Gold Rises in Anticipation of Tariff Policies, Breaking Key Price Levels【January 22, 2025】

Fundamental Analysis

- The Trump administration has postponed implementing tariff policies initially planned for the first day in office.

- While stock markets are rising, there is a growing trend of hedging behavior.

XAUUSD Technical Analysis

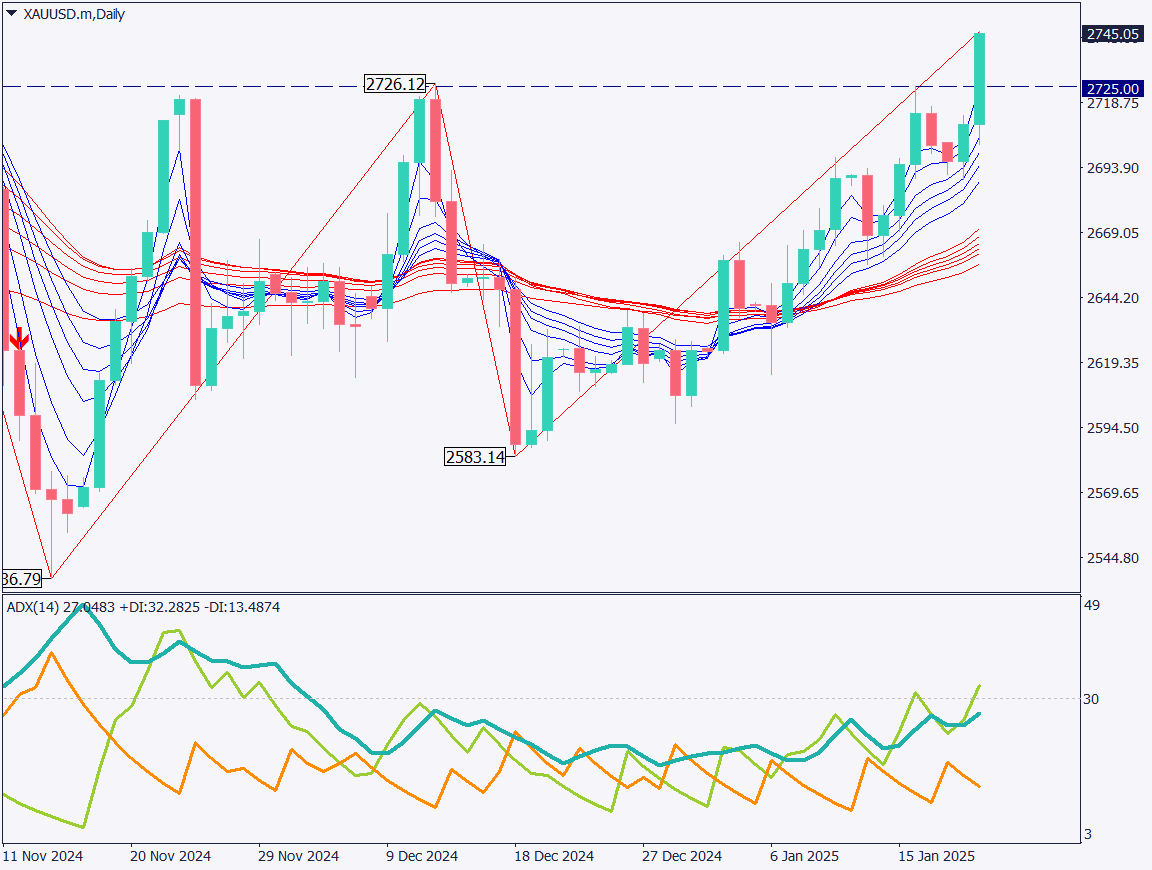

An analysis of the daily chart reveals that Gold has successfully broken above the neckline at 2725 USD, reaching around 2745 USD. The GMMA indicator is extending upward, signaling a strengthening bullish trend. Additionally, the ADX value of 27 and the +DI value of 32 further confirm the momentum of the ongoing upward movement. The market has responded positively to the cautious approach regarding tariff hikes, while continued discussion of these policies has bolstered hedging activity. Consequently, the purchase of Gold as a safe asset is expected to persist.

Day trading strategy (1 hour)

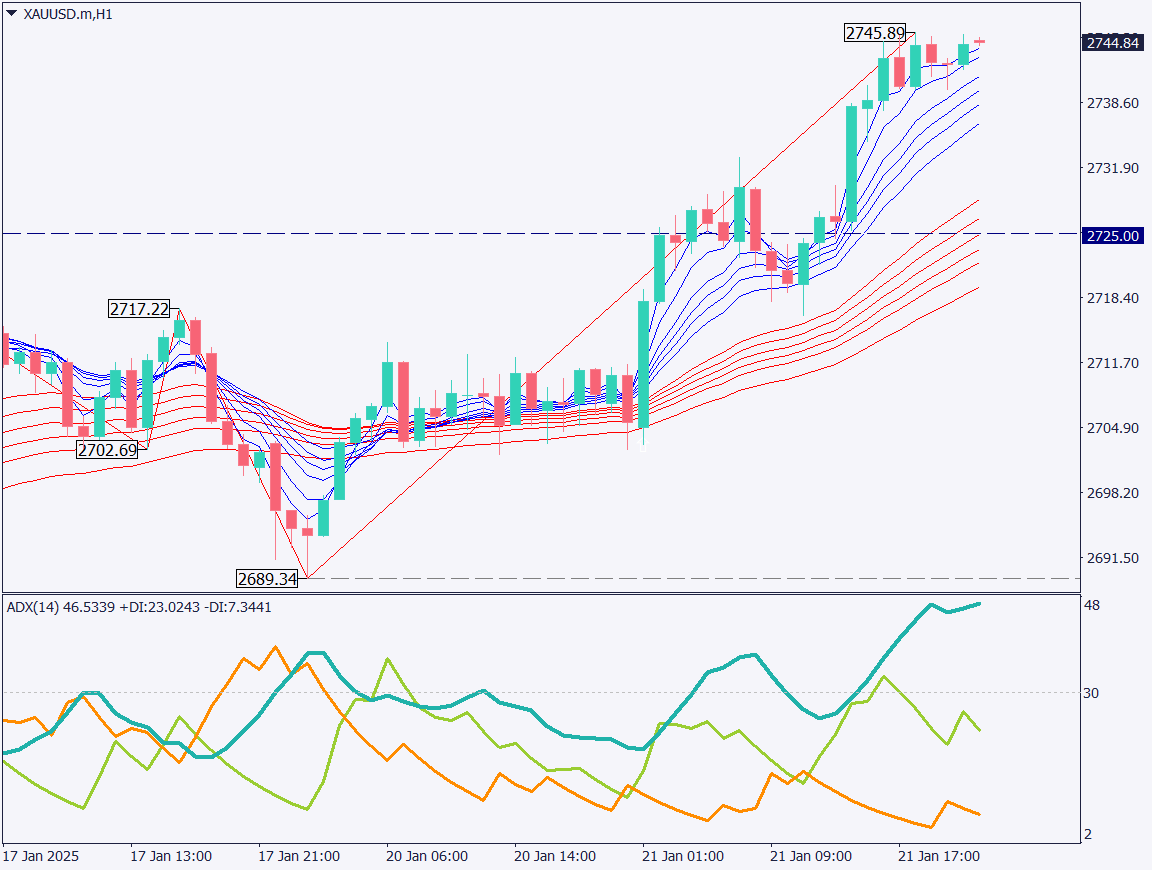

The analysis of the 1-hour chart shows Gold rising to 2745 USD, with potential to challenge its all-time high at 2790 USD. The breach of the 2725 USD neckline is significant, and as long as uncertainty around the Trump administration’s policies remains, the bullish trend is likely to continue. A recommended strategy for day trading is to buy on dips around 2730 USD, with a target of 2750 USD and a stop-loss set below 2720 USD.

Support/Resistance lines

Key support and resistance lines to consider:

- 2725 USD: Neckline

Market Sentiment

XAUUSD: Sell: 65% / Buy: 35%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| US Leading Economic Index | Midnight 0:00 |

| ECB President Lagarde Speech | Around midnight 0:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.