USDJPY Declines Amid Nvidia Stock Crash and Risk Aversion【January 28, 2025】

Fundamental Analysis

- Reports suggest that Chinese AI technology offers nearly the same performance as US AI at a lower cost.

- Risk aversion intensifies as Nvidia’s stock temporarily drops 18%.

USDJPY Technical Analysis

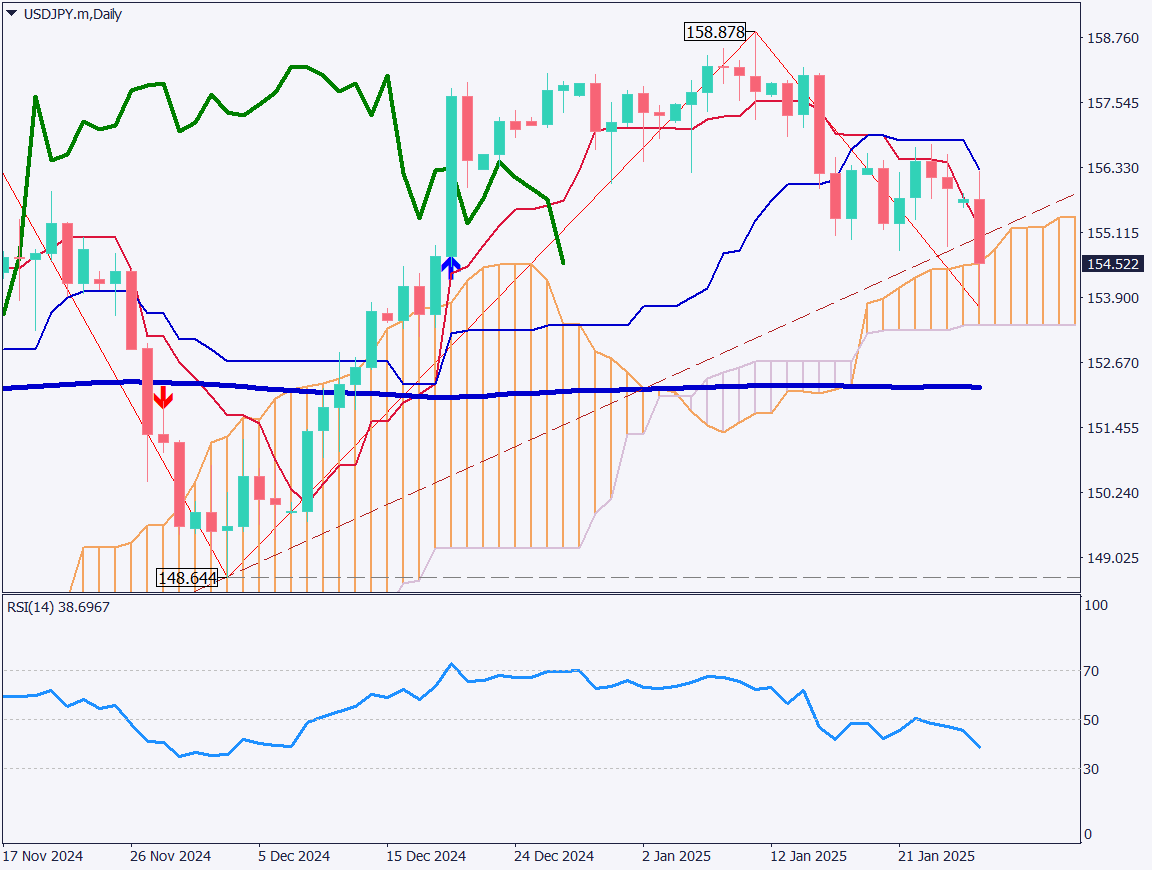

Analyzing the daily chart of USDJPY:

USDJPY broke below the upward trendline and approached the Ichimoku cloud. The pair touched the upper boundary of the cloud and is trading in the 154 JPY range. The conversion line fell below the baseline, and the lagging span also moved below the candlesticks, pointing downward. If the candlesticks break below the cloud, a bearish “three signals” pattern will appear.

The RSI stands at 38, a level suggesting further declines. A drop toward 30 is possible.

US tech and semiconductor stocks are being sold off, indicating a potential correction from overvalued levels. Close attention to future US stock price trends is essential as major adjustments could occur.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY:

USDJPY declined from the 156 JPY range to the 153 JPY range. The 1-hour chart confirms that the former upward trendline now acts as a resistance line. A correction in US tech stocks may have begun, and combined with the Bank of Japan’s interest rate hike, USDJPY is expected to move toward JPY appreciation.

The day trading strategy favors selling. A sell limit order is set at 154.95 JPY, with a target at 153.50 JPY. The stop-loss is set at 155.25 JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 153.35 JPY: Cloud lower boundary

Market Sentiment

USDJPY: Sell: 53% / Buy: 47%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| US Core Durable Goods Orders | 22:30 |

| US Consumer Confidence Index | Midnight (00:00) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.