USDJPY in the Mid-152 JPY Range, Stock Prices on an Uptrend Due to U.S. Rate Cuts【December 12, 2024】

Fundamental Analysis

- U.S. CPI Matches Market Expectations; Rate Cuts Almost Certain

- The USDJPY continues its upward trend, trading in the 152 JPY range.

USDJPY Technical Analysis

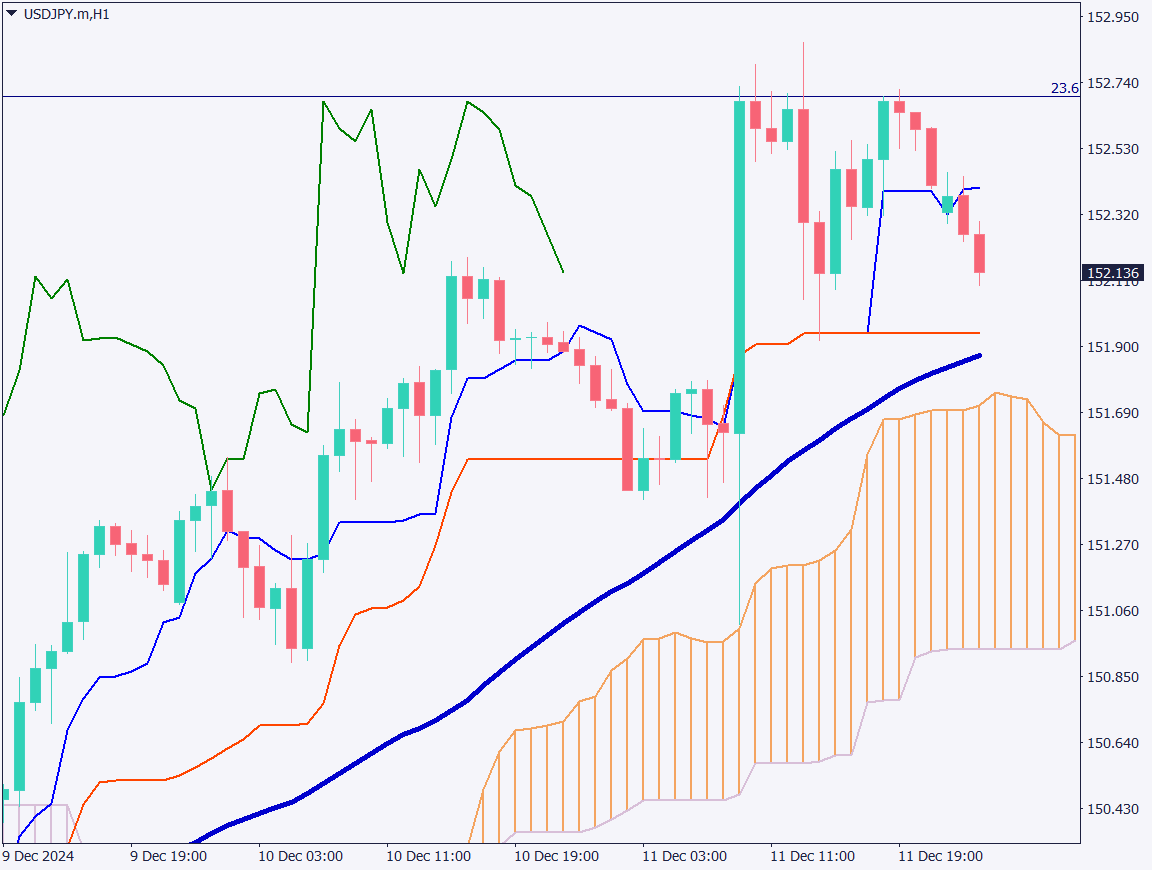

The daily chart for USDJPY highlights the significance of the 52-day moving average, with strong resistance in the 152 JPY range. Additionally, the 23.6% Fibonacci retracement level, the upper limit of the Ichimoku cloud, and the 52-day moving average are all converging, making a breakout challenging without further catalysts.

Although the probability of a Bank of Japan rate hike in December remains low, the announcement of deputy governor speeches and press conferences ahead of January’s BOJ meeting suggests groundwork for future rate hikes. This could increase market focus on JPY buying in the near term.

Until USDJPY clearly breaks above the 152 JPY range, a strategy of selling on rebounds is recommended.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY reveals the clear influence of the 23.6% retracement level. Yesterday saw three attempts to breach higher levels, all unsuccessful. The pair has since broken below the conversion line, signaling a downward shift. The 152 JPY range remains a significant resistance level, requiring stronger catalysts for further depreciation of the yen.

Potential catalysts include whether the U.S. will continue its rate cuts into next year or if there will be a pause.

Day Trading Plan for Today:

- Sell limit: 152.70 JPY

- Stop-loss: 153.25 JPY

- Take-profit: 150.00 JPY

Support/Resistance lines

Key support and resistance lines to consider:

- 152.70 JPY: Fibonacci Level

Market Sentiment

USDJPY: Sell: 48% / Buy: 52%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Australia Employment Data | 9:30 |

| UK GDP | 16:00 |

| ECB Interest Rate Decision | 22:15 |

| U.S. Producer Price Index | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.