EURUSD Rises Ahead of U.S. Employment Data【December 6, 2024】

Fundamental Analysis

- EURUSD’s selling pressure has eased, with market focus shifting to U.S. employment data.

- The pair has solidified above the 1.05 USD range, climbing toward 1.06 USD.

EURUSD Technical Analysis

Analyzing the daily chart of EURUSD:

EURUSD has risen near 1.06 USD after rebounding from a low around 1.033 USD. Following the bounce from 1.033 USD, it consolidated in the 1.05 USD range before advancing to 1.06 USD.

Currently, the Ichimoku Kinko Hyo’s baseline is acting as a resistance level. Additionally, the 28-day moving average is a critical level to watch. The market is awaiting insights from the U.S. employment data, with attention on whether the pair will reverse at the 61.8% Fibonacci expansion level.

Day trading strategy (1 hour)

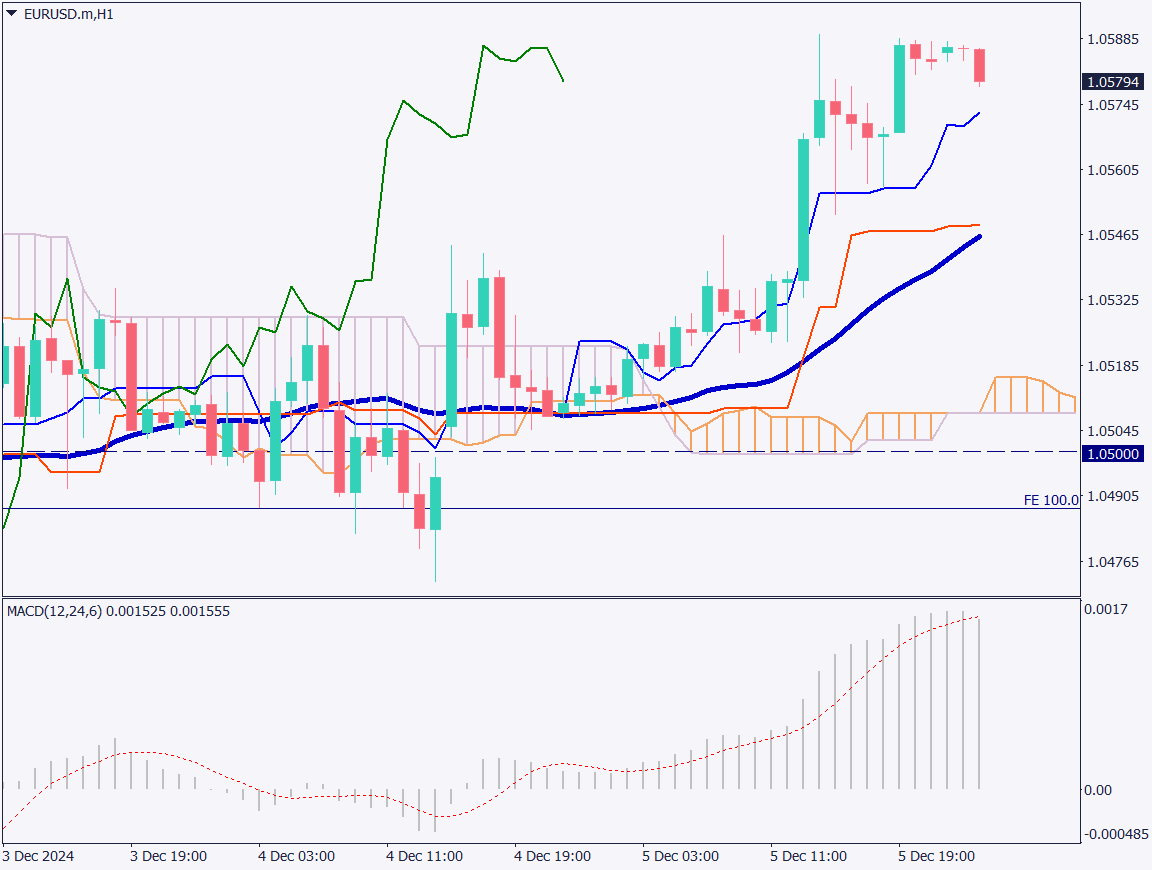

Analyzing the 1-hour chart of EURUSD:

The pair has broken out of a range and risen near 1.06 USD. Profit-taking sell orders have emerged just below the 1.06 USD round number, a psychologically significant level.

In the daily chart, the baseline and 28-day moving average are converging, presenting a selling opportunity.

Suggested strategy: Set a sell limit just below 1.06 USD, targeting 1.055 USD for profit-taking. Set a stop-loss at 1.0625 USD if the price advances further.

Support/Resistance lines

Key support and resistance lines to consider:

- 1.06 USD: Round number resistance

- 1.05 USD: Round number support

Market Sentiment

EURUSD: Sell: 34% / Buy: 66%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japan Household Survey & Consumer Spending | 8:30 |

| EU GDP | 19:00 |

| U.S. Employment Data | 22:30 |

| FOMC Member Bowman Speech | 23:15 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.