USDJPY Exhibits Limited Volatility as Trump Administration Takes Office in the Early Hours of Japan Time【January 20, 2025】

Fundamental Analysis

- The inauguration of President Trump is scheduled for 2:00 AM Japan time.

- Reports suggest that over 100 executive orders are being prepared; the market awaits specifics.

- The market may react sensitively to unexpected executive orders.

USDJPY Technical Analysis

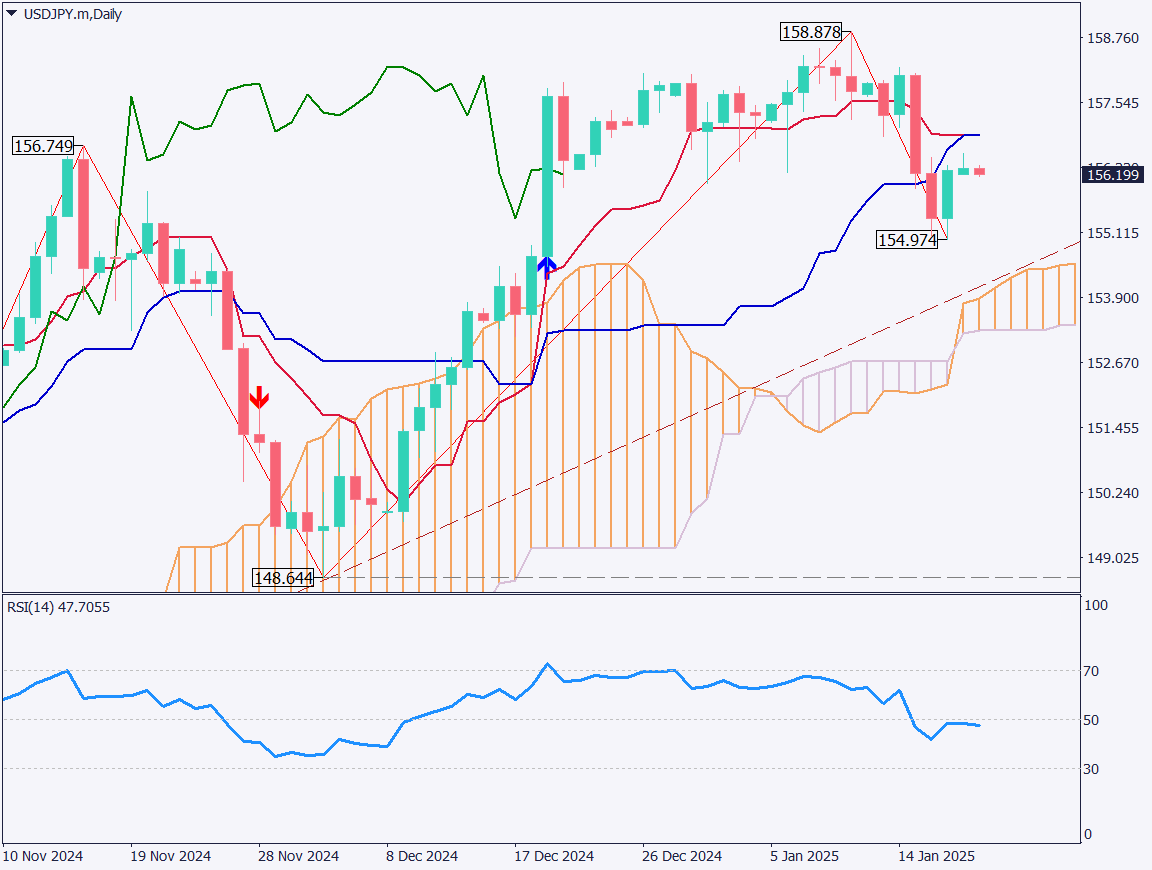

Analyzing the daily chart for USDJPY reveals a strengthening bearish trend. Increased expectations for a Bank of Japan (BOJ) rate hike are driving strong JPY buying. The lagging span of the Ichimoku Cloud is below the candlesticks, signaling further downward movement.

The area around 156.95 JPY, where the conversion line and baseline overlap, is expected to act as a significant resistance level. USDJPY could decline further, potentially reaching the mid-154 JPY range near the ascending trendline. While the BOJ is laying the groundwork for a rate hike, market shock seems likely. Observing whether USDJPY breaks below the cloud will be crucial.

Day trading strategy (1 hour)

Analyzing the 1-hour chart for USDJPY, the pair is likely to remain under heavy upward pressure. Additionally, caution surrounding the Trump administration’s inauguration later today may dampen aggressive USD buying.

USDJPY is trading within the Ichimoku Cloud on the 1-hour chart, and it could test a break below 155 JPY again. Unless it breaks above the cloud, the market outlook remains bearish.

- Trading Direction: Sell

- Target: Take profit at 154.50 JPY

- Stop Loss: Above 156.58 JPY

- Given the inauguration event, focus on short-term selling strategies.

Support/Resistance lines

Key support and resistance lines to consider:

- 156.90 JPY: Conversion Line and Baseline

- 154.95 JPY: Recent Low

Market Sentiment

USDJPY Sell: 61% Buy: 39%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| U.S. Stock Market Closed | – |

| Japan Industrial Production | 9:30 AM |

| Germany Producer Price Index | 4:00 PM |

| U.S. Presidential Inauguration | 2:00 AM (next day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.