USDJPY: Will a New Trend Emerge After the Holiday Market?【January 6, 2025】

Fundamental Analysis

- President Biden Blocks Nippon Steel Acquisition

- The USDJPY is transitioning away from the year-end and New Year markets, raising the possibility of a new trend emerging.

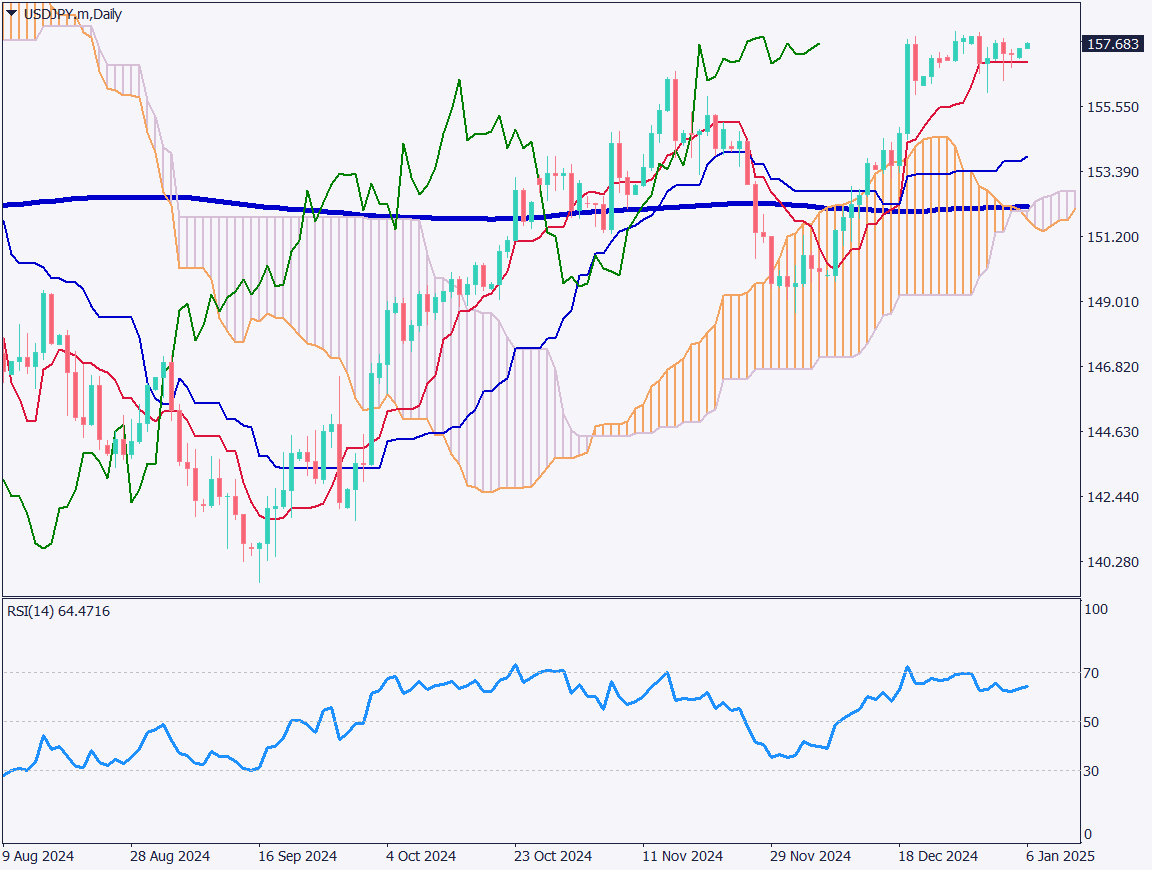

USDJPY Technical Analysis

Analyzing the daily chart of USDJPY: The conversion line has acted as a support line, keeping the pair in a narrow range. Today marks the first trading day of the year for the Japanese stock market, but it started with a decline. The key focus is whether USDJPY can break above the upper limit of the range.

Specifically, breaking above the 158 JPY level will be critical. If USDJPY decisively surpasses 158.15 JPY, a move toward 160 JPY could come into view. This January will be a pivotal month to determine whether the trend of JPY depreciation and USD appreciation will persist this year.

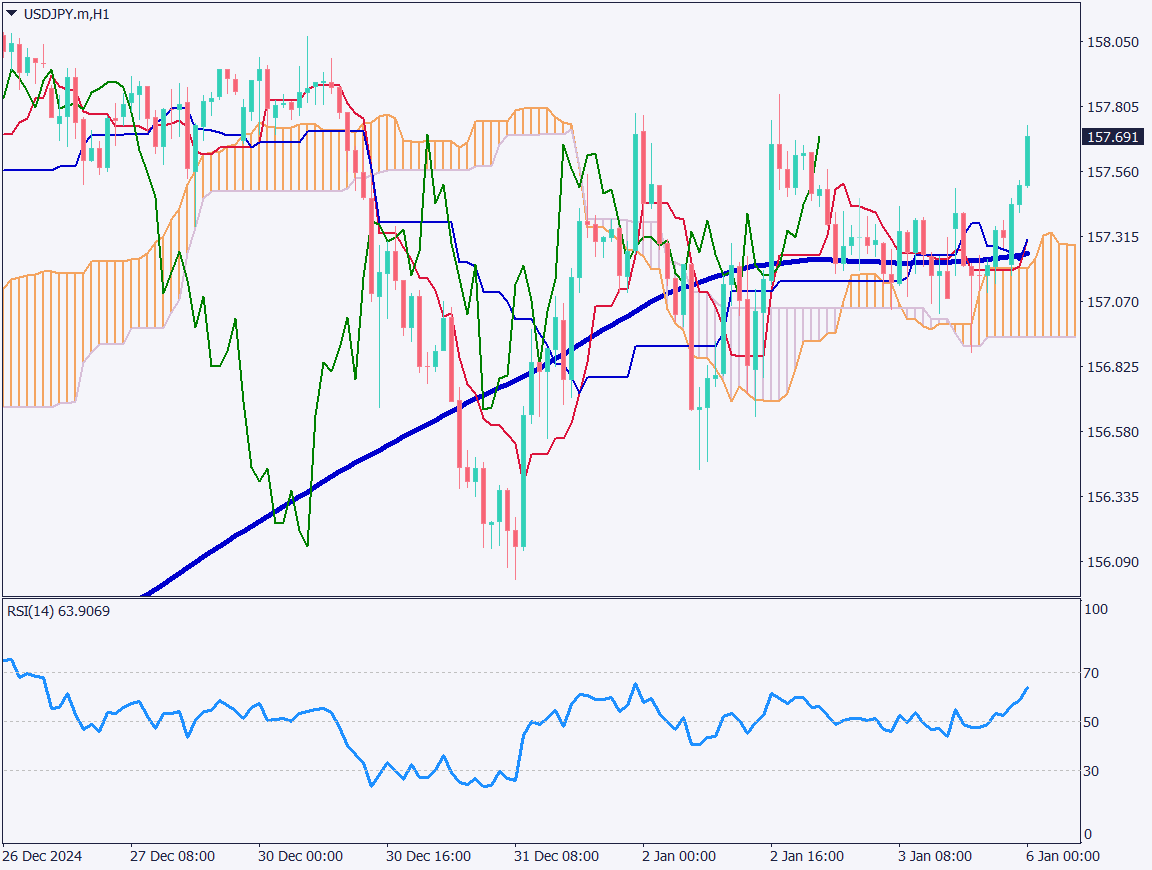

Day trading strategy (1 hour)

For day trading, the strategy is to buy on dips. A dip into the 157 JPY range is an opportunity for active buying. If the price falls below the daily conversion line at 157 JPY, consider exiting the position.

On the 1-hour chart, the 200-moving average is at 157.25 JPY, while the RSI is hovering around 65. With short positions accumulating, there is a possibility of a rise fueled by stop-loss triggers.

Continue to monitor the JPY depreciation trend with caution.

Support/Resistance lines

Key support and resistance lines to consider:

- 157.04 JPY: Daily conversion line

Market Sentiment

USDJPY Sell: 75% Buy: 25%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japanese Market New Year’s Opening | All Day |

| Nikkei Services PMI | 9:30 |

| EU Composite PMI | 18:00 |

| German Consumer Price Index | 22:00 |

| U.S. ISM Services PMI | 23:45 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.