Bank of Japan Monetary Policy Meeting: Will Rate Hikes Strengthen the JPY?【January 24, 2025】

Fundamental Analysis

- The Bank of Japan’s Monetary Policy Meeting is scheduled for today, with markets widely anticipating a rate hike.

- The key question remains whether Governor Ueda’s press conference will lean dovish or hawkish.

USDJPY Technical Analysis

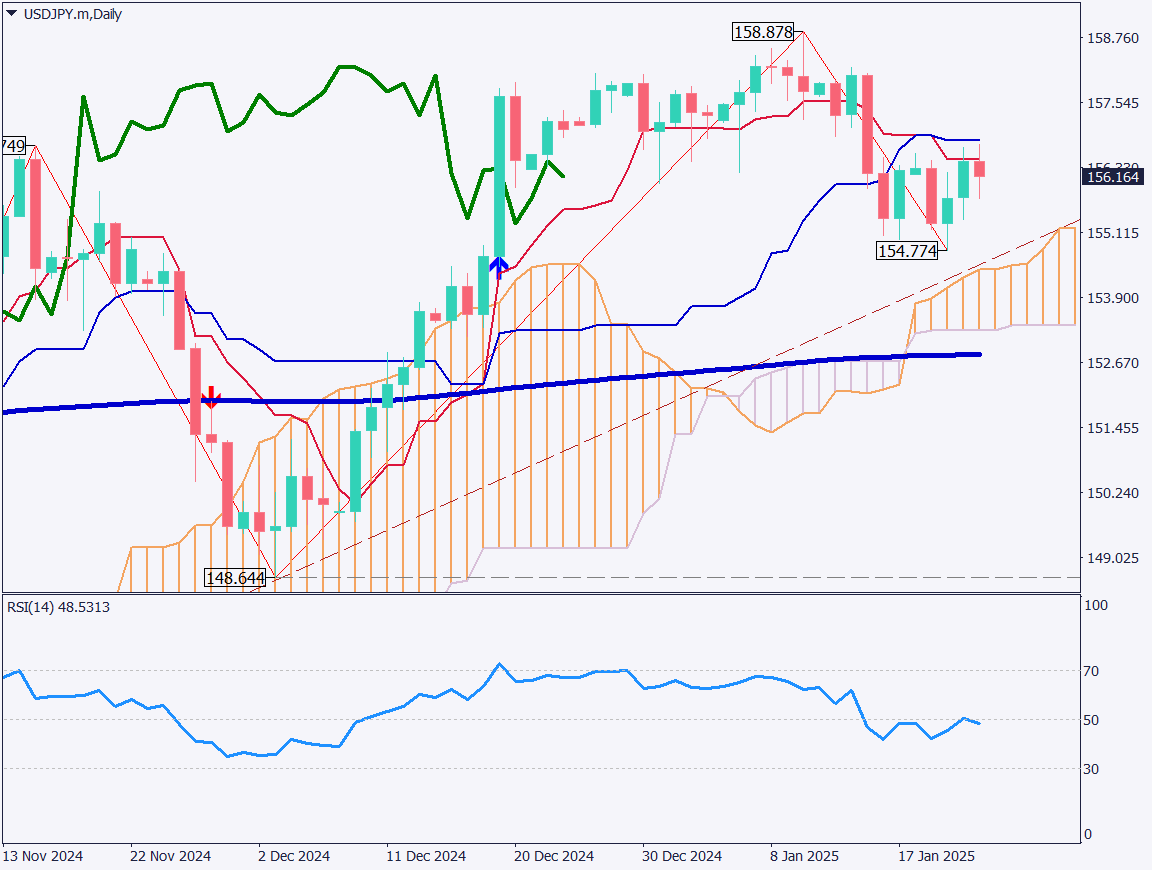

Analyzing the daily chart for USDJPY, the pair is trading near 156 JPY, with support expected at 155 JPY and resistance near 157 JPY. Today’s meeting is expected to finalize a rate hike, raising the policy rate to 0.50%.

In July last year, a rate hike announcement, followed by hawkish comments from the Governor and deteriorating U.S. employment data, led to a significant drop in the Nikkei 225. Caution is advised for today’s press conference and its potential implications, as well as the forthcoming U.S. employment data.

USDJPY could decline to around 150 JPY if a rate hike materializes.

Day trading strategy (1 hour)

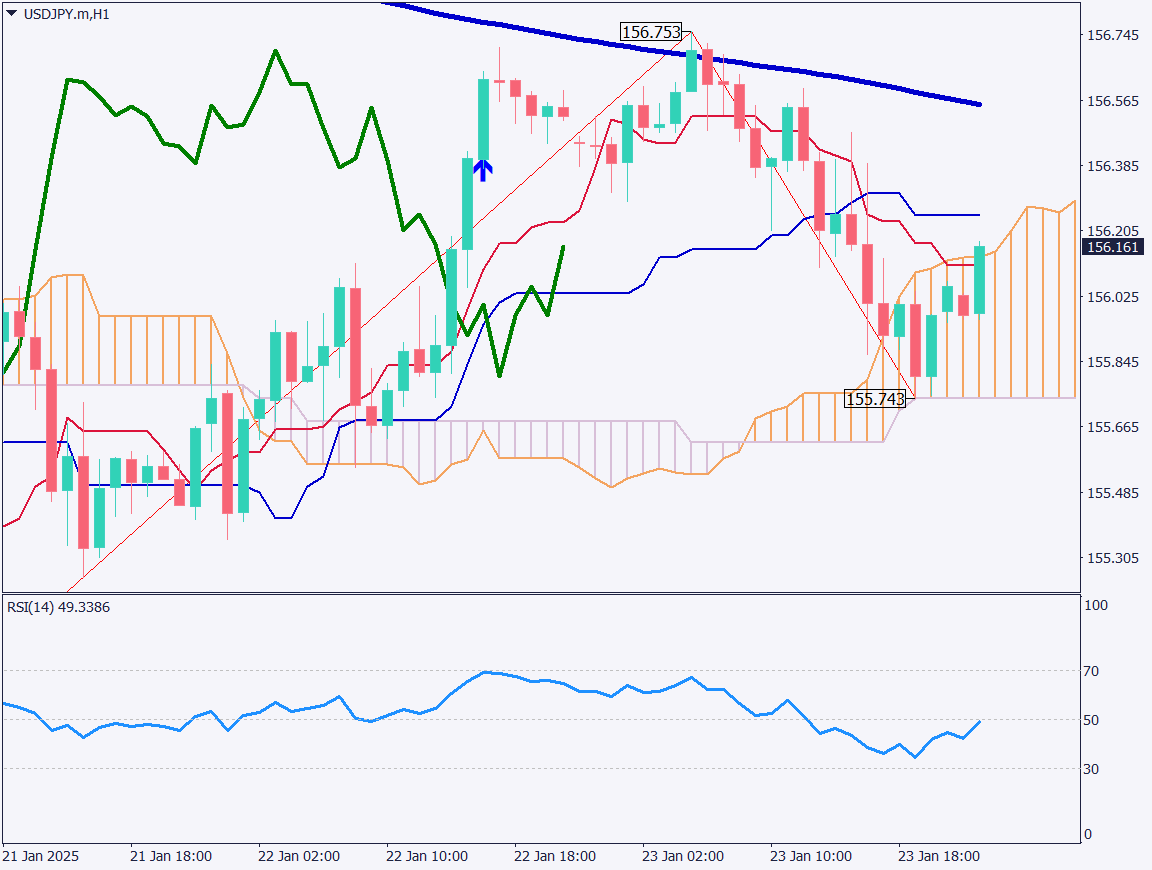

The 1-hour chart for USDJPY shows an RSI of 48, indicating a bearish trend as it remains below 50. If today’s rate hike causes the pair to break below the ascending trendline, USDJPY may temporarily drop to the 240-day moving average, currently at 152.65 JPY.

Given the high probability of a rate hike, a sell strategy is advisable, but traders should confirm market reactions before entering positions. Premature entries should be avoided.

Support/Resistance lines

Key support and resistance lines to consider:

- 154.63 JPY – Monthly Pivot Support Line

Market Sentiment

USDJPY: Sell: 45% / Buy: 55%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japan Consumer Price Index | 8:50 AM |

| Bank of Japan Monetary Policy Announcement | 11:30 AM |

| Bank of Japan Outlook Report | 12:00 PM |

| Governor Ueda’s Press Conference | 3:30 PM |

| U.S. Manufacturing PMI | 11:45 PM |

| U.S. Existing Home Sales | 12:00 AM |

| University of Michigan Consumer Sentiment Index | 12:00 AM |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.