USDJPY Struggles at Resistance Amid Caution Over BOJ Deputy Governor’s Speech【January 14, 2025】

Fundamental Analysis

- Crude oil surges significantly, climbing by USD 5 in just two trading sessions.

- USDJPY remains heavy near the 159 JPY level, as traders exercise caution ahead of BOJ Deputy Governor Himi’s speech.

USDJPY Technical Analysis

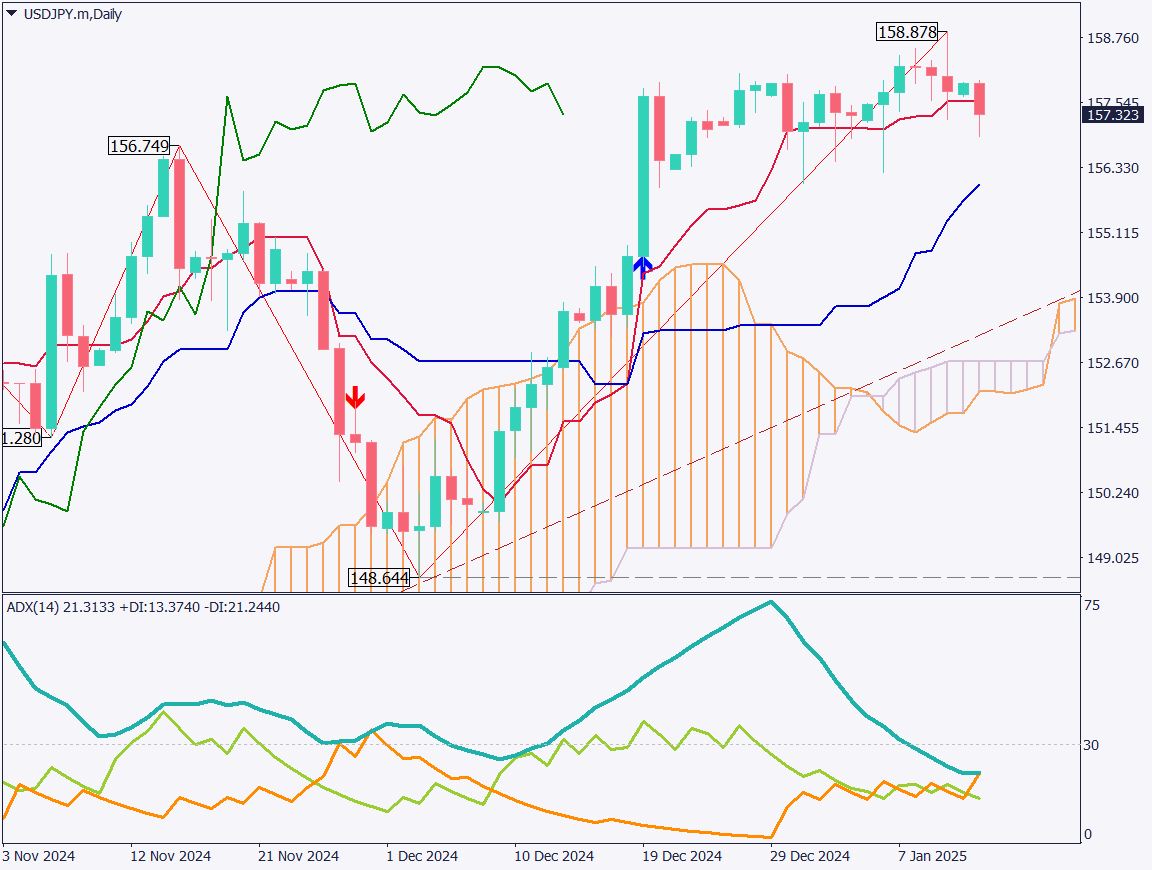

Analyzing the USDJPY daily chart reveals a bearish trend. The pair has broken below the conversion line and has dropped to approximately 157.30 JPY. With BOJ Deputy Governor Himi’s speech approaching, traders are hesitant to buy aggressively.

The pair may continue its gradual decline toward the baseline. While a January rate hike is not expected, attention is focused on the content of Deputy Governor Himi’s speech. Recent announcements of wage hikes for new employees have also raised rate hike expectations.

The ADX indicator is below 30, indicating a lack of a strong trend. For now, it is important to monitor whether the 156.75 JPY level will act as support.

Day trading strategy (1 hour)

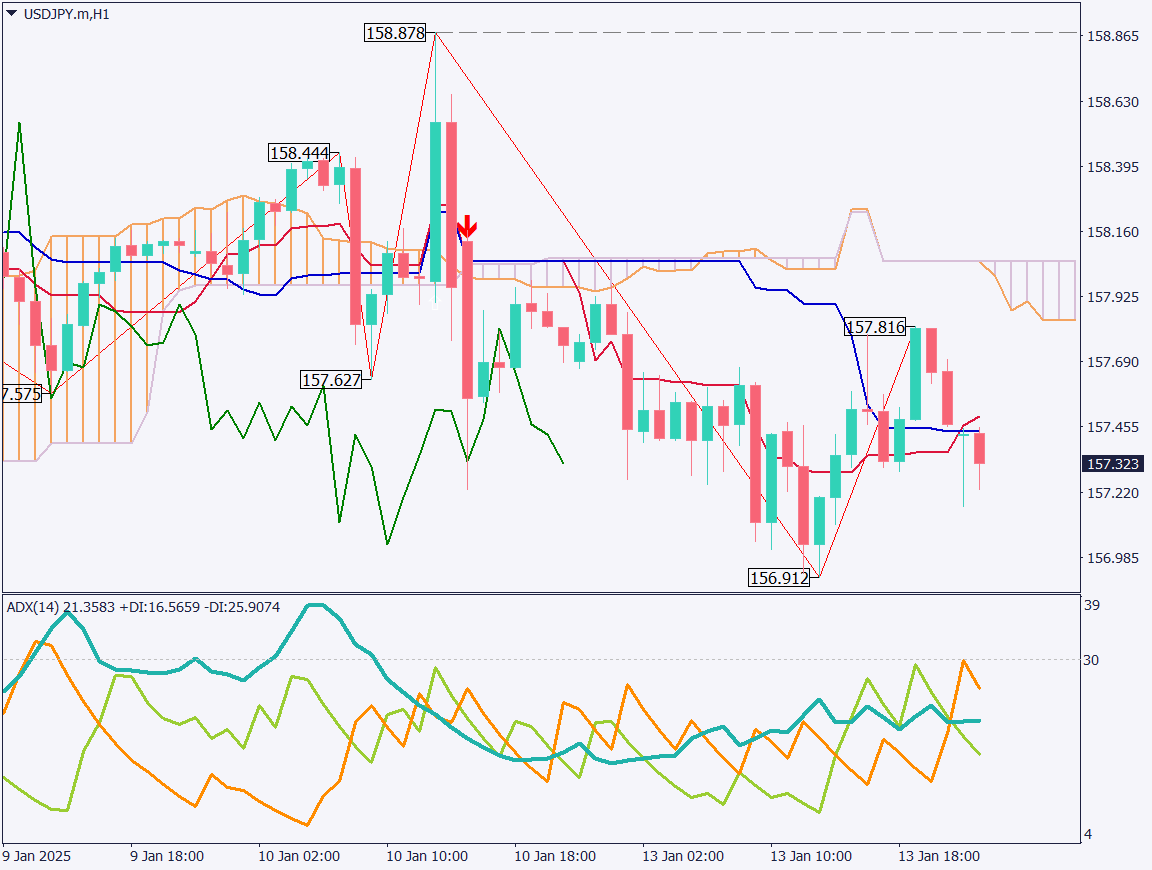

Analyzing the USDJPY 1-hour chart shows a range-bound market with no clear direction. However, dip buying may emerge. Given the uncertainty around the reaction to Deputy Governor Himi’s speech, it is advisable to wait until the speech concludes before making trading decisions.

If USDJPY falls below 156.90 JPY or 156.75 JPY, further appreciation of the JPY is possible. Traders should prepare for potential volatility.

Support/Resistance lines

Key support and resistance lines to consider:

- 156 JPY: Baseline on the daily chart

Market Sentiment

USDJPY Sell: 69% Buy: 31%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| AUD Building Approvals | 9:30 AM |

| BOJ Deputy Governor Himi’s Speech | 10:30 AM |

| EU ZEW Economic Sentiment Index | 7:00 PM |

| US Core Producer Price Index | 10:30 PM |

| FOMC Member Williams’ Speech | Around 5:00 AM (Next Day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.