The Forex Market: Broad JPY Strength Amid Expectations of BOJ Rate Hikes【January 16, 2025】

Fundamental Analysis

- BOJ Governor Comments on Discussing Rate Hikes, Boosting Market Expectations

- US Consumer Price Index Falls Below Expectations, Reviving March Rate Cut Speculations

- Narrowing US-Japan Yield Gap Drives JPY Strength Across the Board

USDJPY Technical Analysis

Analyzing the daily USDJPY chart reveals that the pair has broken below the conversion line and has dropped near the base line. The parabolic indicator, signaling a potential market reversal, has shown a sell signal for the first time since December 10, pointing to continued JPY appreciation. Cross-yen pairs also reflect broad JPY strength.

Following comments from the BOJ Deputy Governor, the BOJ Governor mentioned discussing rate hikes. With voices from the business sector calling for wage increases, the market anticipates a rate hike unless unexpected policies are announced by the Trump administration. However, uncertainty remains about the administration’s future policies.

Details of major policies are expected to be unveiled on the first day of the inauguration next week. It is critical to assess whether the current JPY appreciation will continue.

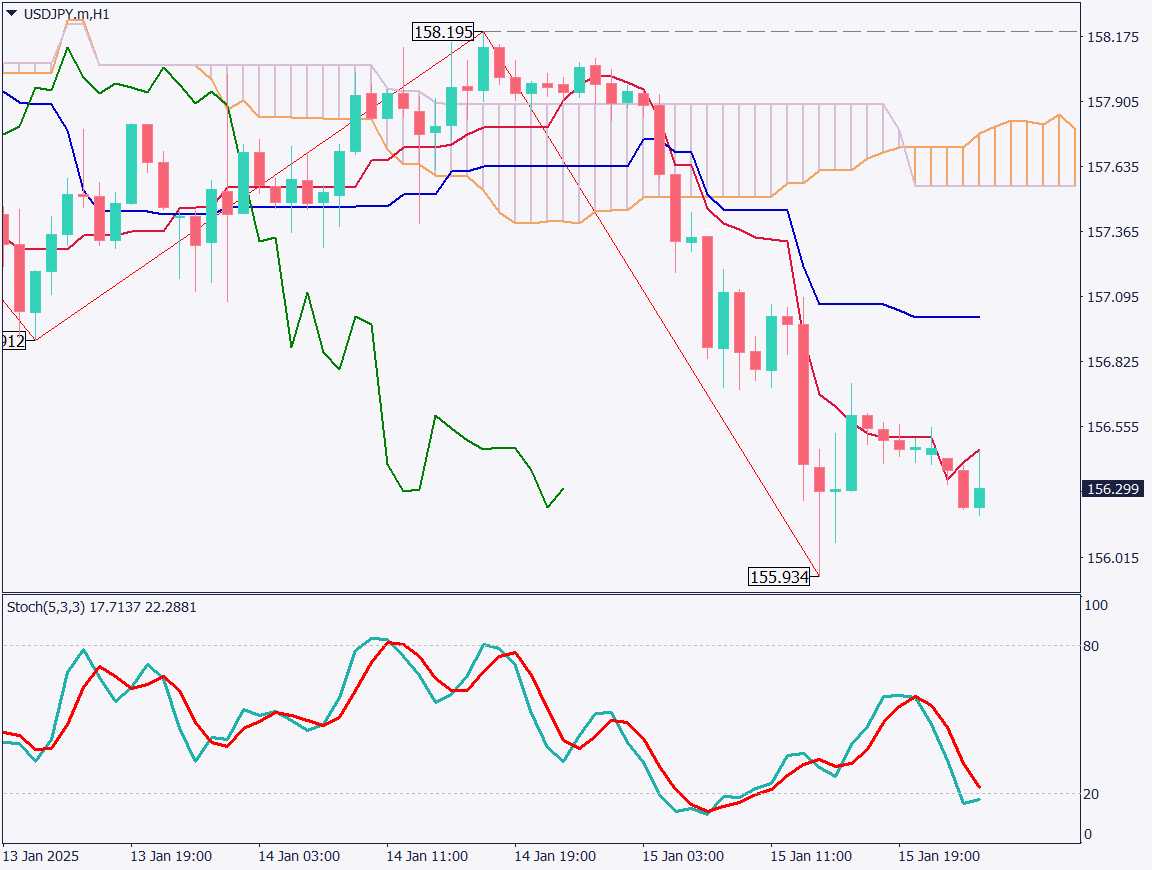

Day trading strategy (1 hour)

Analyzing the 1-hour USDJPY chart, the pair dropped from a high of 158.20 JPY to approximately 155.95 JPY, marking a decline of over 200 pips yesterday. The BOJ rate hike speculation has significantly moved the JPY market. The reporting of such content in advance may suggest groundwork for an eventual rate hike.

The 155 JPY range remains robust. If the pair decisively breaks below 156 JPY, it could further decline to 154.65 JPY, a support line on the monthly chart. Selling at retracement highs is the preferred strategy.

- Sell Limit: 156.75 JPY (Pivot Point)

- Take Profit: 156.15 JPY

- Stop Loss: 157.00 JPY

Support/Resistance lines

Key support and resistance lines to consider:

- 156.75 JPY: Pivot Point

Market Sentiment

USDJPY Sell: 56% Buy: 44%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Australian Employment Data | 9:30 |

| UK GDP | 16:00 |

| German CPI | 16:00 |

| US Core Retail Sales | 22:30 |

| US Initial Jobless Claims | 22:30 |

| Philadelphia Fed Manufacturing Index | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.