USDJPY Moving Toward Yen Strength? BOJ Deputy Governor Mentions Potential Rate Hike【January 15, 2025】

Fundamental Analysis

- The Bank of Japan (BOJ) Deputy Governor stated that inflation forecasts are in line with expectations and wage growth prospects remain high.

- He also commented on the possibility of discussing a rate hike in this month’s meeting.

USDJPY Technical Analysis

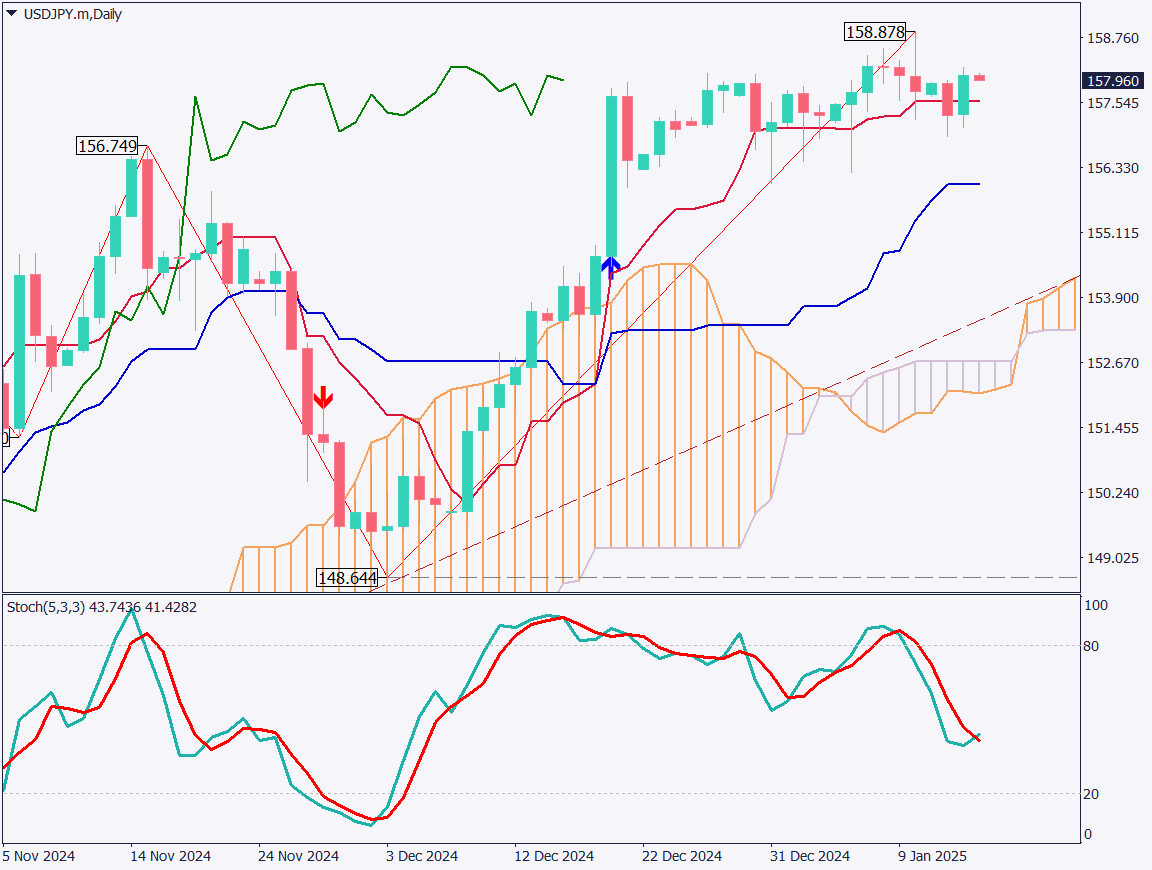

Analyzing the daily USDJPY chart, the pair has rebounded off the conversion line as a support level. It is currently trading near 158 JPY. However, the price faces heavy resistance above 158 JPY, leading to a range-bound movement.

Stochastics indicate a downward trend, with both %K and %D below 50.

The BOJ Deputy Governor’s hawkish stance, mentioning a potential rate hike in next week’s meeting, has been cautiously received by the market. Long-term interest rates continue to rise, slightly increasing rate hike expectations, which is contributing to limiting JPY depreciation.

Day trading strategy (1 hour)

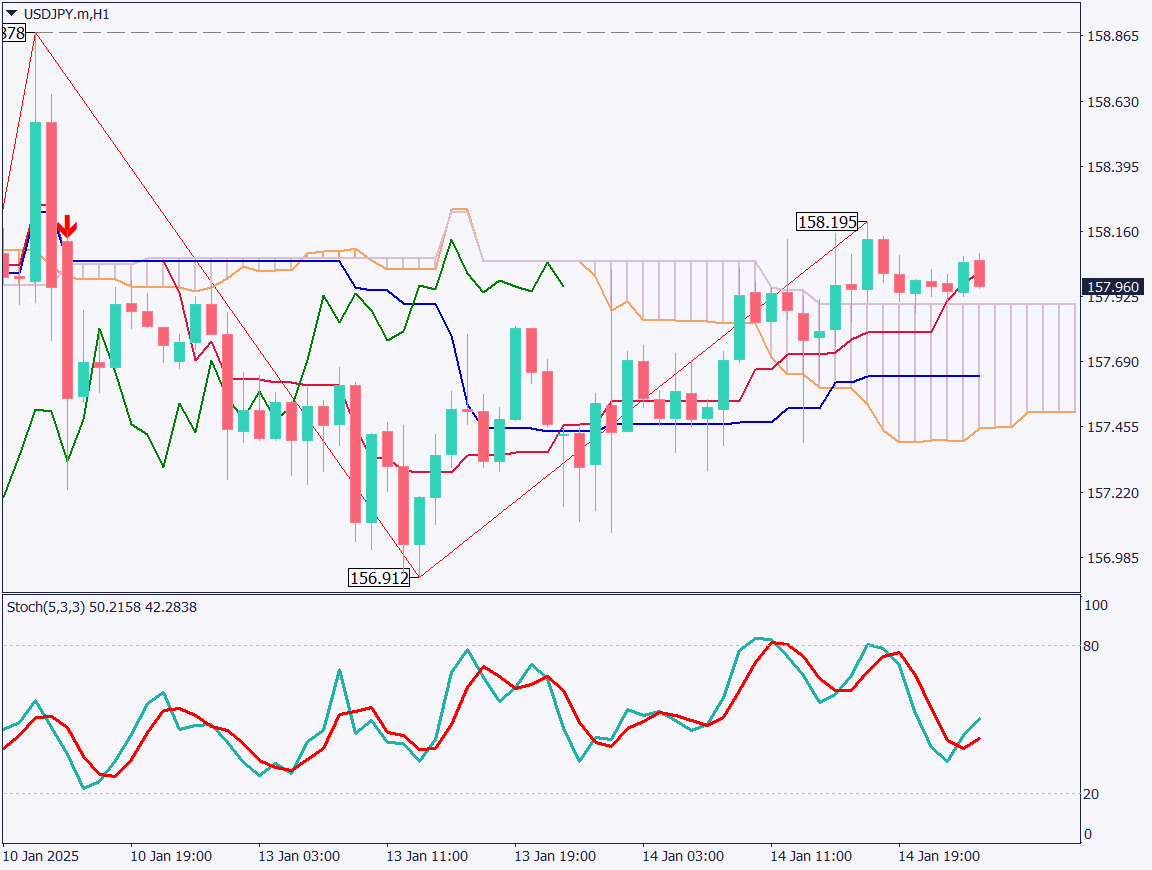

Analyzing the 1-hour USDJPY chart reveals a range-bound market. Although the pair has broken above the Ichimoku cloud, momentum remains subdued. Resistance levels are heavy, and no aggressive upward movement is anticipated.

With significant economic events like next week’s BOJ rate hike discussion, the inauguration of President Trump, and today’s US Consumer Price Index, the USDJPY market is exhibiting limited movement.

A short-term range-bound strategy is recommended. For instance:

- Consider selling if the price exceeds 158 JPY, with a target of 157.65 JPY for profit-taking.

- If the price surpasses 158.25 JPY, close positions temporarily and consider re-entering with sell orders around 158.85 JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 157.65 JPY: Standard line

- 157.56 JPY: Daily conversion line

Market Sentiment

USDJPY Sell: 54% / Buy: 46%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| UK Consumer Price Index | 16:00 |

| US Core Consumer Price Index | 22:30 |

| NY Fed Manufacturing Index | 22:30 |

| US Crude Oil Inventories | 00:30 (Midnight) |

| Speech by FOMC Member Williams | Around 01:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.