JPY Selling Pressure Pushes USDJPY Higher Amid Intervention Risks【December 24, 2024】

Fundamental Analysis

- The JPY weakened against the USD, with USDJPY trading in the lower 157 range.

- The U.S. Consumer Confidence Index declined, raising concerns over tariffs introduced during the Trump administration.

USDJPY Technical Analysis

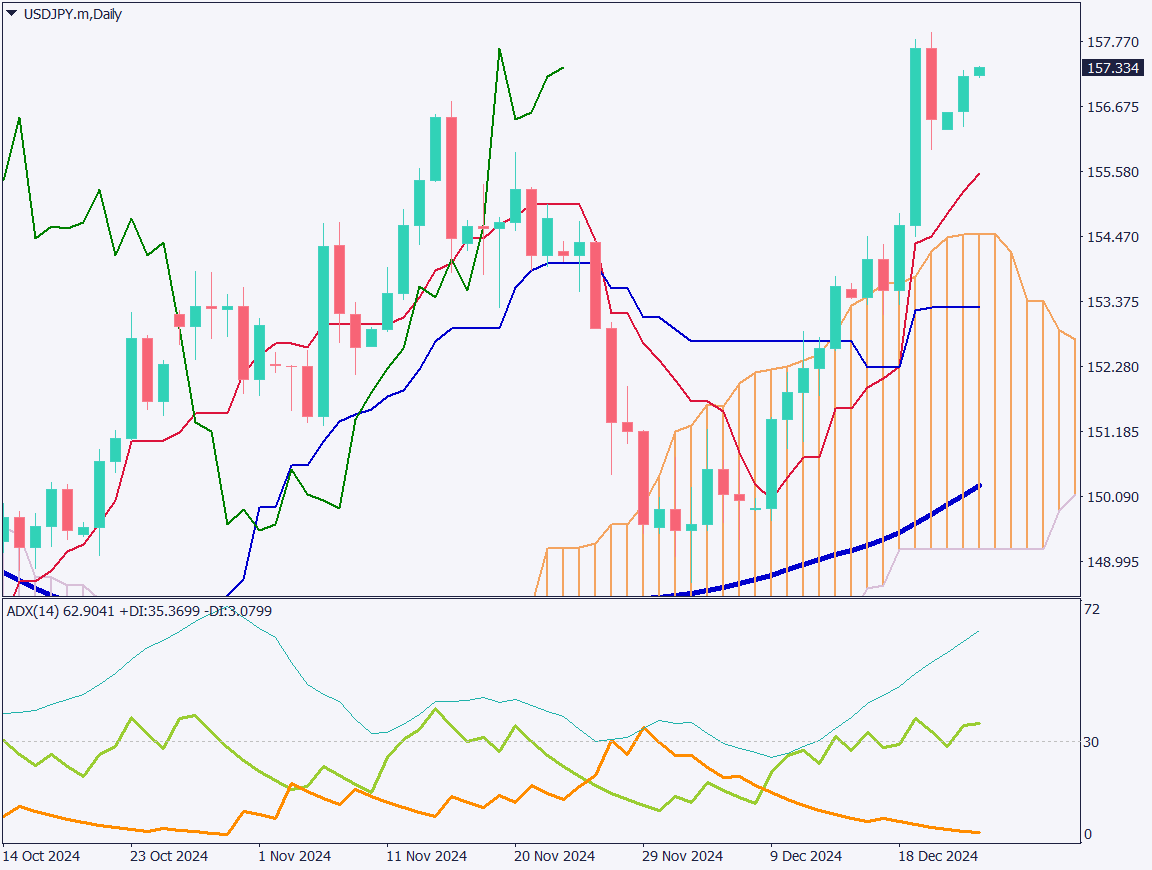

Analyzing the daily chart of USDJPY, the pair extended gains for three consecutive days, attempting to break recent highs. The release of lower U.S. Consumer Confidence Index figures and a slowdown in the Core PCE Price Index supported expectations for U.S. rate cuts. This development favors U.S. stock markets, contributing to equity gains.

Market participants are speculating that the Bank of Japan (BOJ) may not be as hawkish as expected, casting doubt on a January rate hike. As a result, JPY selling continues, with USDJPY holding in the lower 157 range.

The ADX stands at a notably high 62, with the directional index showing +DI at 36 and -DI at 3, signaling a robust uptrend.

Day trading strategy (1 hour)

On the 1-hour chart, USDJPY shows an uptrend supported by the conversion line. Although intervention risks linger, the fundamentals favor JPY weakness and USD strength. A breakout above 157.75 will be a key focus.

Due to the Christmas week, trading volumes are expected to be low, creating a favorable environment for speculative moves. Traders should exercise caution with potential volatility ahead.

The primary strategy remains buying on dips, targeting 157.75 as a short-term objective. However, traders should be mindful of widened spreads.

Support/Resistance lines

Key support and resistance lines to consider:

- 158.45 – Psychological resistance level

Market Sentiment

USDJPY: Sell: 71% / Buy: 29%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Christmas Eve | (U.S., U.K., Australia, New Zealand, and Germany markets closed) |

| BOJ Monetary Policy Meeting Minutes | 8:50 AM |

| RBA Monetary Policy Meeting Minutes | 9:30 AM |

| U.S. New Home Sales | 12:00 AM |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.