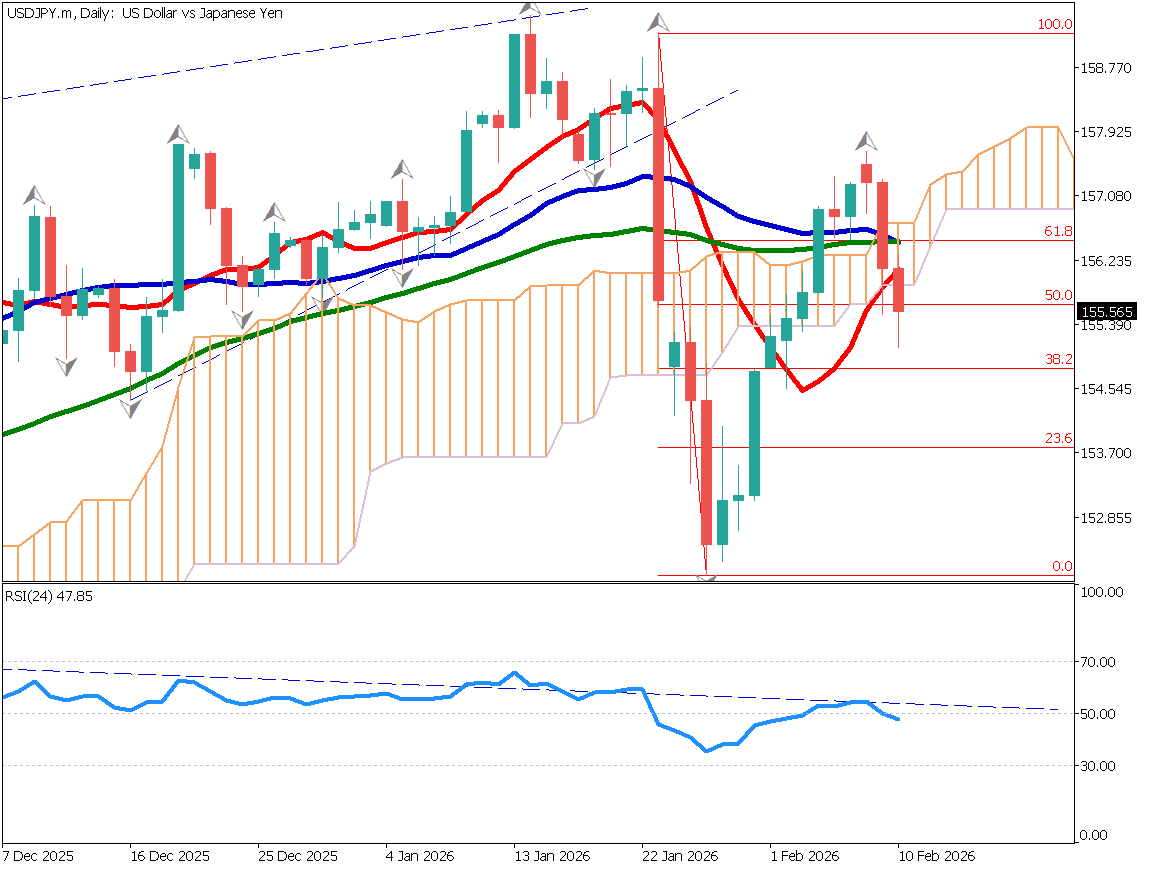

An analysis of the daily chart for USDJPY reveals a potential shift from an uptrend to a downtrend. Key observations include:

- USDJPY has broken below the baseline of the Ichimoku Kinko Hyo and updated recent lows.

- The pair has also fallen below the 61.8% Fibonacci retracement level, signaling a possible transition to a bearish trend.

The RSI is currently at 52; however, if it drops below 50, it would indicate bearish momentum from an RSI perspective.

Despite USD strength due to the Israel-Lebanon ceasefire, JPY remains the most bought currency, causing USDJPY to react with a decline. Currently trading at 152.80 JPY, a further drop to the lower 151 JPY range is anticipated.

Day trading strategy (1 hour)

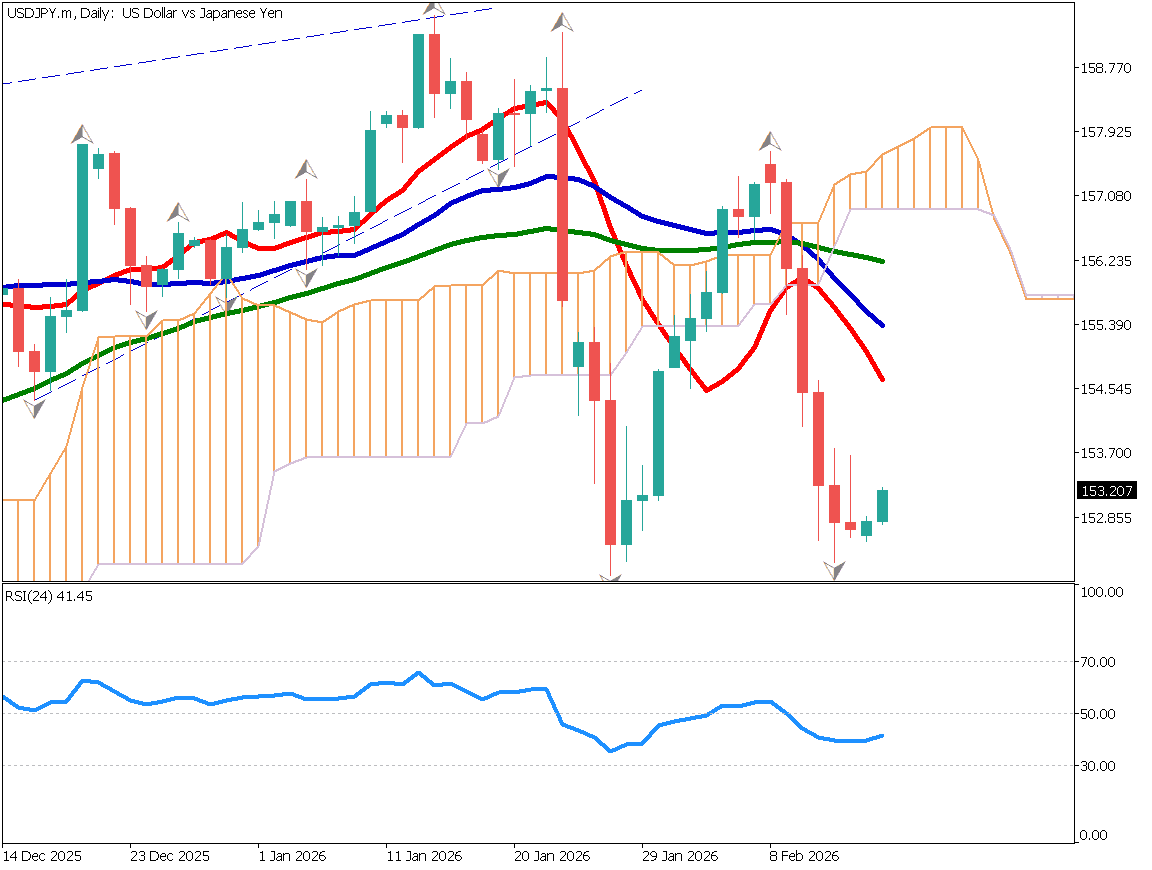

An analysis of the 1-hour chart for USDJPY indicates a downward trend:

- Lower highs have been observed, and the pair has broken recent lows.

- The conversion line is acting as a resistance level, reinforcing the downtrend.

Strategy:

- Aggressive selling is recommended, with a target around 151.30 JPY.

- Today’s market conditions may favor active trading. However, if the pair breaks above 153.25 JPY, a stop and reassessment of the strategy is advised.

Support/Resistance lines

Key support and resistance lines to consider:

- 153.30 JPY – Fibonacci 61.8%

Market Sentiment

USDJPY Sell: 65% / Buy: 35%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Australian Policy Rate Announcement | 10:00 |

| US GDP | 22:30 |

| US Jobless Claims | 22:30 |

| US Core PCE Price Index | Midnight (00:00) |

| US Crude Oil Inventory | 00:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.