USDJPY Hits New Highs Amid Quiet Holiday Markets【December 23, 2024】

Fundamental Analysis

- USDJPY hit new highs as market participants adjust positions ahead of the Christmas holiday.

- The outlook for a January rate hike has also faded, contributing to the pair’s recent movements.

USDJPY Technical Analysis

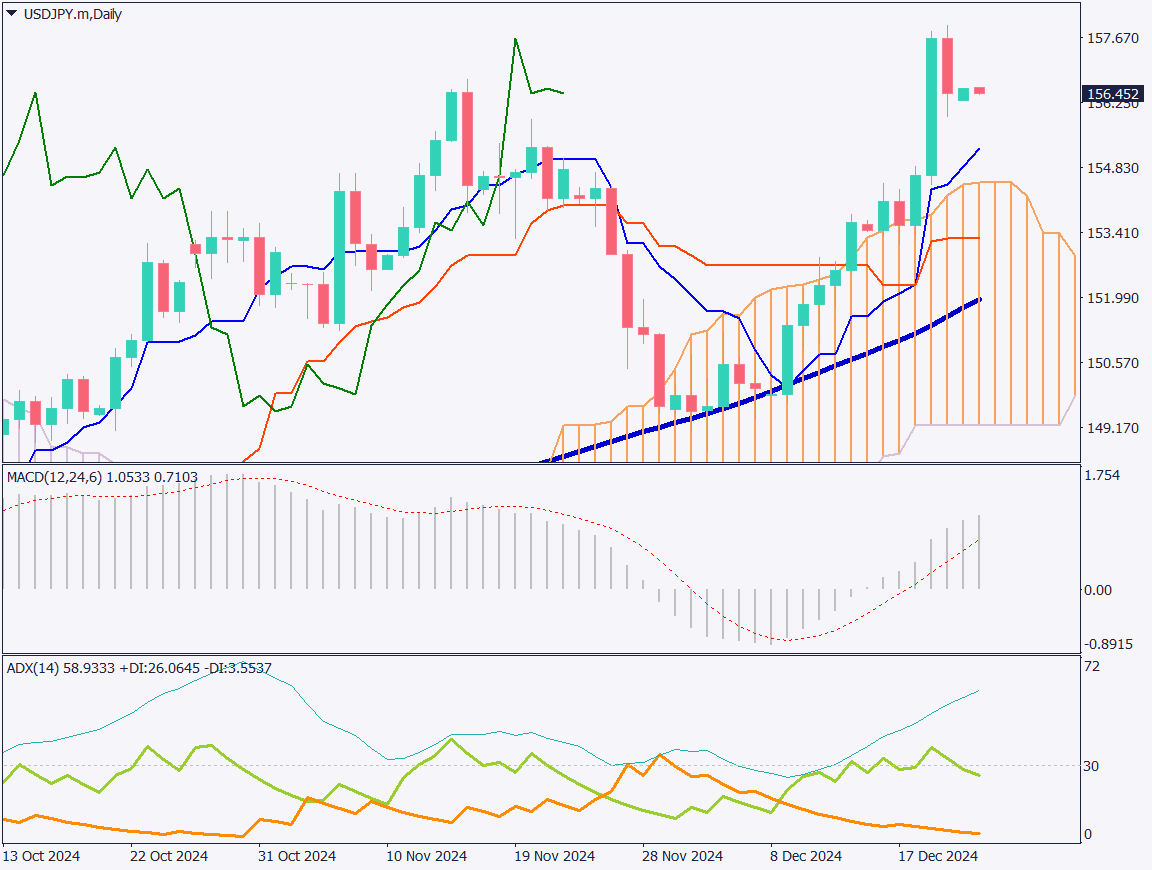

Analyzing the daily chart, USDJPY updated its high to 156.75 JPY. Although there was a slight pullback, the overall trend remains upward. Due to the Christmas holiday, market trading volumes are expected to hit their lowest levels of the year, increasing the possibility of price volatility.

The pair is trading above the conversion line, which is acting as support. If this trend continues, USDJPY could aim to break above 160 JPY early next year. The Bank of Japan is unlikely to raise rates until after the spring labor negotiations in March, signaling potential yen depreciation until then.

Day trading strategy (1 hour)

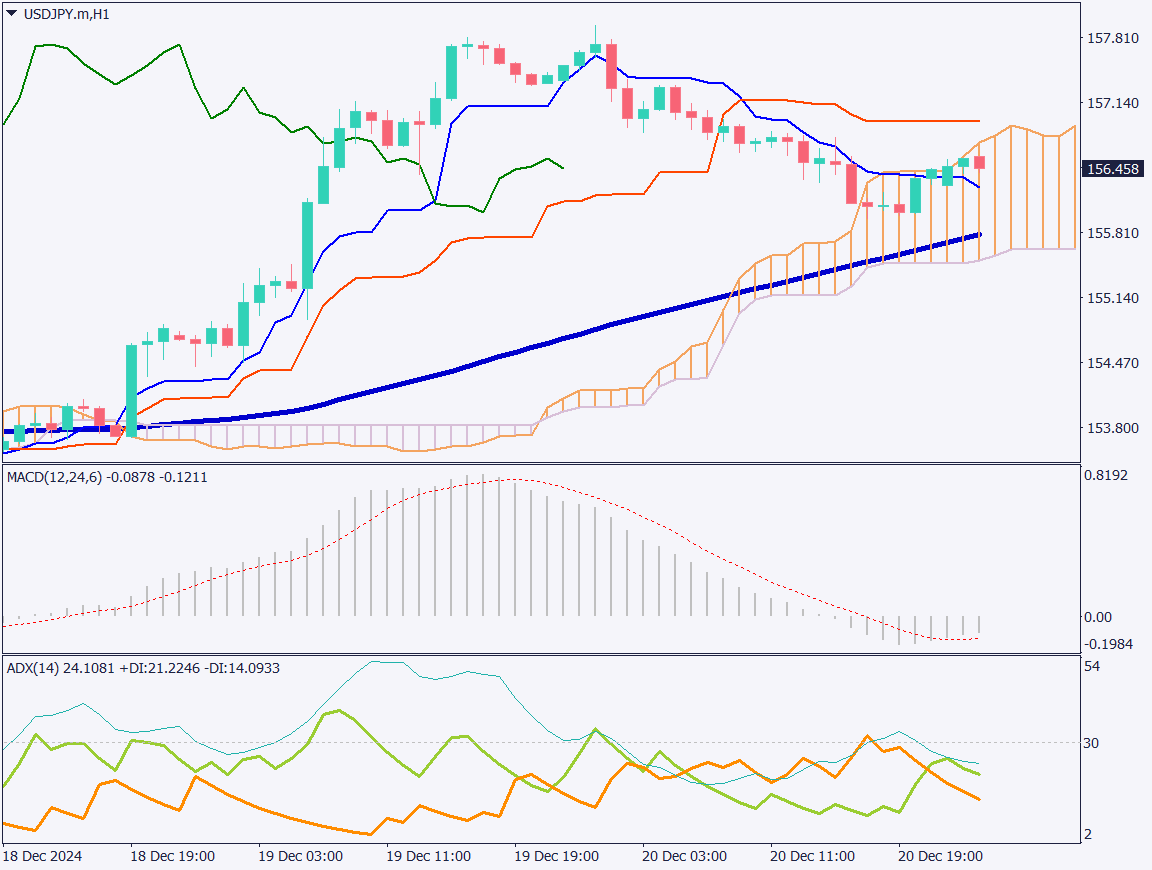

The USDJPY hourly chart suggests potential for unexpected movements during the Christmas holiday, making for a challenging market. Support and resistance levels are likely around 156.10 JPY and 156.70 JPY. It will be crucial to monitor whether the 72-period moving average acts as support.

Strategy: Focus on buying on dips. Consider entering long positions if prices drop to the upper 155 JPY range. Place a stop if the price breaks clearly below the 72-period moving average, and set your target at 157.50 JPY for profit-taking.

Support/Resistance lines

Key support and resistance lines to consider:

- 156.75 JPY: Key psychological level

Market Sentiment

USDJPY Sell: 67% Buy: 33%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| UK GDP | 16:00 |

| Canada GDP | 22:30 |

| US Consumer Confidence Index | Midnight |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.