USDJPY Continues to Rise as BOJ Rate Hike Expectations Significantly Decline【December 16, 2024】

Fundamental Analysis

- The Bank of Japan is expected to refrain from a rate hike as it evaluates the policies of President Trump.

- Reports suggest that the US Federal Reserve is considering pausing rate cuts next year.

USDJPY Technical Analysis

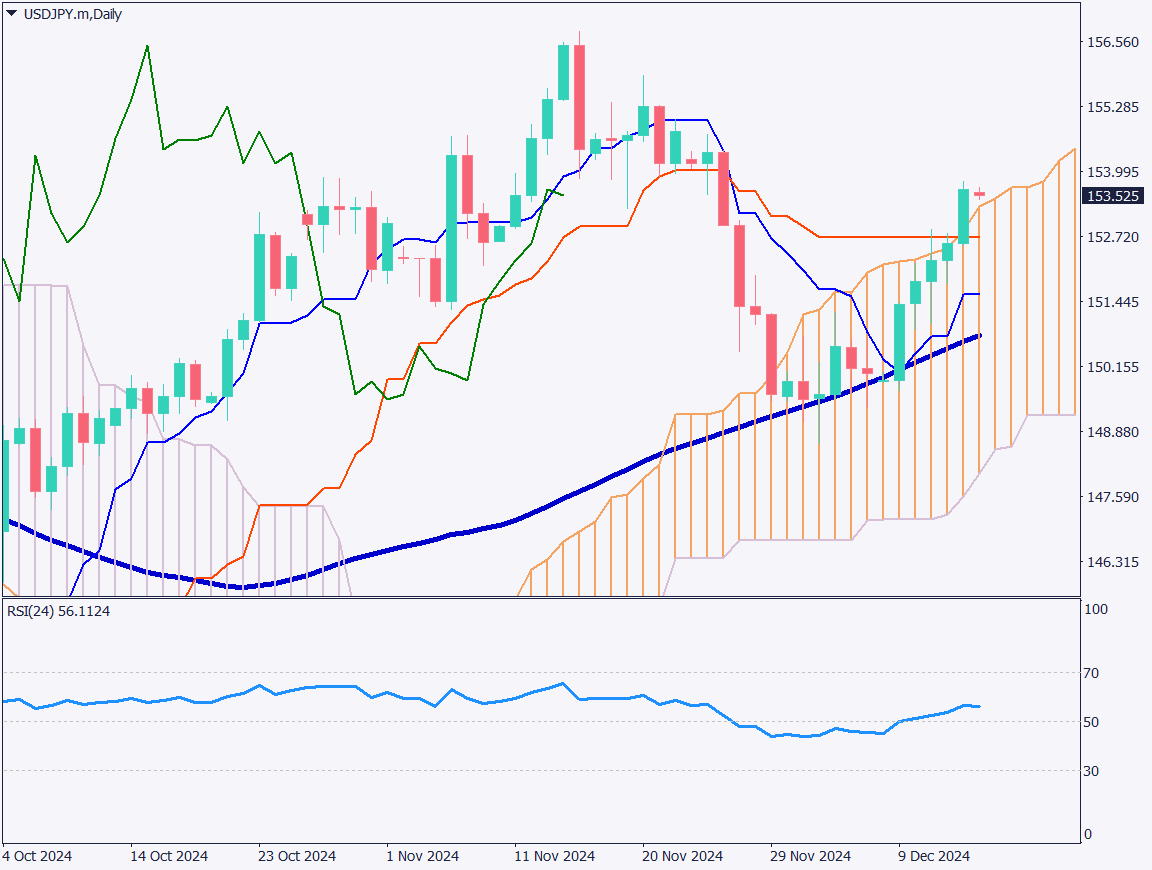

USDJPY has risen for five consecutive days, driven by a strong trend of JPY depreciation against USD appreciation. This is due to expectations of the BOJ holding off on a rate hike and reports about the Fed potentially pausing rate cuts.

From a technical perspective, USDJPY has broken above the Ichimoku Cloud and moved beyond the pullback stage, entering a price range where the trend could accelerate. The pair is likely to target the monthly resistance level around 154.42 JPY.

Day trading strategy (1 hour)

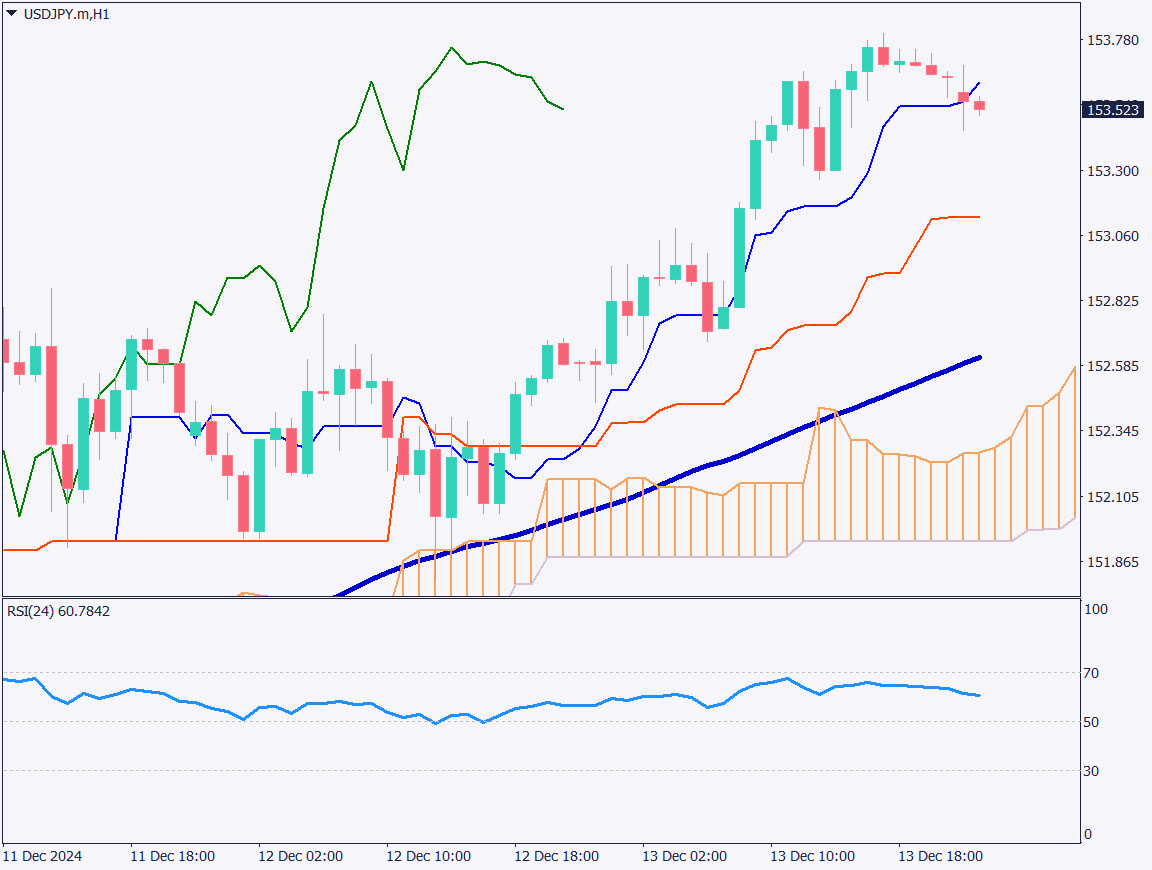

USDJPY broke above the range near 152.60 JPY, rising sharply to 153.78 JPY. With the FOMC and BOJ meetings scheduled for Thursday, movements may be limited, but the JPY depreciation and USD appreciation trend is expected to continue unless there are surprises.

For day trading, a buy-on-dip strategy is recommended:

- Buy Limit: Around 152.95 JPY, near the baseline

- Take Profit: Around 154.35 JPY

- Stop Loss: At 152.50 JPY

Support/Resistance lines

Key support and resistance lines to consider:

- 154.42 JPY: Monthly resistance level

- 151.95 JPY: Monthly pivot point

Market Sentiment

USDJPY Sell: 56% / Buy: 44%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Nikkei Services PMI | 8:50 |

| EU Composite PMI | 18:00 |

| US Manufacturing PMI | 23:45 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.