USDJPY Rises as BOJ Rate Hike Expectations Fall to Around 25%【December 11, 2024】

Fundamental Analysis

- RBA Holds Rates, Hints at January Rate Cut

- Cautious Sentiment Ahead of US CPI

- BOJ December Rate Hike Expectations Decline, USDJPY Climbs to 200-Day Moving Average

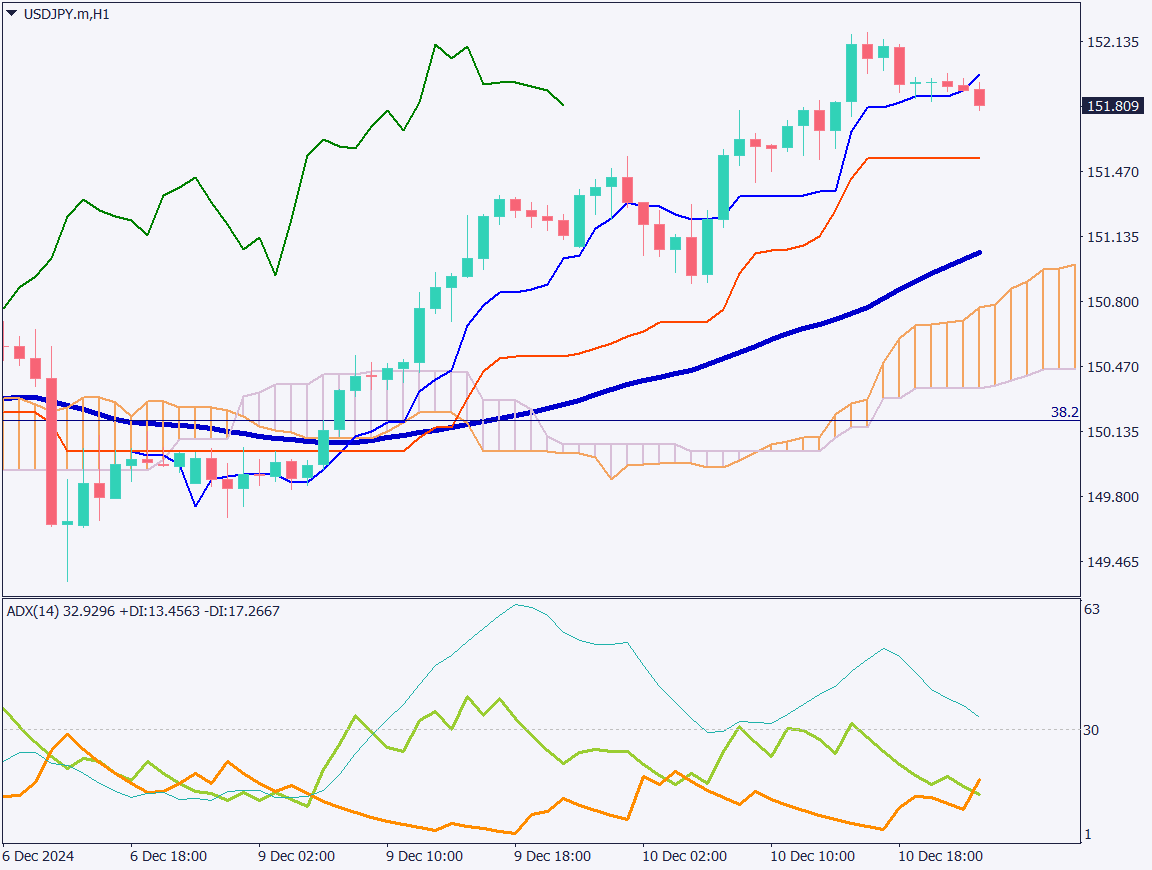

USDJPY Technical Analysis

Analyzing the daily chart for USDJPY, we see a strong yen-selling trend influenced by lowered expectations for a BOJ rate hike and a temporary pause in the Fed’s rate cuts next year. USDJPY is currently testing the 52-day moving average, with the focus on whether it can break through the cloud resistance.

If the pair breaks above the 52-day moving average, it will face the 23.6% Fibonacci retracement level, where intense buying and selling pressure are likely to battle for dominance.

Major securities firms remain divided between yen appreciation and depreciation, with today’s US CPI potentially providing directional clarity.

Day trading strategy (1 hour)

The 1-hour chart for USDJPY shows the pair breaking below the conversion line, indicating a potential decline toward the base line. However, the overall trend remains in favor of yen depreciation. With the US CPI release scheduled for today, the market direction will likely hinge on the results.

If the CPI does not exceed expectations significantly, a gradual shift toward yen appreciation is anticipated.

For day trading, the suggested strategy is:

- Sell Limit Order at 152.70 JPY

- Take Profit Around 150.00 JPY

- Stop Loss at 153.25 JPY

Support/Resistance lines

Key support and resistance lines to consider:

- 152.70 JPY – 52-day Moving Average / Fibonacci Retracement

Market Sentiment

USDJPY Sell: 53% / Buy: 47%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japan Large Manufacturers’ Sentiment Index | 8:50 |

| US Core CPI | 22:30 |

| Canada Policy Rate Announcement | 23:45 |

| US Crude Oil Inventories | 0:30 (next day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.