Gold Remains Range-Bound as Fed Rate Cut Expectations Diminish【January 8, 2025】

Fundamental Analysis

- Gold continues its range-bound movement, although its lows are trending upwards.

- Positive U.S. economic data have pushed expectations for a Federal Reserve (Fed) rate cut to the latter half of the year.

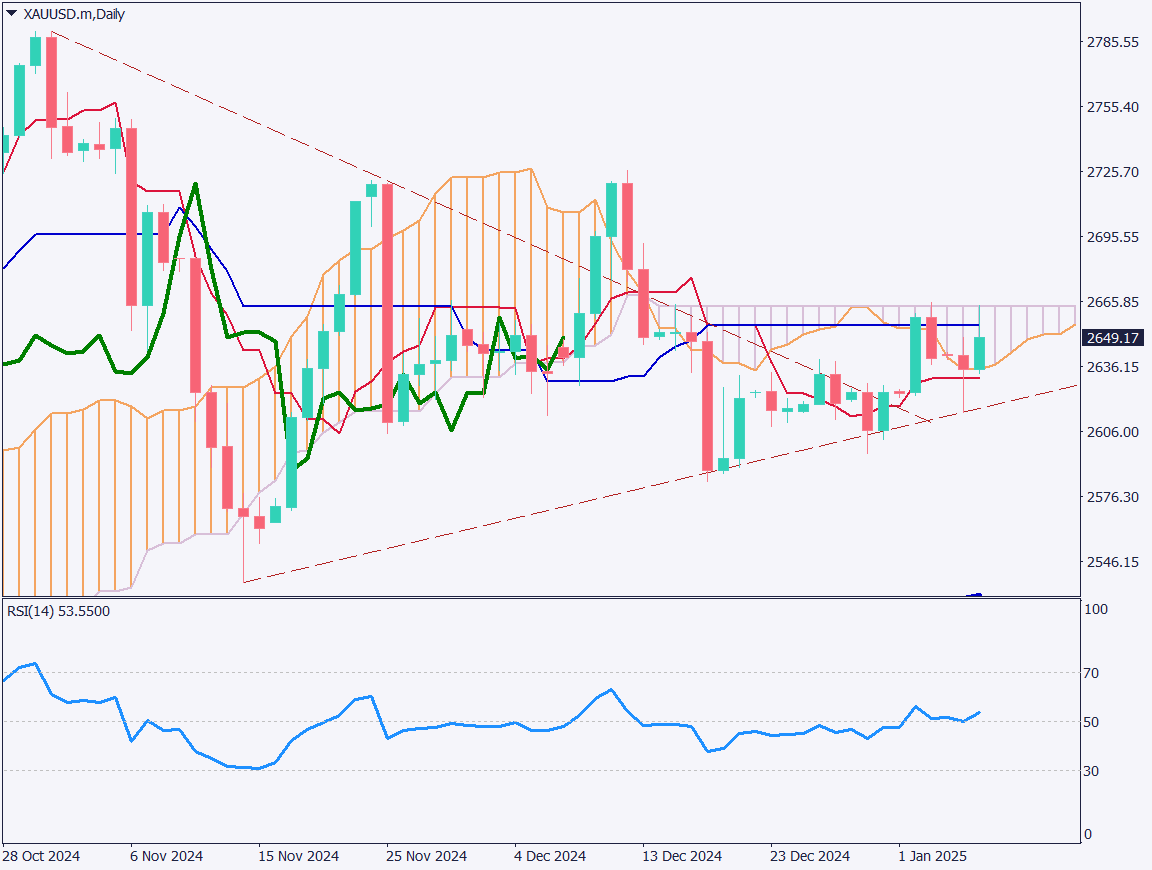

XAUUSD Technical Analysis

The daily chart shows gold trading within the Ichimoku cloud, with market attention focused on whether it can break out. The baseline and the cloud serve as strong resistance zones, preventing significant upward movement. However, the upward trendline suggests rising lows, and a breakout above the cloud could push prices closer to 2,700 USD. The RSI hovers around 50, hinting at the possibility of an emerging upward trend.

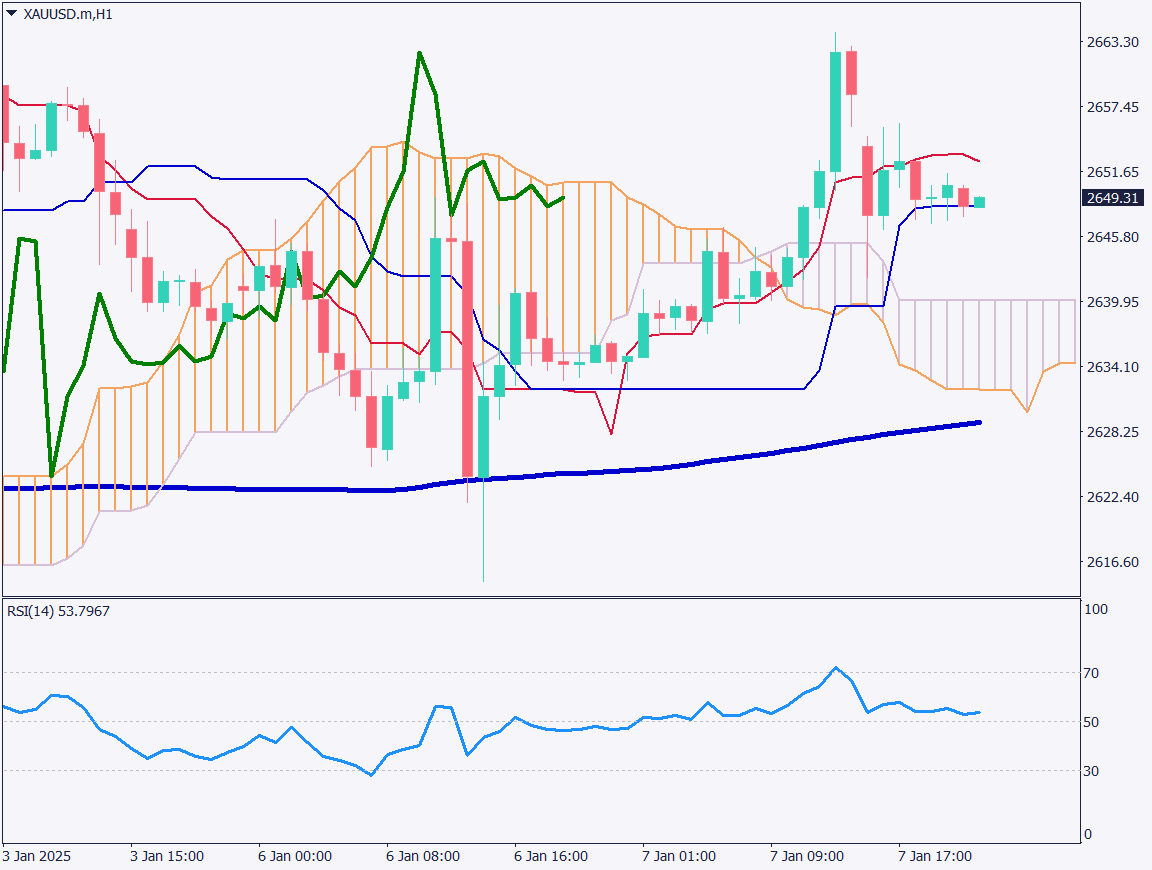

Day trading strategy (1 hour)

On the 1-hour chart, gold initially climbed along the conversion line, reaching a high of 2,660 USD, but subsequently fell back to the baseline. A break below the baseline could lead to further declines toward the upper boundary of the Ichimoku cloud, near 2,640 USD. However, the 240 EMA shows signs of support, indicating potential buying interest around 2,620 USD. A buy limit near 2,635 USD with a target of 2,650 USD is recommended, while a stop loss should be set at 2,630 USD to manage risks.

Support/Resistance lines

Key support and resistance lines to consider:

- 2,680 USD – Daily resistance line

- 2,700 USD – Monthly resistance line

Market Sentiment

XAUUSD: Sell: 53% / Buy: 47%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| U.S. ADP Employment Report | 22:15 |

| U.S. FOMC Meeting Minutes | Next day 4:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.