BOJ Raises Interest Rate by 0.25%, Returning to Pre-Lehman Shock Levels【January 27, 2025】

Fundamental Analysis

- The Bank of Japan (BOJ) has decided on a 0.25% rate hike, adjusting the interest rate to 0.50%, a level not seen since 2008.

- There was no major disruption in USDJPY, as the market had already priced in the decision due to pre-announcement leaks.

USDJPY Technical Analysis

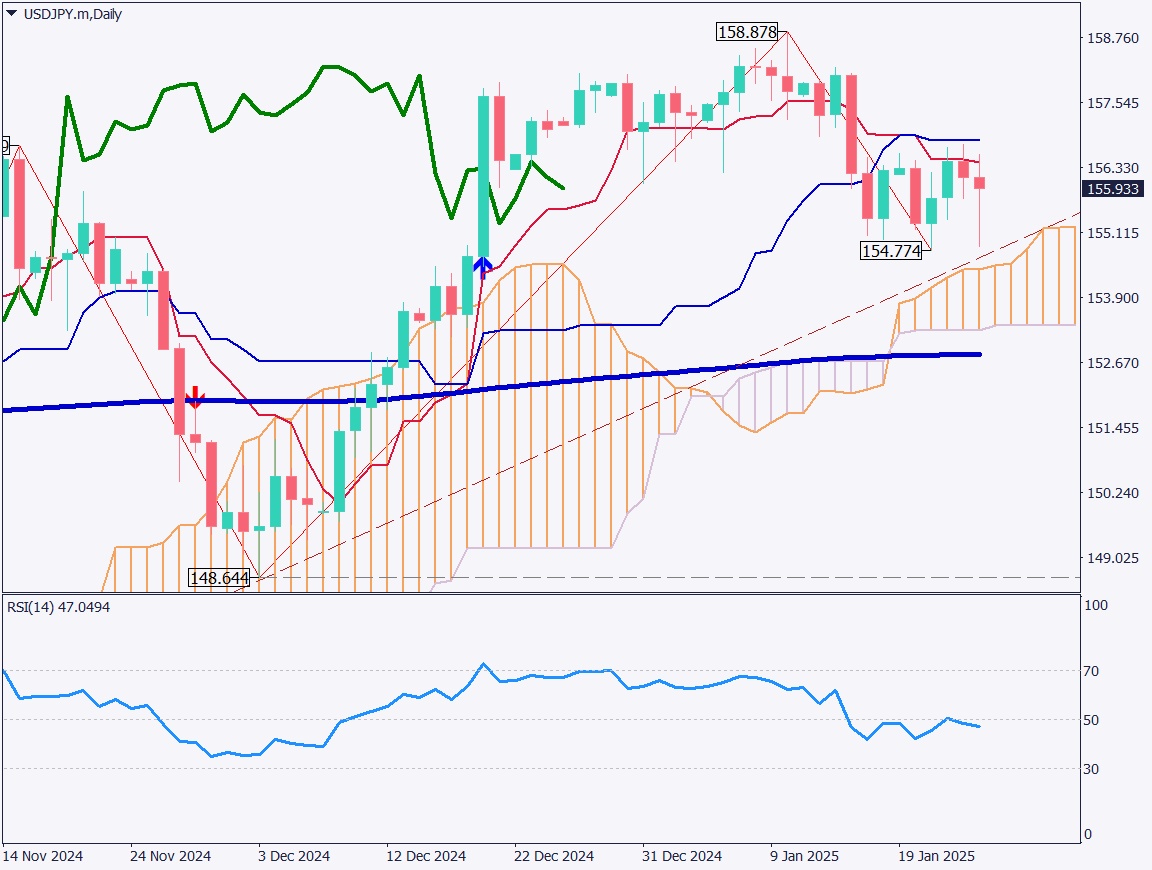

Analyzing the daily chart of USDJPY reveals interesting movements. USDJPY temporarily fell to 154.85 JPY, indicating strong JPY appreciation pressure. However, during the New York session, short covering pushed it back up to 156.57 JPY. The market did not exhibit signs of aggressive selling after the announcement.

On the daily chart, the base line acts as resistance, with the ascending trend line and Ichimoku cloud providing support below. Technically, it remains challenging to determine the market’s direction. RSI is at 47 after reversing near the 50 level. The strong support zone between 154.50 JPY and 154.77 JPY could prevent further declines; however, if this range is breached, a scenario targeting the 150 JPY level becomes plausible.

Day trading strategy (1 hour)

On the 1-hour chart, USDJPY is facing resistance at the 240-period moving average (representing the past day’s average price). After the BOJ announcement, volatility increased, with a fluctuation of around 200 pips. However, no significant trend emerged, and USDJPY closed near the 156 JPY mark.

RSI is at 50, indicating a lack of clear direction. Market sentiment shows a slight leaning toward selling positions. From a fundamental perspective, the possibility of JPY appreciation remains.

While a cautious approach is recommended on Monday, a sell-on-rebound strategy could be considered. Suggested trade setup:

- Sell Limit: 156.45 JPY

- Stop Loss: 156.60 JPY

- Take Profit: 155.60 JPY

Support/Resistance lines

Key support and resistance lines to consider:

- 154.85 JPY: Low from January 24

- 154.77 JPY: Recent lowest price

Market Sentiment

USDJPY Sell: 56% Buy: 44%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Germany Economic Forecast | 18:00 |

| US New Home Sales | 00:00 (Midnight) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.