USDJPY Declines for Four Consecutive Days, Reacting to Hawkish Remarks from BOJ Member【February 7, 2025】

Fundamental Analysis

- BOJ’s Tamura suggests a 1% rate hike in late 2025

- Bank of England cuts rates by 0.25%, leading to a downtrend in GBPJPY

USDJPY Technical Analysis

Analyzing the daily chart of USDJPY, the pair has declined for four consecutive days, influenced by hawkish remarks from BOJ’s Tamura, who stated that “interest rates will be at least around 1% in late 2025.” As a result, USDJPY has dropped to just below 150 JPY. Additionally, the pair has broken below the 200-day moving average, suggesting a possibility of further declines below 150 JPY.

However, a Bollinger Bands analysis shows that USDJPY is currently trading below the -3σ line, indicating that a rebound is expected today. Given that candlesticks tend to stay within the 3σ range with a probability of 99.7%, a short-term rebound is likely.

Potential resistance levels for this rebound are:

- Around 152 JPY, where the 200-day moving average is positioned

- Around 152.65 JPY, where the -2σ Bollinger Band line is moving

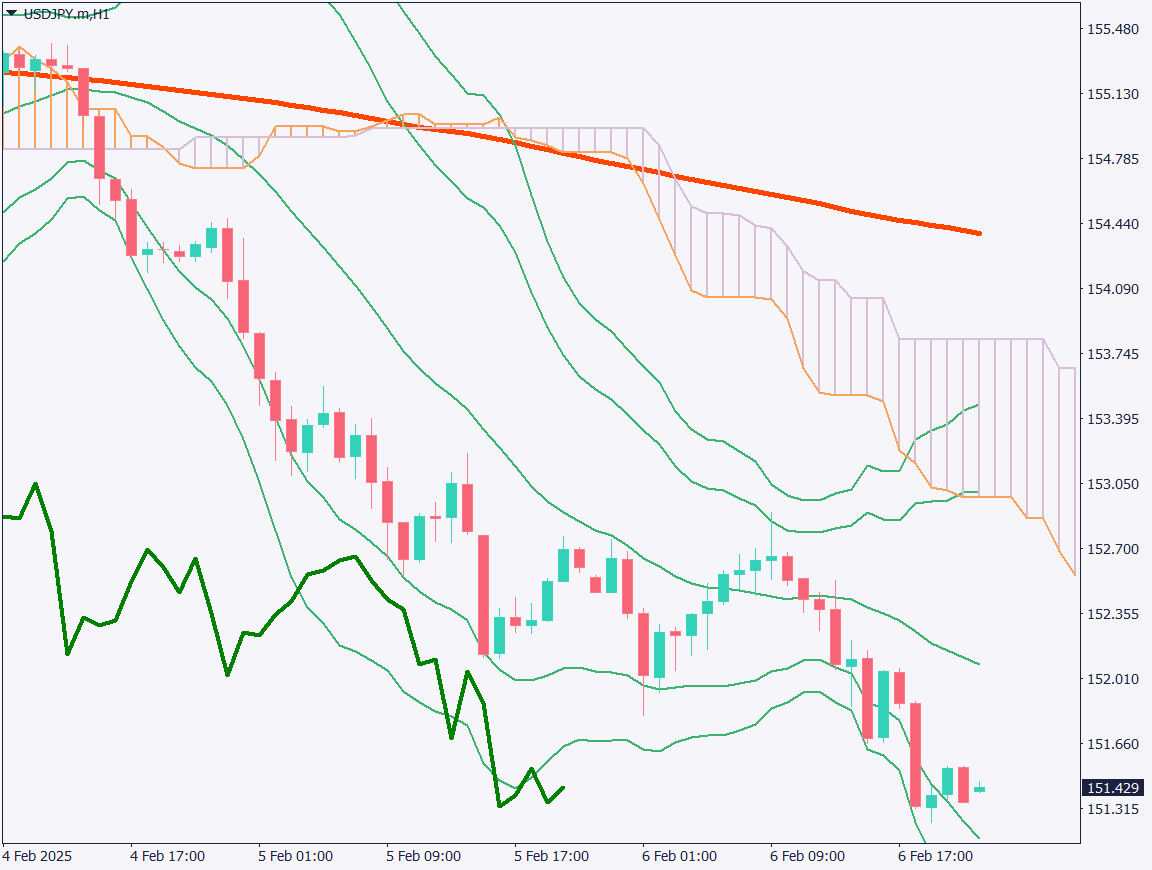

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY, the downtrend continues but has slowed down. As per the daily analysis, a rebound is expected today. While the long-term trend remains JPY bullish, the strategy for today is to look for selling opportunities on the rebound.

Key resistance levels to watch for selling opportunities:

- Around 152 JPY, where the Bollinger Bands’ central line is positioned

- Around 151.80 JPY, where the Ichimoku Cloud’s lower boundary is moving

It is advisable to wait until after the U.S. Non-Farm Payroll (NFP) release to trade in the New York session.

Day Trading Strategy: Sell on Rebounds

- Sell near 152 JPY

- Take profit at 151.15 JPY

- Stop loss at 152.35 JPY

Support/Resistance lines

Key support and resistance lines to consider:

- 152.65 JPY → Bollinger Bands’ -2σ line

- 152 JPY → 200-day moving average

- 151.15 JPY → Major support level

Market Sentiment

USDJPY: Sell: 30% / Buy: 70%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Household Survey & Consumer Spending | 8:30 AM |

| U.S. Non-Farm Payrolls (NFP) | 10:30 PM |

| Canada Employment Report | 10:30 PM |

| University of Michigan Consumer Sentiment Index | Midnight |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.