USDJPY Maintains Yen Weakness Trend but Traders Remain Cautious【December 17, 2024】

Fundamental Analysis

- Nasdaq Hits New Highs While S&P 500 Declines Consecutively

- USDJPY maintains a yen-weakening trend as traders remain cautious ahead of the Bank of Japan (BOJ) meeting results.

USDJPY Technical Analysis

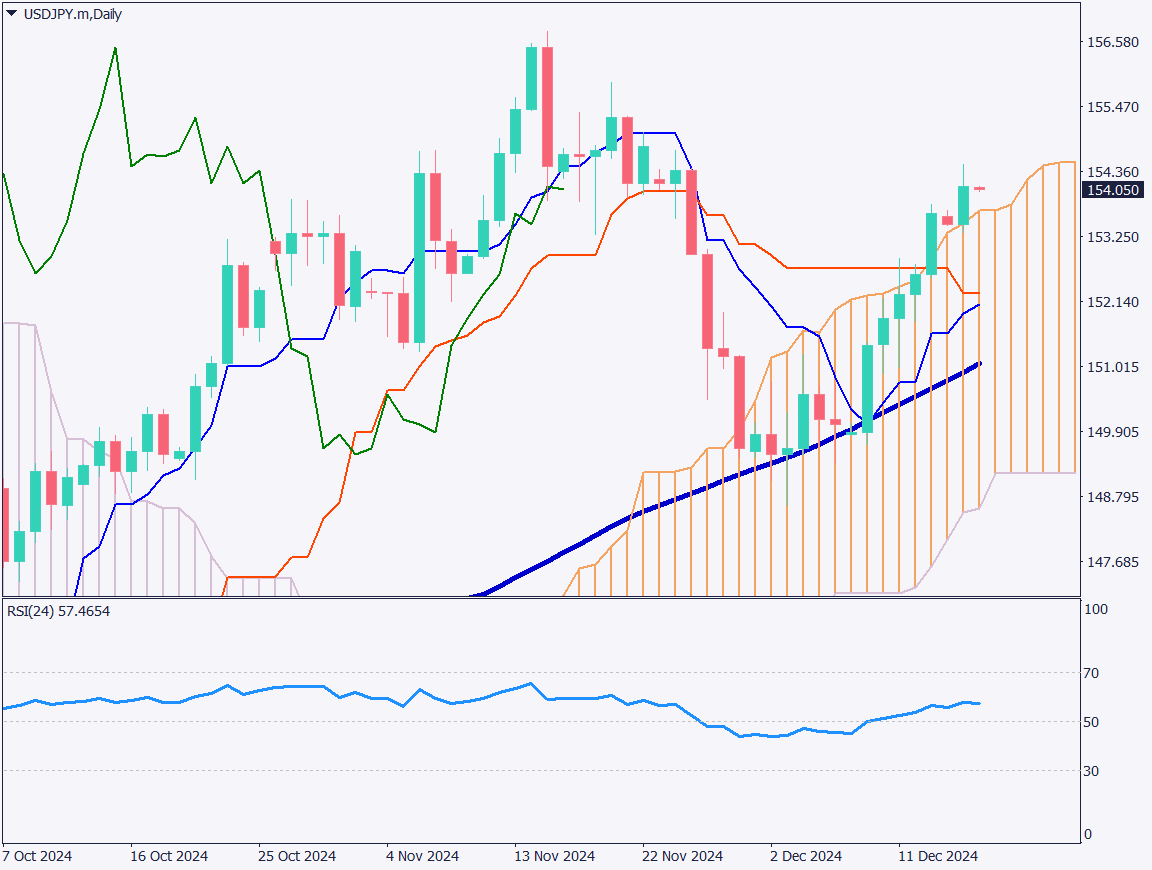

Analyzing the daily USDJPY chart, the pair has broken above the Ichimoku cloud and climbed to the 154 JPY level. With the BOJ holding off on rate hikes, yen weakness has intensified. There is a strong resistance zone at 154.42 JPY, and while the pair retraced yesterday, focus remains on whether it can break above this level today.

There is potential for an upward move to around 156.75 JPY this month. The 72-day moving average is also trending upward, suggesting USDJPY could attempt to surpass the recent daily high of 156.75 JPY.

Day trading strategy (1 hour)

Analyzing the 1-hour USDJPY chart, the pair continues to hit new highs, but the MACD histogram remains in a declining state. A classic divergence has occurred.

The MACD divergence indicates a narrowing gap between the 12-period and 24-period moving averages.

The strategy remains to target pullbacks:

- Buy limit at 153.21 JPY

- Take profit at 154.42 JPY

- Stop loss below 153 JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 155.50 JPY: Key psychological level

- 154.48 JPY: Yesterday’s high

Market Sentiment

USDJPY: Sell: 65% / Buy: 35%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| UK Employment Data | 16:00 |

| US Core Retail Sales | 22:30 |

| Canada CPI | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.