USDJPY Shows Limited Movement, With Strong Resistance and Support Levels【January 10, 2025】

Fundamental Analysis

- USDJPY remains range-bound, struggling to break higher or lower.

- Today’s Nonfarm Payrolls report may provide the momentum to break this range.

USDJPY Technical Analysis

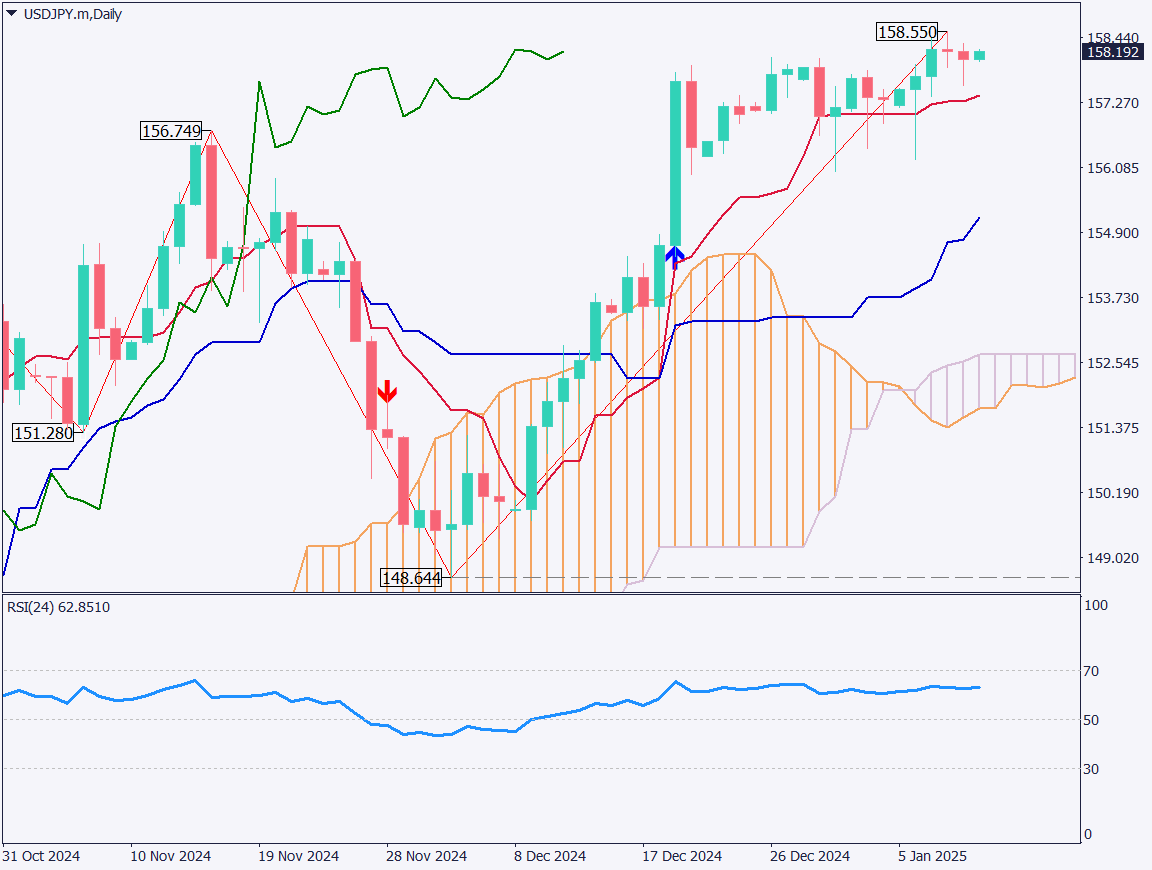

Analyzing the USDJPY daily chart: The pair rose to 158.55 JPY but quickly reversed, dropping to 157.50 JPY before stabilizing near 158 JPY.

Currently, USDJPY remains above the conversion line, sustaining its upward momentum. However, the 159 JPY level presents significant resistance.

On the downside, any dip attracts buying interest, leading to the formation of candlestick wicks.

Today’s Nonfarm Payrolls may catalyze a breakout from this range. If expectations of a US rate cut diminish, USDJPY could breach the 159 JPY barrier.

Day trading strategy (1 hour)

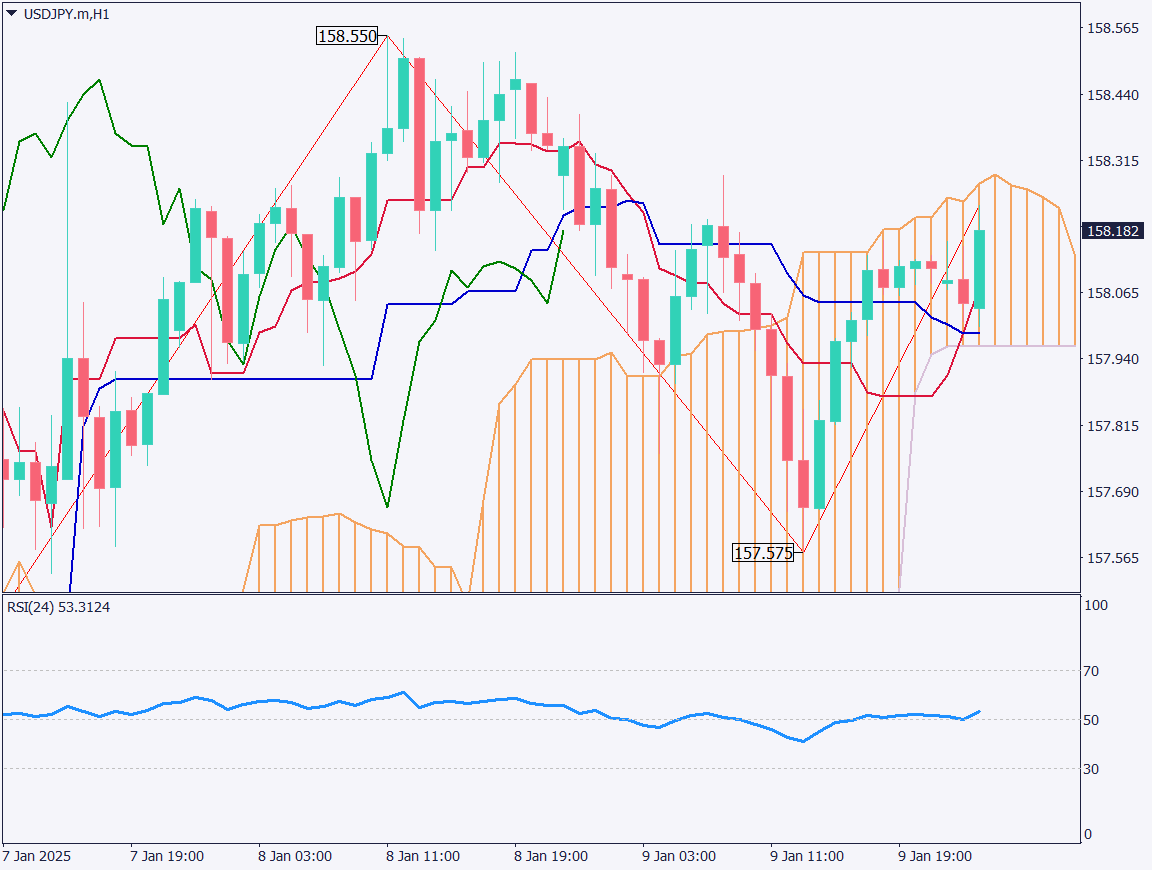

Analyzing the USDJPY hourly chart: The pair is trading within the Ichimoku cloud, reflecting a consolidating market.

With today’s Nonfarm Payrolls release on the horizon, the London session is expected to remain subdued. Intervention concerns may also be curbing active trading.

Range trading is likely to persist until the London session, while the New York session hinges on the payrolls outcome.

We look forward to a potential breakout.

Support/Resistance lines

Key support and resistance lines to consider:

- 158.55 JPY: Recent high

Market Sentiment

USDJPY Sell: 65% Buy: 35%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japan Household Spending Survey | 8:50 |

| US Nonfarm Payrolls | 22:30 |

| Canada Employment Report | 22:30 |

| Michigan Consumer Sentiment Index | 00:00 (Midnight) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.