Trump Announces Tariffs, USDJPY Declines【January 31, 2025】

Fundamental Analysis

- President Trump announces a 25% tariff on Canada and Mexico.

- Risk aversion intensifies, leading to a decline in USDJPY and a rise in gold prices.

USDJPY Technical Analysis

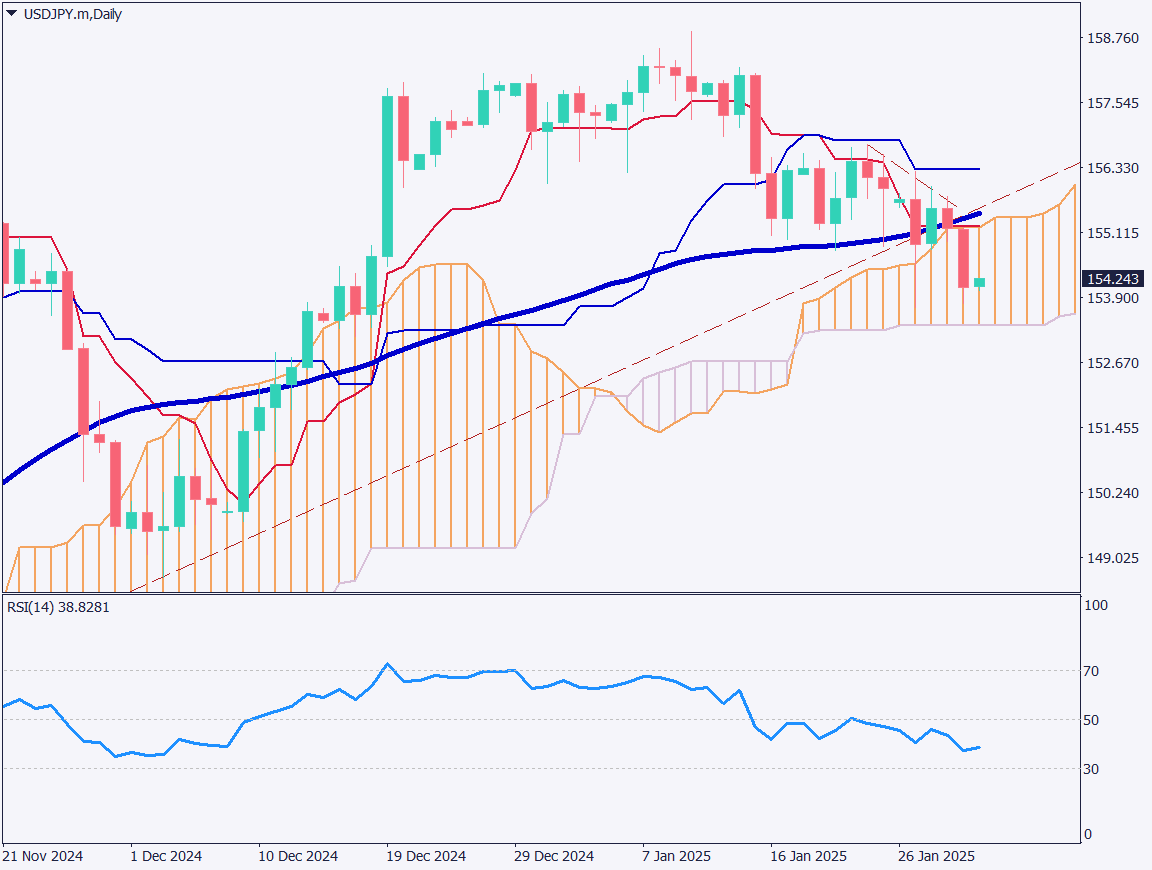

Analyzing the daily chart of USDJPY, the pair is experiencing strong risk aversion, leading to JPY appreciation. It has clearly broken below the 52-day moving average and is trading within the Ichimoku cloud. The uptrend is beginning to collapse.

President Trump has announced a 25% tariff on Canada and Mexico, imposing tariffs on neighboring countries before targeting China. This move may lead to rising U.S. inflation and increased market volatility. Japanese companies operating in the U.S. could also be affected.

The RSI stands at 38, indicating further downside potential. Attention should be paid to a possible decline toward 153.48 JPY.

Day trading strategy (1 hour)

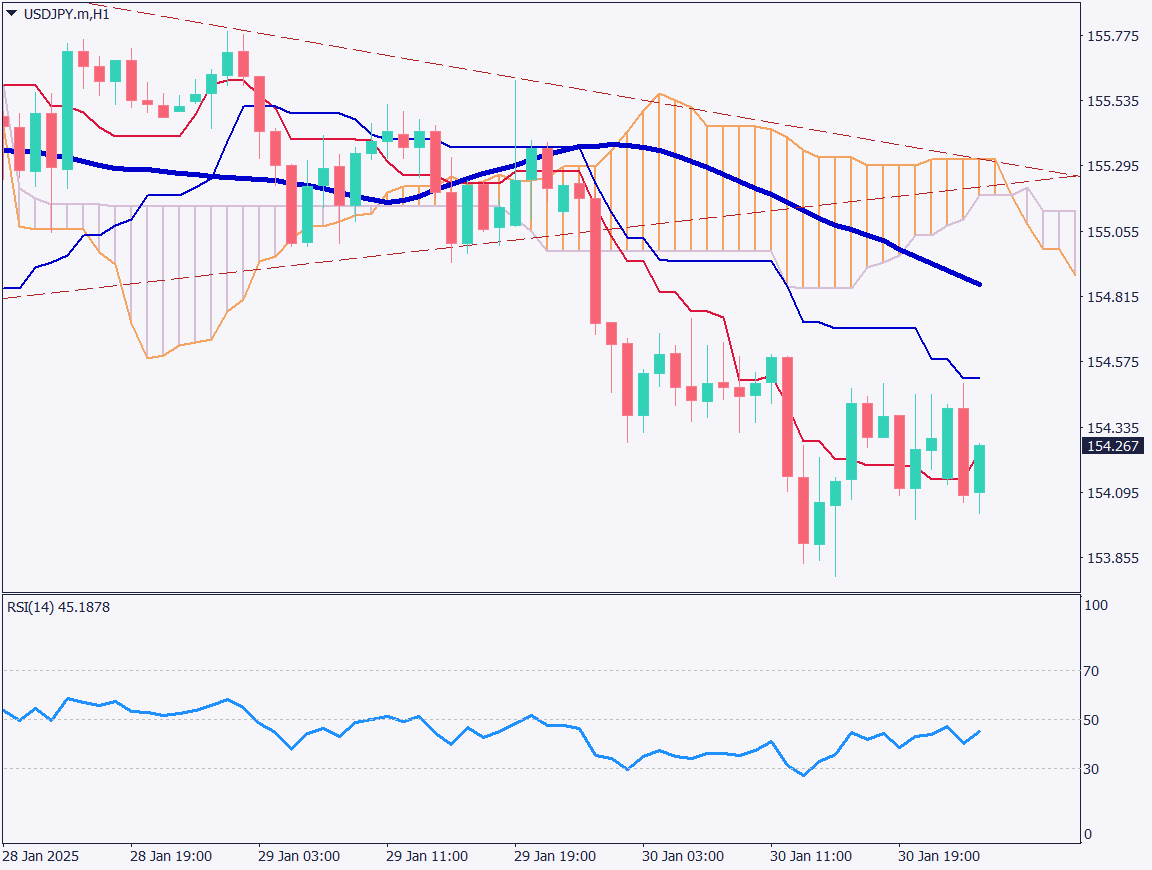

Analyzing the 1-hour chart of USDJPY, the 153 JPY level remains firm, preventing a further decline. From a fundamental perspective, JPY appreciation is likely to strengthen. The implementation of U.S. tariffs may cause economic turmoil, reinforcing risk aversion.

Day Trading Strategy: Sell

- Sell Limit Order: 154.35 JPY (Pivot Point)

- Take Profit: 153.48 JPY

- Stop-Loss: Above 154.58 JPY

Support/Resistance lines

Key support and resistance lines to consider:

- 154.35 JPY – Pivot Point

- 153.48 JPY – Key Support Level

Market Sentiment

USDJPY: Sell 49% / Buy 51%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Germany Consumer Price Index | 22:00 |

| U.S. Core Personal Consumption Expenditures (PCE) Price Index | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.