Gold Approaches Key High Amid Expectations of US Rate Cuts【January 17, 2025】

Fundamental Analysis

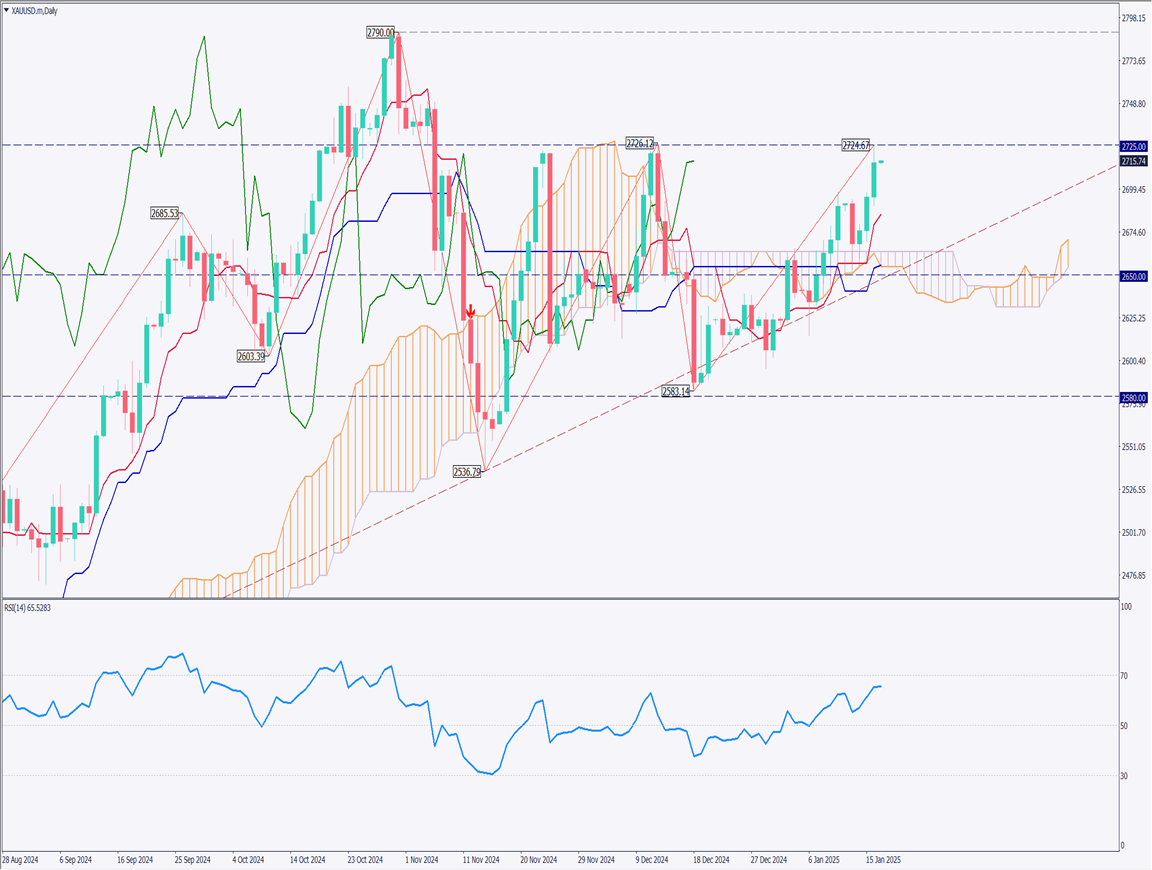

- Gold is approaching a key high of 2725 USD, supported by expectations of a US rate cut.

- USDJPY is trending lower due to heightened speculation of a Bank of Japan rate hike.

XAUUSD Technical Analysis

Gold has risen for three consecutive days, nearing the key level of 2725 USD. The focus is on whether it can break through this resistance. If it surpasses 2725 USD, it could aim for a new high of 2790 USD.

Next week, the Trump administration is set to take office, which appears to be making the markets nervous. With the new president prioritizing economic measures, stock prices are expected to rise. However, the markets are also awaiting announcements on tariff policies and immigration strategies. According to the Ichimoku Cloud, the lagging span is above the candlesticks, suggesting an upward trend.

Will gold continue to attract buying as a safe-haven asset?

Day trading strategy (1 hour)

Analyzing the 1-hour chart for gold, the price has broken below the conversion line but still suggests a stable upward trend. It is currently trading at 64, showing no significant signs of overheating.

A resistance line exists at 2725 USD, and breaking above this level may take time.

If 2725 USD is confirmed as a support line, a buying opportunity on dips could be considered. However, as the market seems nervous, cautious trading is advised.

Support/Resistance lines

Key support and resistance lines to consider:

- 2725 USD: Key high

Market Sentiment

XAUUSD: Sell: 58% / Buy: 42%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| UK Retail Sales | 16:00 |

| EU Consumer Price Index | 19:00 |

| US Housing Starts | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.