USDJPY Falls as Position Adjustment Intensifies Ahead of U.S. Thanksgiving【November 28, 2024】

Fundamental Analysis

- Position adjustments intensify ahead of U.S. Thanksgiving

- Risk-averse JPY buying emerges, pushing USDJPY down to the lower 151 JPY range

USDJPY Technical Analysis

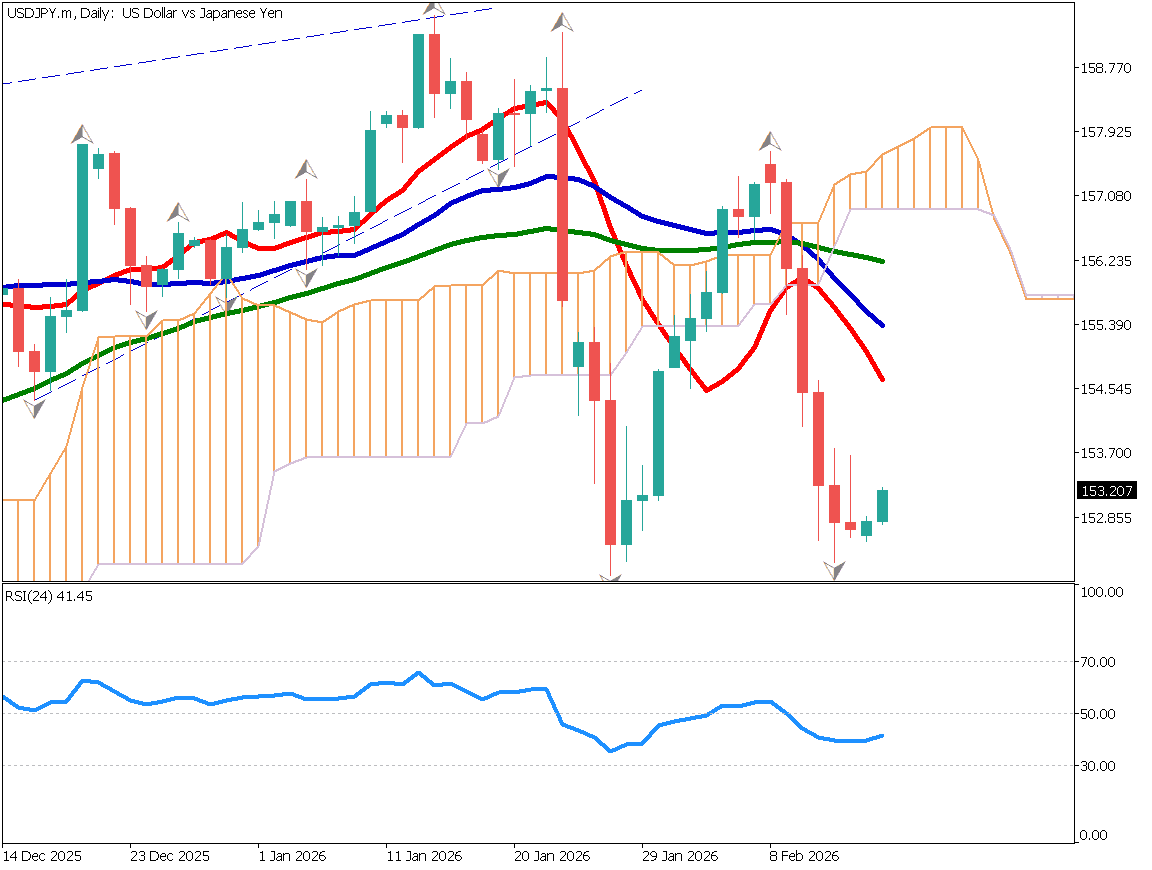

Analyzing the daily chart for USDJPY:

The key indicator to watch in USDJPY is the RSI. When RSI falls below 50, it indicates a bearish trend. Following yesterday’s significant decline, USDJPY broke below its recent low, settling around 151 JPY. RSI also dropped below 50, signaling the potential end of the bullish phase and the start of a renewed bearish trend.

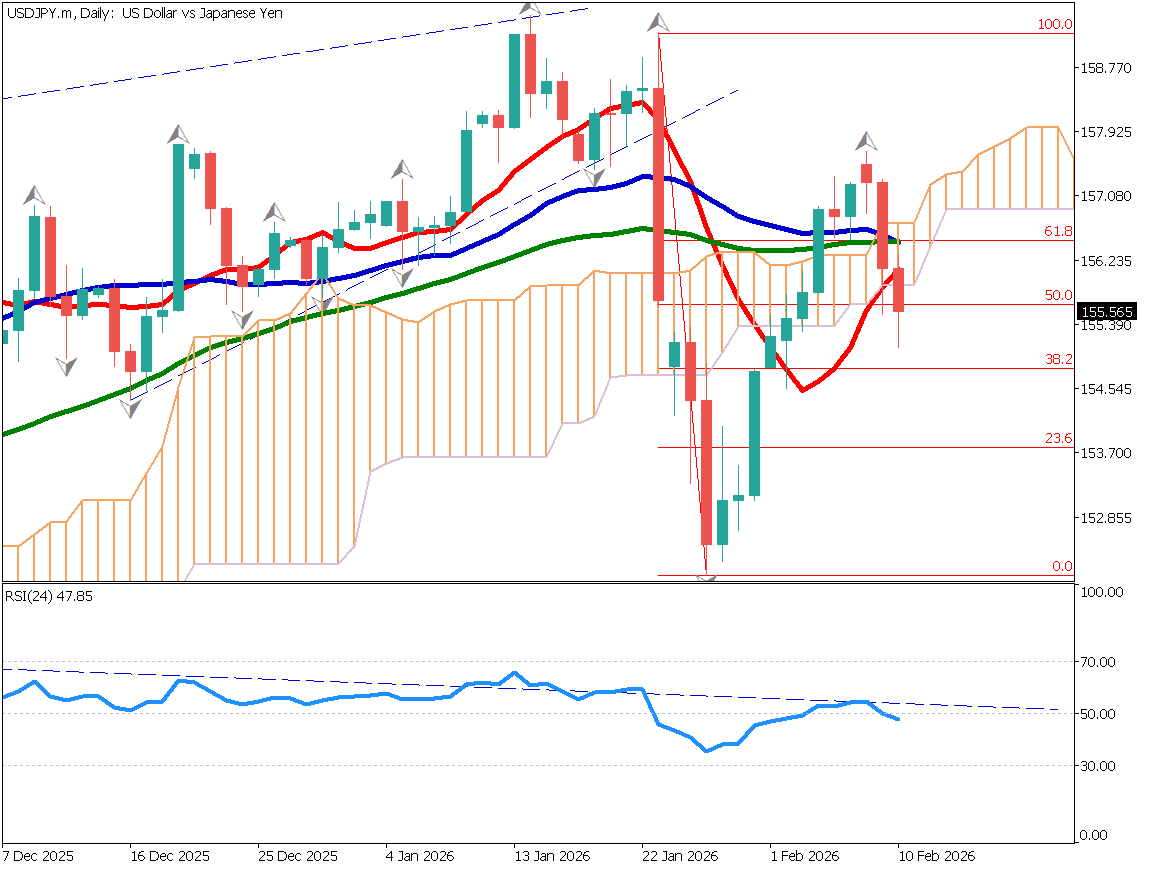

Taking a broader view of USDJPY, the pair fell from the 161 JPY range to the 139 JPY range, then rebounded to 156 JPY, before bearish momentum strengthened again. Within this larger context, it may be more prudent to consider that USDJPY remains in a broader downtrend.

USDJPY has declined to the 50% Fibonacci retracement level, making it a critical focal point. Below this level, there are clouds on the Ichimoku chart offering potential support, while liquidity is also diminishing. Caution is advised regarding downside risks, although the market may continue to lack clear direction.

Day trading strategy (1 hour)

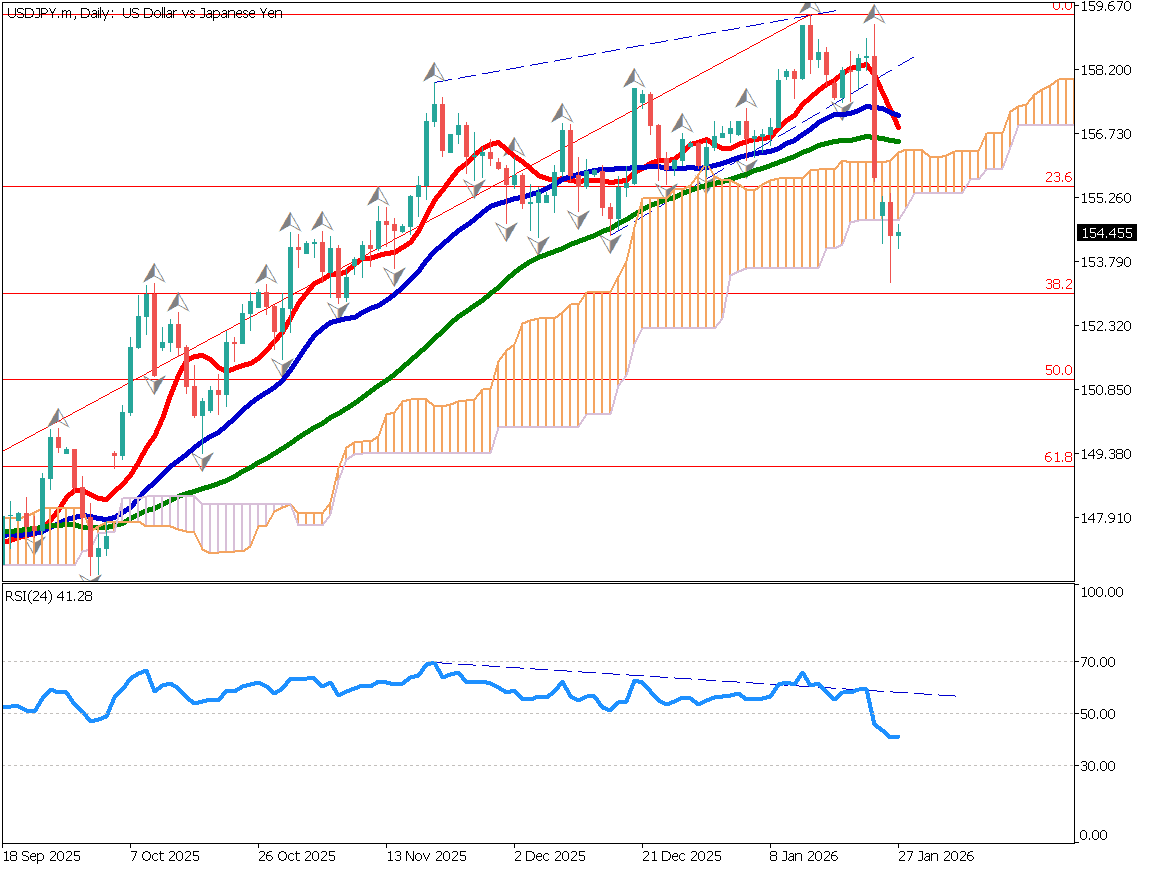

Analyzing the 1-hour chart for USDJPY:

USDJPY has shown a steady downtrend, dropping to around 150.70 JPY before a minor rebound. With reduced liquidity expected during the U.S. Thanksgiving holiday, trading activity is likely to concentrate during the daytime session.

The market is primarily viewed as a sell-on-rallies environment. A suggested trade setup could be to enter a sell position around 152 JPY, set a stop at 152.50 JPY, and take profit at 150.75 JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 150.70 JPY: Daily Fibonacci 50%

- 148 JPY: Daily Fibonacci 38.2%

Market Sentiment

USDJPY Sell: 47% / Buy: 53%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| U.S. Thanksgiving (U.S. stock markets closed) | – |

| German Consumer Price Index | 22:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.