The Bank of Japan maintains a dovish stance, USDJPY rises to the 157 JPY level【December 20, 2024】

Fundamental Analysis

- USDJPY surges, breaking key daily resistance

- The BOJ Governor remains dovish, suggesting a desire to monitor continued wage increases

- The Governor may prioritize the results of spring labor negotiations, with a rate hike likely after spring

USDJPY Technical Analysis

Analyzing the daily USDJPY chart: USDJPY has broken through the key daily resistance at 156.75 JPY, forming a new high. This signals the emergence of an uptrend according to Dow Theory. The uptrend is gaining momentum, with yen weakness and dollar strength becoming evident.

The backdrop is the BOJ’s cautious approach to rate hikes. The Governor cited the need to confirm the sustainability of wage increases and uncertainties surrounding the policies of the next U.S. administration as reasons for deferring rate hikes. While inflation aligns with the BOJ’s outlook, the Governor expressed a need for further confirmation of sustained wage increases and frequently mentioned “spring labor negotiations,” emphasizing its importance.

Although there are expectations of a January rate hike, if the Governor prioritizes the results of spring labor negotiations, it is likely that rate hikes will also be postponed in January, pushing the decision to spring. For the time being, yen weakness and dollar strength are expected to persist.

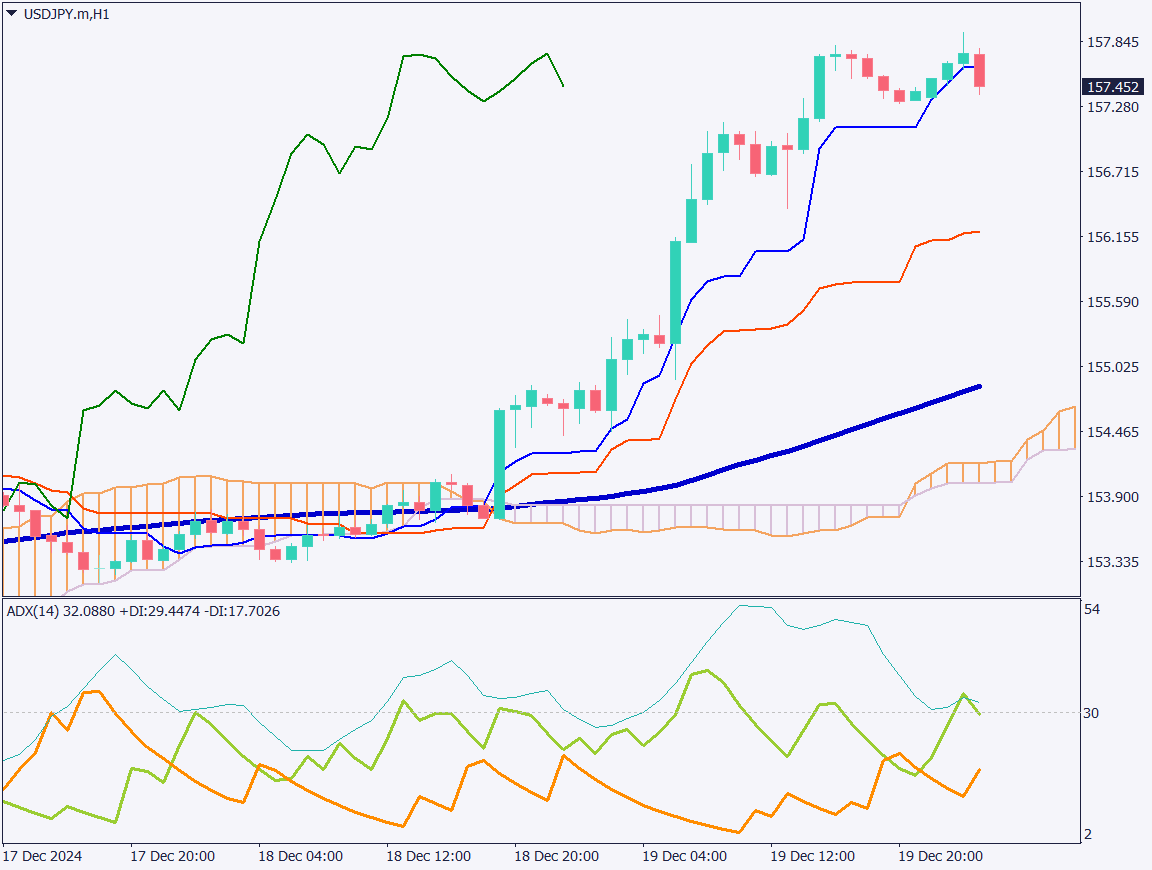

Day trading strategy (1 hour)

Analyzing the 1-hour USDJPY chart:

USDJPY is facing resistance at 157.70 JPY, with strong resistance to upward movement. A double top pattern is forming, suggesting potential profit-taking. However, the overall trend favors buying on dips.

Next week marks the Christmas holiday, which will see a significant decline in trading volume. As a result, position adjustments may increase, and a move toward 160 JPY might be deferred until the new year.

Day Trading Plan:

- Place a buy limit order at 155.57 JPY.

- Set a take-profit order at 157.70 JPY.

- Place a stop-loss at 154.90 JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 157.80 JPY: Yesterday’s high

- 157.00 JPY: Monthly resistance line

Market Sentiment

USDJPY Sell: 69% Buy: 31%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japan Nationwide Core CPI | 8:50 |

| U.S. Core PCE Price Index | 22:30 |

| Canada Retail Sales | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.