USDJPY Drops Below 150 JPY Amid Rising Expectations for BOJ Rate Hike【December 2, 2024】

Fundamental Analysis

- BOJ Governor Suggests Rate Hike Timing Is Near

- The BOJ governor commented that further JPY depreciation poses significant risks and requires action.

- With the December meeting approaching, expectations for a rate hike have grown, pushing USDJPY below 150 JPY.

USDJPY Technical Analysis

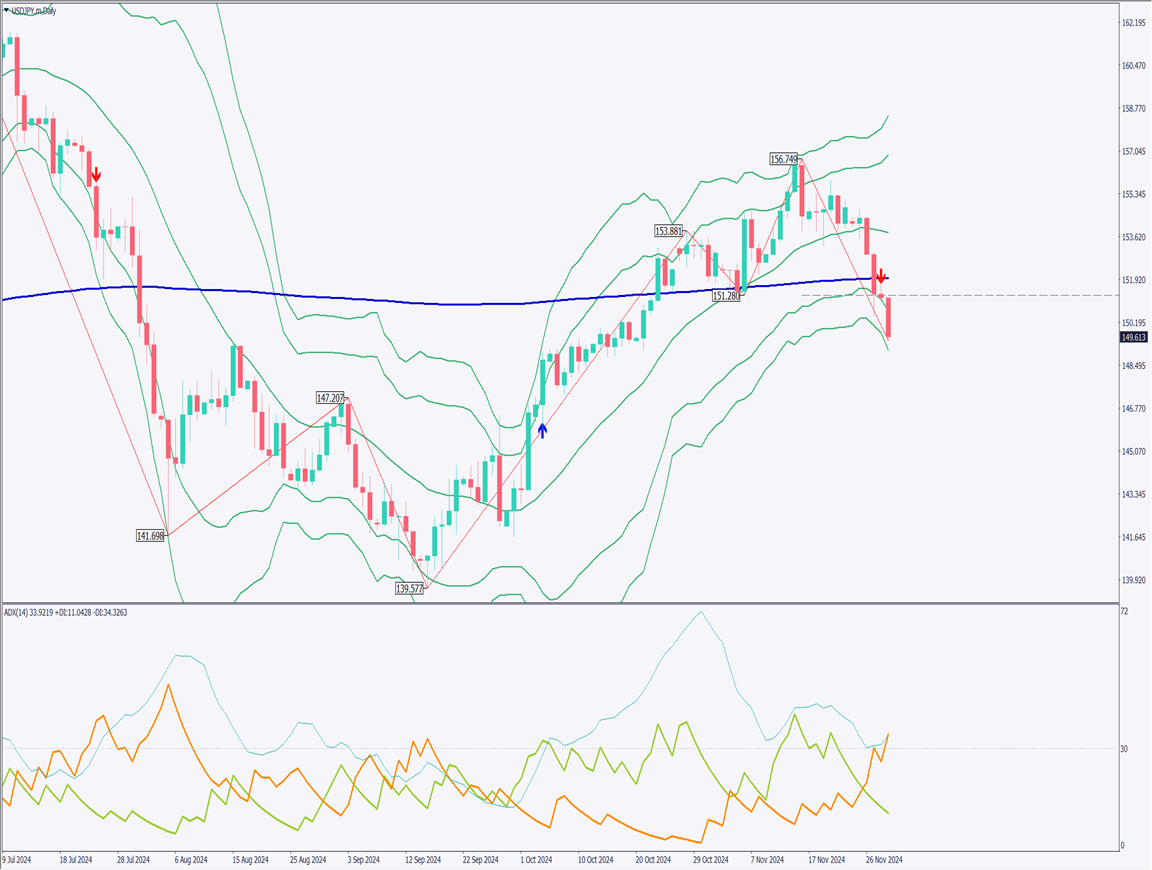

Analyzing the USDJPY daily chart: USDJPY closed at 149.60 JPY, falling below the 240-day moving average. The Bollinger Bands indicate that USDJPY has breached the -2σ line and is approaching the -3σ line.

This decline reflects the BOJ governor’s statements about the proximity of a rate hike and concerns about excessive JPY depreciation. The BOJ policy meeting scheduled for December 18–19 raises expectations for a rate hike, driving JPY buying. Additionally, the FOMC on December 17–18 adds to the importance of the third week of December.

If USDJPY falls below 149 JPY, it may rapidly decline to the 147 JPY range. Historical trends suggest there is no strong support line around the 148 JPY level, warranting caution against JPY appreciation risks.

The ADX stands at 33, with the -DI at 34, signaling a continued downtrend.

Day trading strategy (1 hour)

Analyzing the USDJPY 1-hour chart: USDJPY appears to have support at 149.50 JPY. The downtrend is becoming more evident, with USDJPY and other cross-yen pairs being sold.

If BOJ rate hike expectations for mid-December rise further and dovish expectations for the FOMC increase, the narrative of USD selling/JPY buying will solidify.

Key level to watch: a break below 149 JPY. If this level is breached, USDJPY may drop sharply to the 147 JPY range. Until the BOJ meeting, it is advisable to trade with JPY appreciation in mind.

Day Trade Strategy

- Sell on rebounds: Place a sell limit order around 150.05 JPY.

- Target profit: Early 149 JPY range.

- Stop-loss: Above 150.25 JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 147.20 JPY: Historical significant level

Market Sentiment

USDJPY: Sell: 41% / Buy: 59%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Australian Retail Sales | 10:30 |

| EU Unemployment Rate | 19:00 |

| US Manufacturing PMI | 23:45 |

| US ISM Manufacturing PMI | Midnight |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.