EURUSD Declines as Trump’s Speech Drives USD Higher【January 9, 2025】

Fundamental Analysis

- Trump’s Speech Sparks USD Rally Across the Board

- EURUSD is approaching the 1.03 USD level, which served as a support line in 2016.

EURUSD Technical Analysis

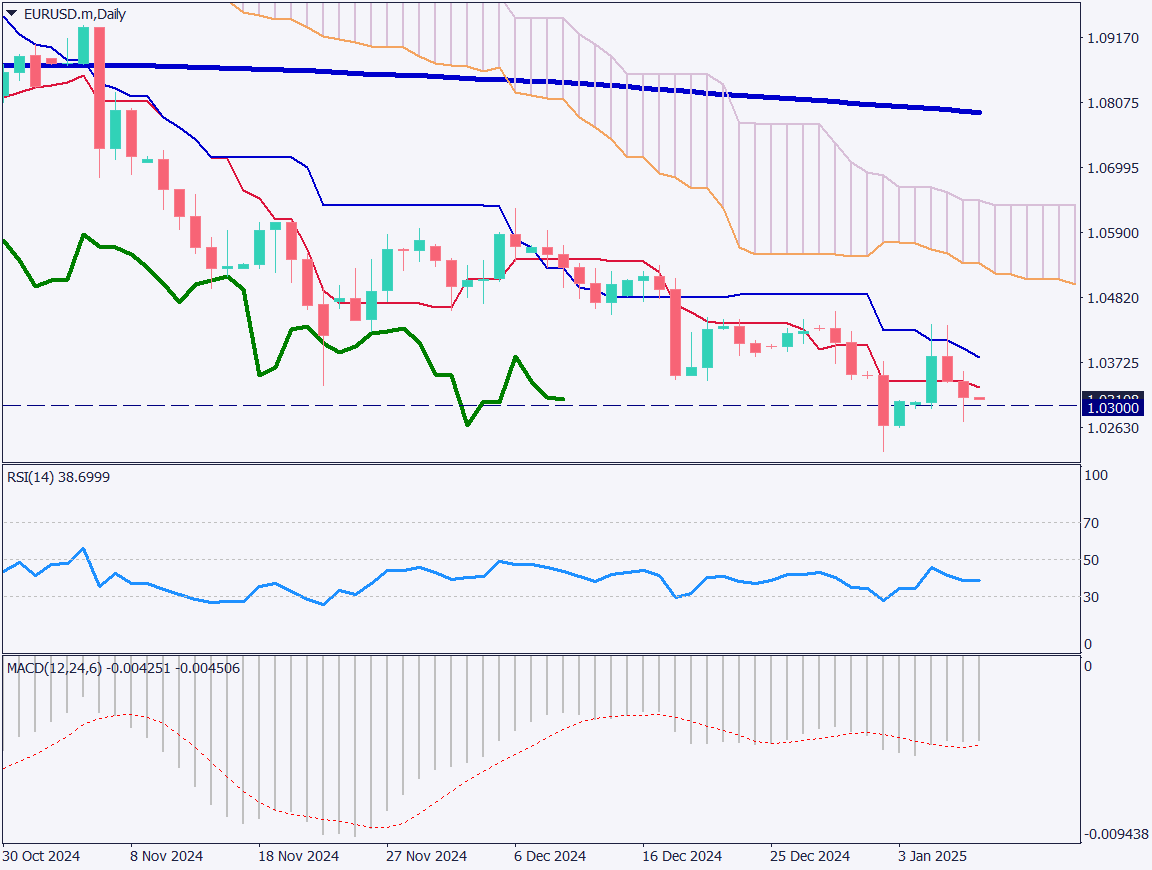

Analyzing the daily chart of EURUSD, the pair is nearing the 1.03 USD level and is showing signs of stabilization. With strong U.S. economic indicators and weaker economic conditions in the Eurozone, the trend of EUR weakness and USD strength is becoming more evident.

The Ichimoku Kinko Hyo conversion line has been breached, and the 200-day moving average is gradually turning downward. The MACD histogram shows deeper troughs, indicating a steady downtrend. Additionally, the RSI stands at 38, suggesting further downside potential.

For now, attention will be focused on whether EURUSD can break below the recent low of 1.0225 USD.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of EURUSD, the pair has slightly rebounded to the baseline but remains under selling pressure. With U.S. equity markets closed today, the downward momentum may temporarily ease.

The focus will be on whether EURUSD can decisively break below the 1.03 USD level.

For a day trading strategy, consider a contrarian buy approach. Set a buy limit at 1.0254 USD, a take-profit level at 1.032 USD, and a stop-loss at 1.022 USD.

Support/Resistance lines

Key support and resistance lines to consider:

- 1.03 USD: Psychological round number

Market Sentiment

EURUSD Sell: 22% / Buy: 78%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| U.S. Jobless Claims | 22:30 |

| U.S. Stock Markets Closed | – |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.